Komercni Banka rose its net profit 32.8% to CZK 4,650 mil in 3Q2022 and generated ROE of 14.6%.

Revenues increased 25.8% yoy and cost rose 3.80%, so cost to income decreased to 37.2%

Bad loans fell to 2.27% of total loans and cost of risk amounted 0.349%.

Loan to deposit ratio increased to 69.3% and capital adequacy decreased to 21.1%

Revenues increased 25.8% yoy to CZK 9,838 mil in the third quarter of 2022. Net interest income rose 36.2% yoy and formed 75% of total with net interest margin increasing 0.371 pp to 1.97% of total assets. Fee income grew 7.41% yoy and added a further 15.0% to total revenue. When compared to three years ago, revenues were up 19.0%:

Average asset yield was 7.03% in the third quarter of 2022 (up from 2.53% a year ago) while cost of funding amounted to 5.53% in 3Q2022 (up from 1.03%). With loan and deposit growth slowing to 9.4% and 2.4% yoy, we guesstimate that some three quarters of the revenue growth came from higher interest rates and margin when compared to last year:

Costs increased by 3.80% yoy and the bank operated with very impressive cost to income of 37.2% in the last quarter. Staff cost rose 0.569% only as the bank employed 7,496 persons (down 2.71% yoy) and paid CZK 86,445 per person per month including social and health care insurance cost:

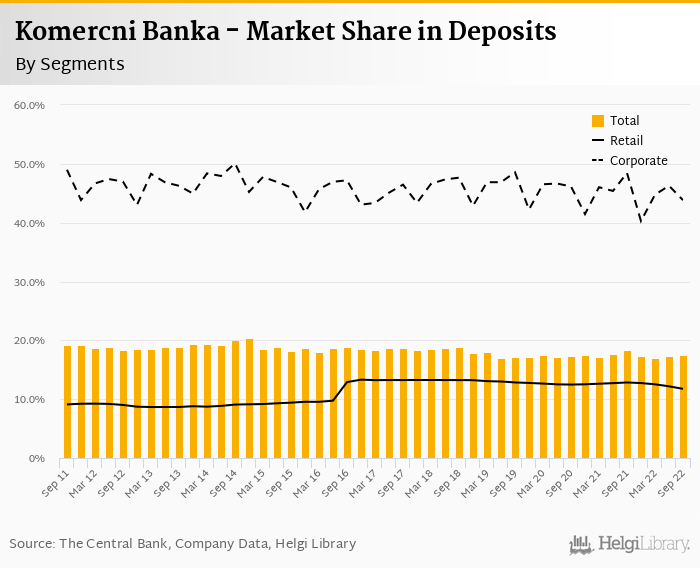

Komercni Banka's customer loans grew 2.51% qoq and 9.4% yoy in the third quarter of 2022 while customer deposit growth amounted to 1.53% qoq and 2.44% yoy. That’s compared to average of 5.66% and 8.11% average annual growth seen in the last three years. The market growth has been clearly showing down, though Komercni seems to continue losing market share in mortgage loans and household deposits.

At the end of third quarter of 2022, Komercni Banka's loans accounted for 69.3% of total deposits and 52.0% of total assets.

Retail loans grew 0.721% qoq and were 5.20% up yoy. They accounted for 55.8% of the loan book at the end of the third quarter of 2022 while corporate loans increased 3.83% qoq and 12.8% yoy, respectively. Mortgages represented 34.4% of the Komercni Banka's loan book, consumer loans added a further 21.4% and corporate loans formed 51.6% of total loans:

We estimate that Komercni Banka has gained 0.314 pp market share in the last twelve months in terms of loans (holding 19.1% of the market at the end of 3Q2022). On the funding side, the bank seems to have lost 0.927 pp and held 17.5% of the deposit market. The Bank seems to continue losing share in mortgage loans and household deposits:

Komercni Banka's non-performing loans reached 2.27% of total loans, down from 2.65% when compared to the previous year. Provisions covered some 50.6% of NPLs at the end of the third quarter of 2022, down from 52.0% for the previous year.

Provisions have "eaten" some 10.8% of operating profit in the third quarter of 2022 as cost of risk reached 0.349% of average loans. The numbers seem fine for now, though provisions created in the last quarter (CZK 669 mil) are the highest since the end of 2020:

Komercni Banka's capital adequacy ratio reached 21.1% in the third quarter of 2022, down from 23.0% for the previous year. The Tier 1 ratio amounted to 20.5% at the end of the third quarter of 2022 while bank equity accounted for 16.6% of loans:

Overall, Komercni Banka made a net profit of CZK 4,650 mil in the third quarter of 2022, up 32.8% yoy. This means an annualized return on equity of 14.6%, or 22.5% when equity "adjusted" to 15% of risk-weighted assets:

Komercni Banka stock traded at CZK 629 per share at the end of 3Q2022 resulting in a market capitalization of USD 4,802 mil. The stock lost 5.1% in the last three months and is 21.4% down when compared to three three years ago. This put stock at a 12-month trailing price to earnings of attractive 6.39x and price to book value of 0.919x as of the end of 3Q2022.

Over the previous five years, the PE multiple reached a high of 15.7x in 1Q2021 and a low of 6.39x in 3Q2022 with an average of 11.4x.

Solid set of results very much in line with the market expectations. Strong revenue growth heavily driven by rising interest rates and margins, very good cost control and limited pressure from asset quality deterioration seen so far. On the other hand, retail loan and deposit growth remains weak as the Bank continues losing market share in that area.

Apart from interest margin development, we would watch for signs of asset quality deterioration and inflation pressure on the cost side in the coming months.