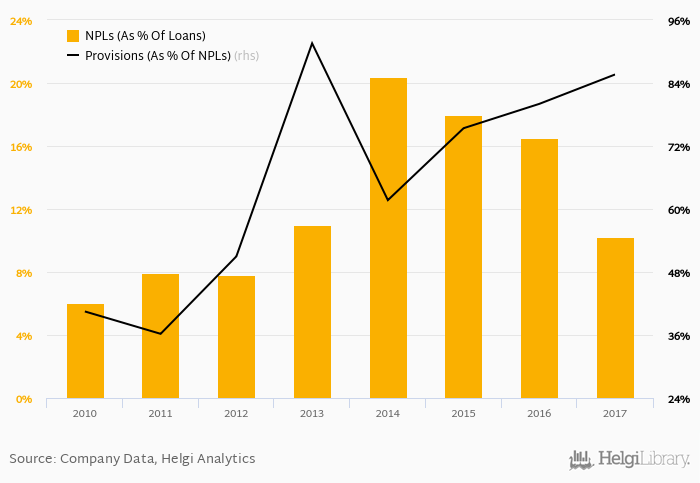

Societe Generale Serbia's non-performing loans reached 10.2% of total loans at the end of 2017, down from 16.5% compared to the previous year. Historically, the NPL ratio hit an all time high of 20.4% in 2014 and an all time low of 6.02% in 2010.

Provision coverage amounted to 85.6% at the end of 2017, up from 80.0% compared to a year earlier.

The bank created loan loss provisions worth of -1.19% of average loans in 2017. That's compared to 1.57% of loans the bank put aside to its cost on average in the last five years.

Comparing Societe Generale Serbia with its closest peers, Komercijalna Banka Beograd operated at the end of 2017 with NPL ratio of 15.7% and provision coverage of 69.4%, Bank Intesa Serbia with 9.25% and 51.5% respectively and Raiffeisenbank Serbia had 4.74% of bad loans covered with 95.5% by provisions at the end of 2017.

You can see all the bank’s data at Societe Generale Serbia Profile, or you can download a report on the bank in the report section.