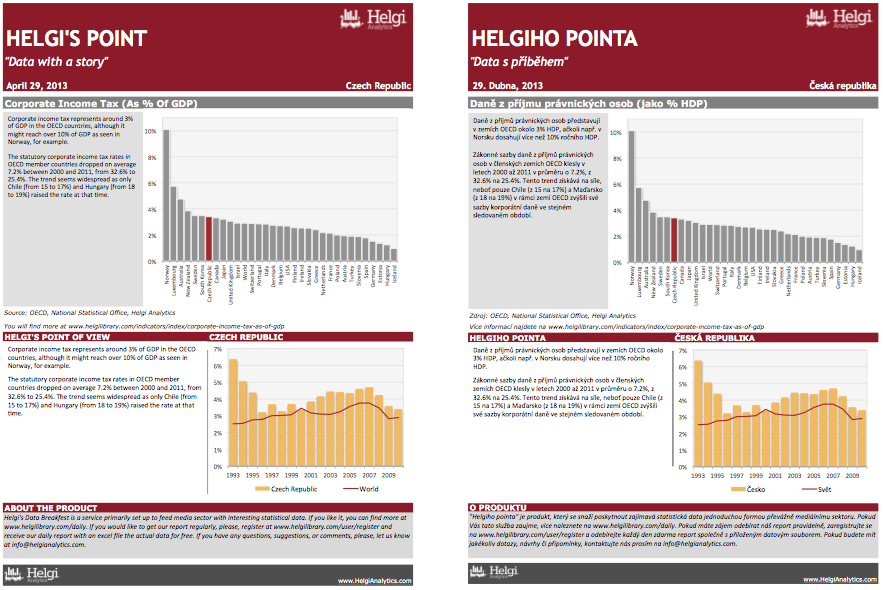

Corporate income tax represents around 3% of GDP in the OECD countries, although it might reach over 10% of GDP as seen in Norway, for example.

The statutory corporate income tax rates in OECD member countries dropped on average 7.2% between 2000 and 2011, from 32.6% to 25.4%. The trend seems widespread as only Chile (from 15 to 17%) and Hungary (from 18 to 19%) raised the rate at that time.