Philip Morris Czech Republic (PMCR) made a net profit of CZK 4,019 mil under sales of CZK 17.1 bil in 2019

The firm might have sold 27,691 mil cigarettes in 2019, on our estimates

We calculate that the company made revenue of CZK 12.3 and a net profit of CZK 2.90 per pack of cigarettes sold in 2019

PMCR held 41.3% share on the domestic Czech market in 2019 and 54.8% share in Slovakia

Philip Morris Czech Republic made a net profit of CZK 4,019 mil under revenues of CZK 17,092 mil in 2019, up 4.77% and up 21.4%, respectively, when compared to the last year.

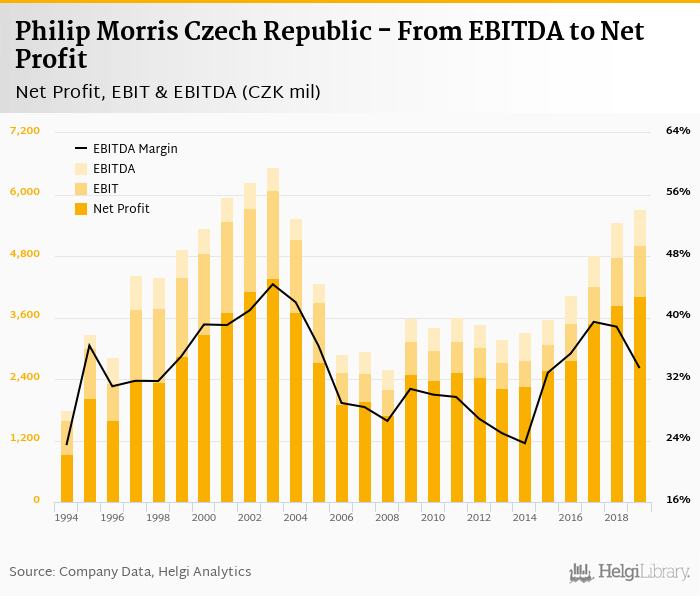

This translates into a net margin of 23.5%. On the operating level, EBITDA margin reached 33.4% and EBIT amounted to 29.3% of sales in 2019:

We estimate Philip Morris Czech Republic sold 27,691 mil cigarettes in 2019, up 5.04% when compared to the previous year. Overall, shipments of cigarettes have been growing by an average 0.335% a year in the last 20 years.

Some 8,600 mil of cigarettes have been sold on the domestic Czech market, up 0.585% when compared to a year earlier. In Slovakia, 4,400 mil pieces of cigarettes have been shipped:

Philip Morris CR held 41.3% of the domestic Czech market in 2019, down 1 pp from a year ago. That is compared to 55.5% seen a decade ago and a 80.8% market share achieved in 1999. In Slovakia, Philip Morris held 54.8% of the market share in Slovakia, down 1.6 pp when compared to a previous year:

Based on our estimate of total cigarettes sold, we calculate that the firm made a net profit of CZK 2.90 per pack of cigarettes sold in 2019. That is 114% more than 5 years ago and 66.2% more than a decade ago:

Philip Morris Czech Republic still operates without any external debt. The Company was operating with a net cash of CZK 6,200 mil at the end of 2019, which accounted for whopping two thirds of of equity. When compared to EBITDA, net debt amounted to -1.09x at the end of the year:

Overall, Philip Morris CR remains impressively profitable company. The net profit of CZK 4,019 mil implies return on equity of 41.8% and return on invested capital of 59.1% in 2019. That is compared to 38.1% and 61.6% average seen in the last five years.

The above is abviously reflected in high valuation and solid share price performance, in spite of the recent sell-off on the markets. When looking at the long-term valuation of the Company, the stock has appreciated by 41.2% since 2014 implying an annual average growth of 7.15%. In absolute terms, the value of the company rose by USD 549 mil.

At the end of 2019, the firm traded at price to earnings of 10.4x. In terms of EV/EBITDA, the stock traded at 6.04x at the end of 2019.

In other words, smoking still pays off nicely in the Czechoslovakia, at least for cigarette producers.