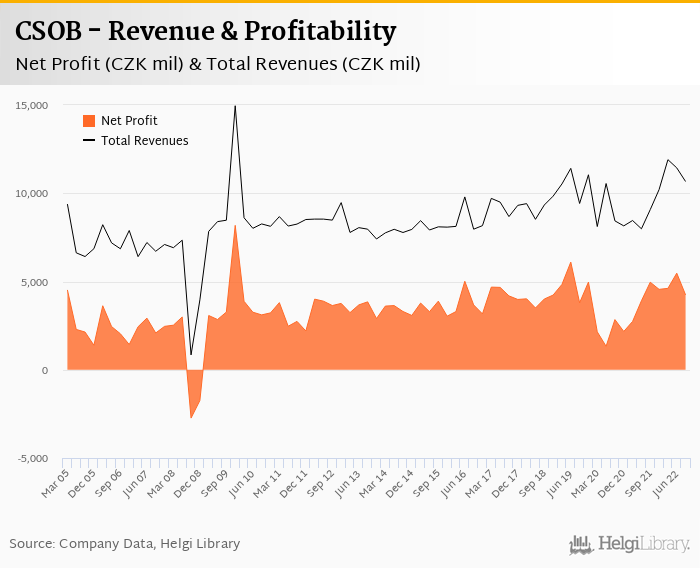

CSOB decreased its net profit 14.5% to CZK 4,241 mil in 3Q2022 and generated ROE of 17.3%.

Revenues increased 17.5% yoy and cost rose 13.7%, so cost to income decreased to 47.3%

Bad loans fell to 1.36% of total loans and cost of risk amounted 0.277%.

Loan to deposit ratio increased to 83.0% and capital adequacy decreased to 19.6%

Revenues increased 17.5% yoy to CZK 10,665 mil in the third quarter of 2022 driven by interest margin expansion (up 0.304 pp). Net interest income rose 35.0% yoy and formed 72.0% of total, on the other hand, fee income was flat and other income fell CZK 400 mil when compared to last year. Total revenues were up only 13.2% when compared to three years ago:

Average asset yield was 5.80% in the third quarter of 2022 (up from 1.87% a year ago) while cost of funding amounted to 4.51% in 3Q2022 (up from 0.719%).

Costs increased by 13.7% yoy, the most among the large banks and across the board. Having said that, the bank operated with relatively low cost to income of 47.3% in the last quarter. Staff cost rose 10.4% as the bank employed 8,034 persons (down 1.40% yoy) and paid CZK 103,269 per person per month including social and health care insurance cost:

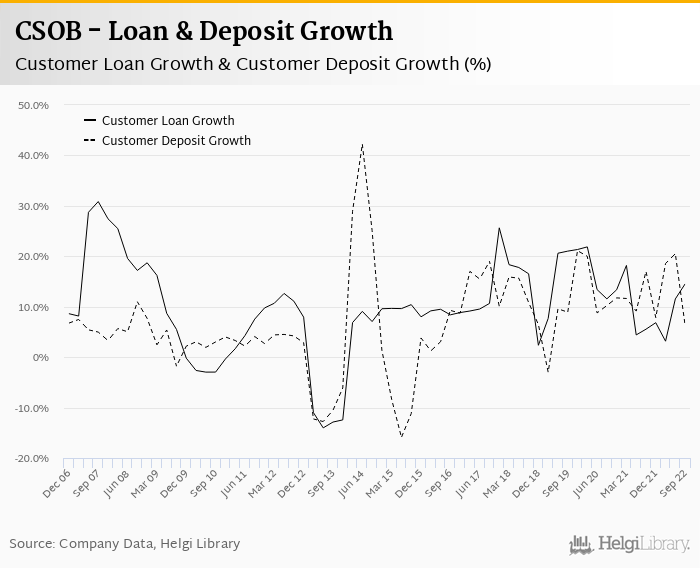

CSOB's customer loans grew 3.51% qoq and 14.5% yoy in the third quarter of 2022 while customer deposit fell 4.19% qoq and were up 6.30% yoy. That’s compared to average of 12.1% and 13.6% average annual growth seen in the last three years.

At the end of third quarter of 2022, CSOB's loans accounted for 83.0% of total deposits and 57.7% of total assets.

