mBank Czech Republic increased number of customers by 0.8% to 723,687

Loans amounted fell 3.6% qoq to CZK 36.6 bil with mortgages forming 75% of total

Deposits increased 1.8% qoq and the Bank held 1.8% of the retail deposit market

Revenues increased 0% yoy to in the third quarter of 2022. Net interest income rose 0% yoy and formed of total with net interest margin increasing pp to of total assets. Fee income grew 0% yoy and added a further to total revenue. When compared to three years ago, revenues were up 0%:

Average asset yield was in the third quarter of 2022 (up from a year ago) while cost of funding amounted to in 3Q2022 (up from %).

Costs increased by 0% yoy and the bank operated with average cost to income of in the last quarter. Staff cost rose 0% as the bank employed persons (up 0% yoy) and paid per person per month including social and health care insurance cost:

mBank Czech Republic's customer loans decreased 3.56% qoq and 0.056% yoy in the third quarter of 2022 while customer deposit growth amounted to 1.82% qoq and -1.64% yoy. That’s compared to average of 19.2% and 8.77% average annual growth seen in the last three years.

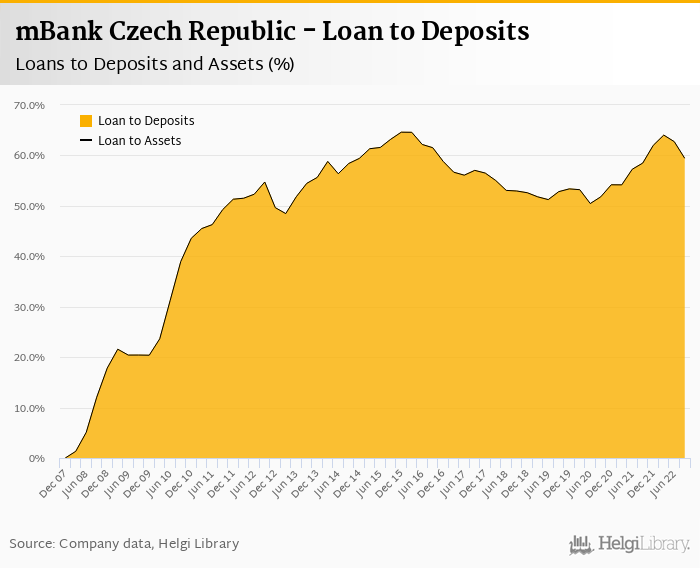

At the end of third quarter of 2022, mBank Czech Republic's loans accounted for 59.4% of total deposits and 59.4% of total assets.

Retail loans fell 3.56% qoq and were 0.056% up yoy. They accounted for 100% of the loan book at the end of the third quarter of 2022. Mortgages represented 75.1% of the mBank Czech Republic's loan book and consumer loans added a further 24.9%:

We estimate that mBank Czech Republic has lost 0.069 pp market share in the last twelve months in terms of loans (holding 0.902% of the market at the end of 3Q2022).

In mortgages, the Bank peaked in the middle of 2021 when it reached 1.94% of the market. It has been losing its position since and we estimate the Bank held 1.66% of the mortgage market at the end of September 2022.

In consumer loans, mBank has been strengthening its position and gained 0.4% of the market within the last twelve months on our calculation (holding 1.96% of the market at the end of September).

On the funding side, the bank seems to have lost 0.093 pp and held 0.961% of the deposit market. The Bank maintains a stable position of approximately 1.84% of the market in terms of retail deposits and average size of deposits accounts for around CZK 90,000 per customer.

Share of sight deposits fell from 60% last year to 46% now as higher interest rates attract customers to switch into term deposits:

mBank Czech Republic's non-performing loans reached of total loans, up from when compared to the previous year. Provisions covered some of NPLs at the end of the third quarter of 2022, up from for the previous year.

ERROR: Division by zeroProvisions have "eaten" some NAN% of operating profit in the third quarter of 2022 as cost of risk reached of average loans:

mBank Czech Republic's capital adequacy ratio reached in the third quarter of 2022, up from for the previous year. The Tier 1 ratio amounted to at the end of the third quarter of 2022 while bank equity accounted for of loans:

Overall, mBank Czech Republic made a net profit of in the third quarter of 2022, up 0% yoy. This means an annualized return on equity of , or when equity "adjusted" to 15% of risk-weighted assets:

mBank Czech Republic maintains a stable position on the Czech market within the last year with approximately 0.72 mil customers and a network of 30 mini-branches. Growth and product development of the Bank seem to have stabilized as the Bank hit a 1-2% of the retail market with relatively little progress seen.