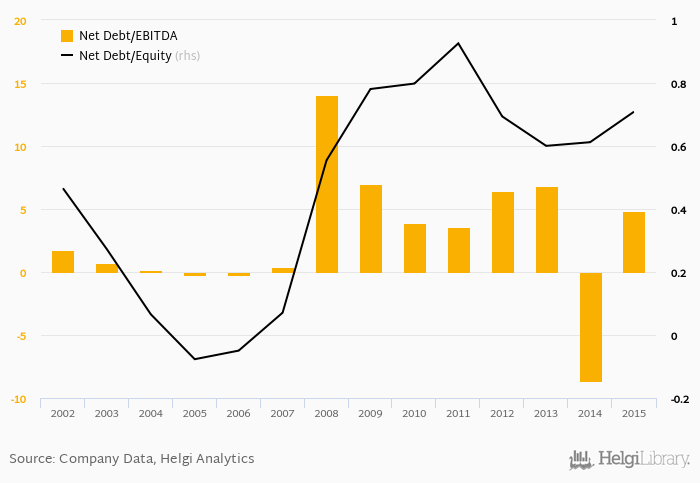

Grupa Lotos's net debt stood at PLN 5,467 mil and accounted for 0.709 of equity at the end of 2015. The ratio is up 0.097 pp compared to the previous year.

Historically, the firm’s net debt to equity reached a high of 0.926 in 2011 and a low of -0.077 in 2005 between 2002 and 2015. The average for the last five years was 0.708%.

Net debt to EBITDA was calculated at 4.80x at the end of the year. That is up from 3.89x seen in 2010. The ratio reached a high of 14.1x in 2008 and a low of -8.65x in 2014.

The company’s cost of funding amounted to 9.06% in 2015, up which is above the 5-year of 5.25%. Funding costs have “eaten” some 146% of the operating profit generated in 2019.

You can see all the company’s data at Grupa Lotos profile, or you can download a report on the company in the report section.