The scale of fiscal support being deployed to fight the Covid-19 economic crisis is huge.

The Czech Government is willing to spend an impressive 20% of GDP, but the what has been accomplished so far is mediocre.

The Government is slow in distributing help to those most in need, lacks expertise and fails to communicate effectively.

Good examples from abroad should be followed, such as teaming up with banks to speed things up.

The Coronavirus crisis has upended conventional economic thinking. While central banks have responded by pushing monetary policy to the limits, the role of governments is being completely rethought.

Size matters

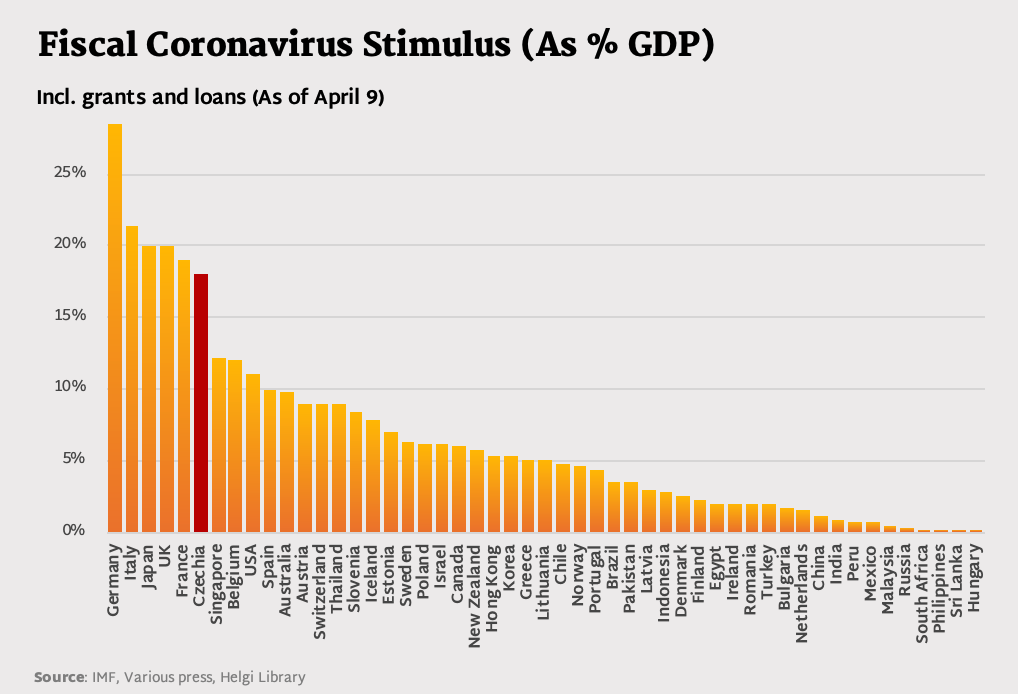

Unlike in 2008-2009, the scale of fiscal support that has been deployed is huge. The 2020 fiscal stimulus is more than 3% of world GDP, already twice as much as in 2009:

When discussing the key aspects of successful fiscal stimulus, three “S”s should be considered:

• Size – will the money be enough to help protect the economy?

• Speed – will the money reach people and businesses fast enough?

• Scale - is there the commitment to scale it up if necessary?

As seen in the chart above, size is no problem this time. While Europeans were reluctant to spend more than 5% of GDP on fiscal stimulus back in 2008-2009, a number of countries are willing to commit more than 20% of their GDP to fight off the economic downturn. This includes the Czech Republic, which has plenty of room to manoeuvre with public debt at only 30% of GDP.

Only if help is delivered

Unfortunately, Czechs fail in delivering the help to those most in need when compared to the majority of developed countries. This can be seen in the following areas:

• Speed - some 20-30% of households and companies might have a problem surviving the month without financial help. When we look, for example, at how quickly and simply Berlin (and Germany) distributes its direct payments, the Czech Government is failing big time with very little cash having arrived in anyone's hands yet, a month after the economy was frozen...

• Fairness - the inability to use at least some of the many databases available to the Government (such as data from EET) to come up with a targeted plan for how to distribute help to the most needy provides a grim picture about how the state administration operates. As a result, payments are more general and wider, which reduces the fairness of the fiscal stimulus .

• Communication - the initial proposal about compensating the self-employed based on 1Q results (the so called “25”) or the out-of-the-blue suggestion of a loan moratorium to everyone reveals an absolute lack of communication, not only internally but also with the external economic community.

Size matters only when there is a system which is able to deliver help quickly to the most needy. Let's face it. It's not working...

Example from Switzerland

The shame is that there are so many good examples in other countries which Czechs can follow. Instead of pushing CMRZB beyond its limits, for example, in a number of countries private banks are helping to distribute state guaranteed loans to companies in need.

