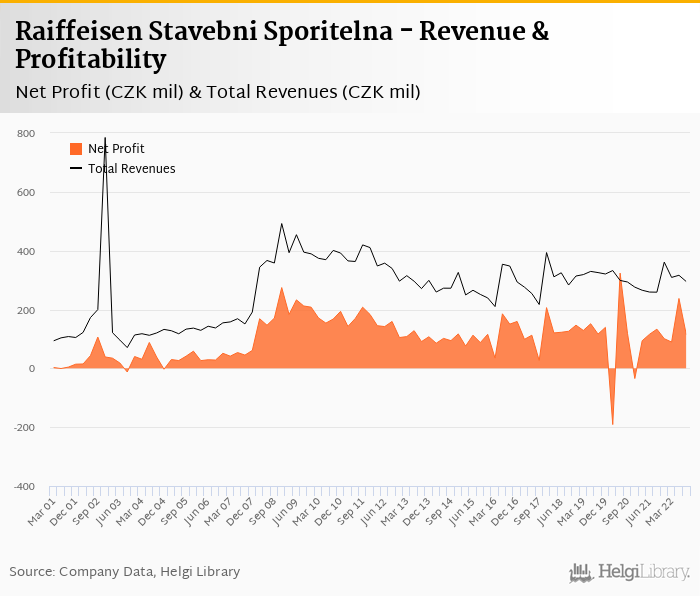

Raiffeisen Stavebni Sporitelna decreased its net profit 14.2% to CZK 114 mil with ROE of 7.9%.

Revenues increased 13.9% yoy and cost fell 15.5%, so cost to income decreased to 45.3%

Cost of risk amounted 0.123% and loan to deposit ratio increased to 113%

Revenues increased 13.9% yoy to CZK 295 mil in the third quarter of 2022. Net interest income fell 0.91% yoy and formed 72.6% of total with net interest margin decreasing 0.009 pp to 1.13% of total assets. Fee income jumped 97.5% yoy (or by CZK 40 mil yoy) which could be partly an accounting mirror effect of the substantial increase in interest cost. When compared to three years ago, revenues were down 9.42%:

Average asset yield was 2.87% in the third quarter of 2022 (up from 2.31% a year ago) while cost of funding amounted to 1.88% in 3Q2022 (up from 1.26%).

Costs decreased by signicant 15.5% yoy and accross the board, so the bank operated with average cost to income of 45.3% in the last quarter. Staff cost fell 27.3% as the bank employed 84 persons (down 55% yoy) and closed additional 6 branches during last year (to 172):

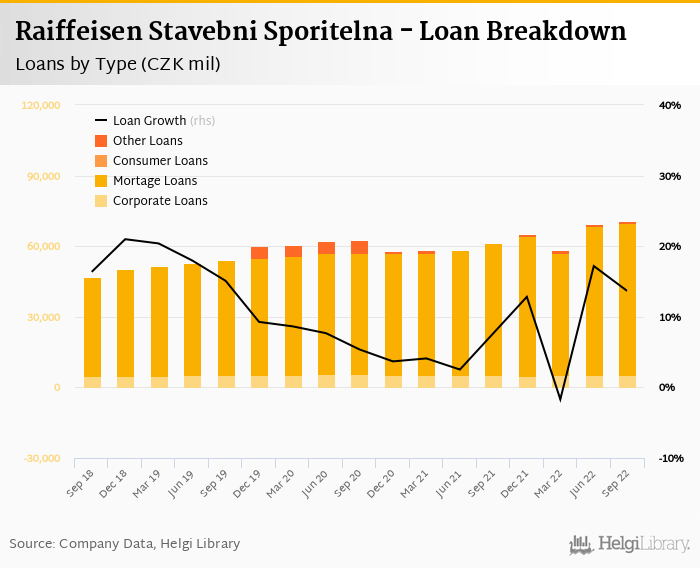

Raiffeisen Stavebni Sporitelna's loans grew 1.95% qoq and 13.7% yoy in the third quarter while deposit growth amounted to -2.74% qoq and -11.0% yoy. That’s compared to average of 7.58% and 1.59% average annual growth seen in the last three years.

At the end of third quarter of 2022, Raiffeisen Stavebni Sporitelna's loans accounted for 113% of total deposits and 92.8% of total assets.

Retail loans grew 1.95% qoq and were 14.7% up yoy. They accounted for 92.5% of the loan book at the end of the third quarter while corporate loans increased 1.97% qoq and 2.17% yoy, respectively forming 7.5% of total loans:

We estimate that Raiffeisen Stavebni Sporitelna has gained 0.091 pp market share in the last twelve months in terms of loans (holding 1.72% of the market at the end of 3Q2022). On the funding side, the bank seems to have lost 0.205 pp and held 0.965% of the deposit market:

Cost of risk reached 0.123% of average loans during the quarter and provisions have "eaten" some 13.2% of operating profit. We assume Raiffeisen Stavebni Sporitelna's non-performing loans reached 0.9-1.0% of total loans, down from 1.14% when compared to the previous year. Provisions coverage of the Bank has been historically one of the highest exceeding 130% of NPLs, something we do not expect to change:

Without reporting the details, we expect Raiffeisen Stavebni Sporitelna's capital adequacy ratio reached 16-17.0% in the third quarter of 2022, up from 15.4% for the previous year. The Tier 1 ratio could have amounted to approximately 14.5-15.0% at the end of the third quarter of 2022 while bank equity accounted for 8.40% of loans:

Overall, Raiffeisen Stavebni Sporitelna made a net profit of CZK 114 mil in the third quarter of 2022, down 14.2% yoy. The decline in profitability was due only to higher cost of risk when compared to last year since operating profit of the Bank increased by almost 60% yoy in the third quarter. This means an annualized return on equity of 7.88%, or 10.2% when equity "adjusted" to 15% of risk-weighted assets:

Solid set of results from revenue growth, very good cost control and to relatively low cost of risk. The comparison with last year is heavily distorted by CZK 65 mil provision write-backs, but the overall operating profitability remains strong. Decline in deposits as the main source of funding is something to watch for in the coming quarters.