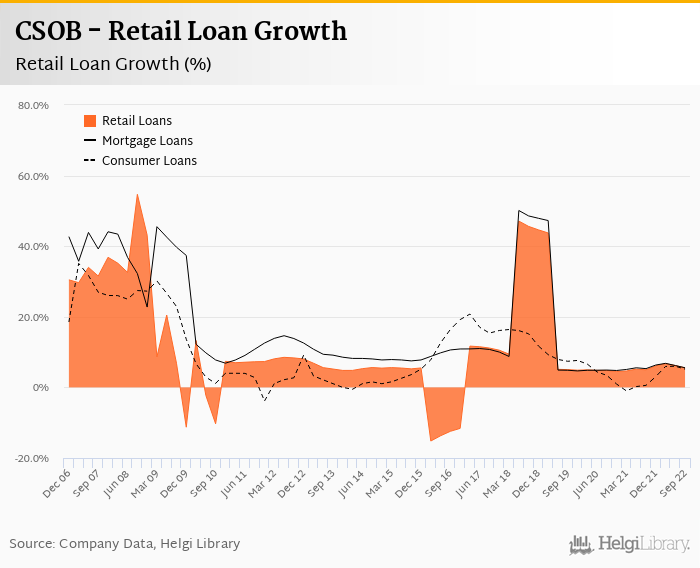

Retail loans grew 0.682% qoq and were 5.54% up yoy. They accounted for 48.5% of the loan book at the end of the third quarter of 2022 while corporate loans increased 2.08% qoq and 10.5% yoy, respectively. Mortgages represented 45.3% of the CSOB's loan book, consumer loans added a further 3.28% and corporate loans formed 30.7% of total loans:

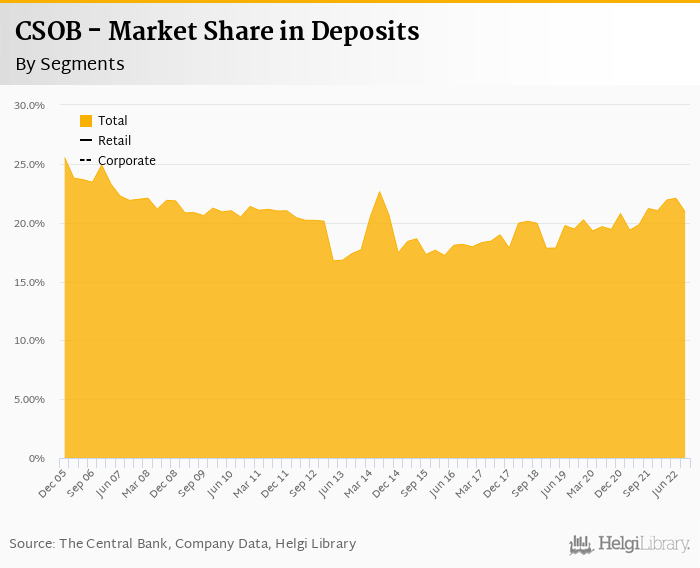

We estimate that CSOB has gained 1.65 pp market share in the last twelve months in terms of loans (holding 27.4% of the market at the end of 3Q2022). On the funding side, the bank seems to have lost 0.309 pp and held 20.9% of the deposit market. That's calculated on bank's consolidated numbers including slovak operations, so actual figures will be somewhat lower:

CSOB's non-performing loans reached 1.36% of total loans, down from 1.73% when compared to the previous year. Provisions covered some 75.4% of NPLs at the end of the third quarter of 2022, up from 72.6% for the previous year.

Provisions have "eaten" some 13.5% of operating profit in the third quarter of 2022 as cost of risk reached 0.277% of average loans. These are still pretty good numbers, on the other hand, the level of provisions created last quarter was the biggest within the last two years, something to watch for in the coming months:

CSOB's capital adequacy ratio reached 19.6% in the third quarter of 2022, down from 23.3% for the previous year. The Tier 1 ratio amounted to 20.0% at the end of the third quarter of 2022 while bank equity accounted for 9.02% of loans:

Overall, CSOB made a net profit of CZK 4,241 mil in the third quarter of 2022, down 14.5% yoy. This means an annualized return on equity of 17.3%, or 29.6% when equity "adjusted" to 15% of risk-weighted assets. On the more positive side, operating profit has risen impressive 21.2% yoy, so the underlying trends are better than bottom line might be suggesting:

Solid set of results heavily driven by interest margin expansion and solid volume growth. On the other hand, lack of growth in fee income and relatively fast growth in operating cost might be somewhat disappointing. Cost side and asset quality remain the main areas to watch for in the quarters ahead...