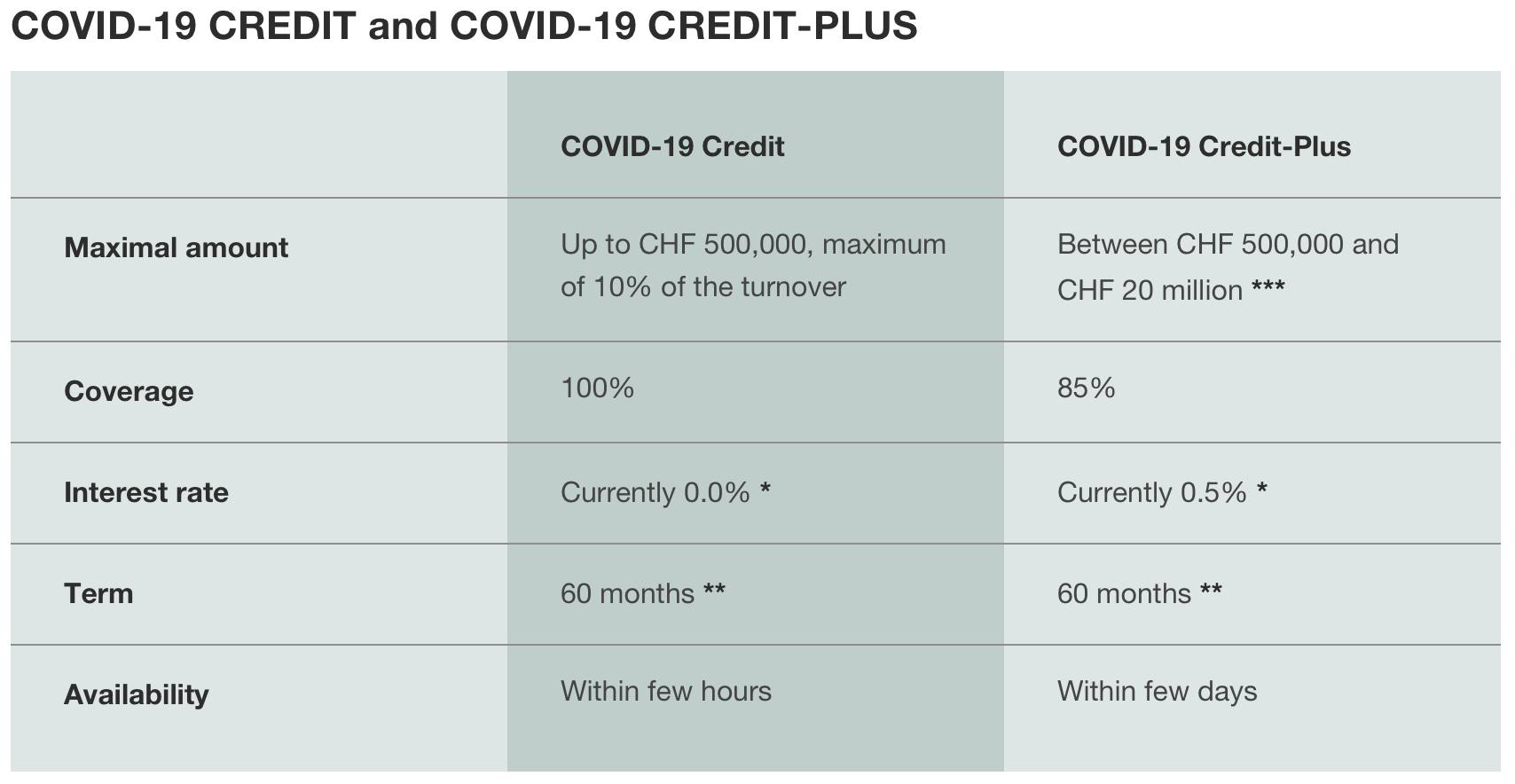

In Switzerland, for example, the Government teamed up with private banks and introduced joint lending - available just a few hours after submission. The state guarantee loan programme was introduced on March 13 with CHF 580 mil for SMEs. It was then extended by a further CHF 20 bil on March 20 (with bridging loans to SMEs) and CHF 15 bil was distributed within a week. On April 3, the Government announced doubling the size of the loan guarantee program from CHF 20 bil to CHF 40 bil. That's a demonstration of the “3 S”s, i.e. size, speed and scale.

Smaller loans with 100% state guarantee and a zero interest rate are distributed within hours. There is a higher level of risk for private banks on bigger loans if not repaid. They must therefore evaluate the likelihood of default. However, this is somewhat reduced if all three parties, the State, the Bank as well as Company share the burden of risk:

While the Czech Government might have promised some 20% of GDP as a fiscal stimulus, the execution so far has been rather mediocre when compared to its western peers.

Since most of the financial help should come in the form of state guaranteed loans, the Government should find inspiration from abroad and team up with domestic banks in the distribution and risk-evaluation of loans.

Unlike in 2008, the banking sector hasn't caused the current crises and new bank loans will be essential to overcome it.

Switzerland serves as a good example how to do it but similar examples could be found elsewhere, such as in France or the Netherlands.