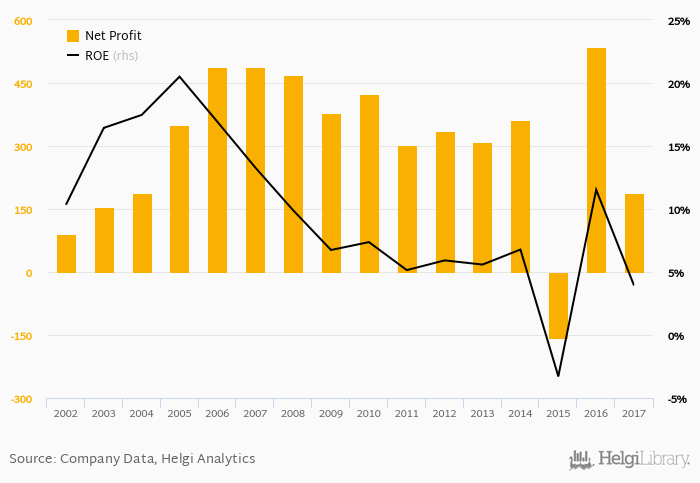

Raiffeisenbank Croatia made a net profit of HRK 188 mil in 2017, down 64.9% compared to the previous year. This implies a return on equity of 3.93%.

Historically, the bank’s net profit reached an all time high of HRK 535 mil in 2016 and an all time low of HRK -156 mil in 2015. The average profit in the last five years amounted to HRK 247 mil.

The bank generated its shareholders an average return on equity of 4.91% in the last five years with maximum at 11.5% and minimum at -3.28%

Comparing Raiffeisenbank Croatia with its closest peers, Zagrebacka Banka generated a net profit of HRK 1,042 mil with ROE of 5.66% in 2017, Splitska Banka netted HRK -85.0 mil (ROE of -2.34%) and Privredna Banka Zagreb announced a net profit of HRK 1,331 mil implying ROE of 7.98%.

Raiffeisenbank Croatia has been ranked 239th within the group of 310 banks we follow in terms of return on equity in 2017.

You can see all the bank’s data at Raiffeisenbank Croatia Profile, or you can download a report on the bank in the report section.