Operating costs rose 5.20% yoy and cost to income fell to 34.2% last quarter. When compared to total assets, operating costs reached 0.818%, down 0.020 bp yoy.

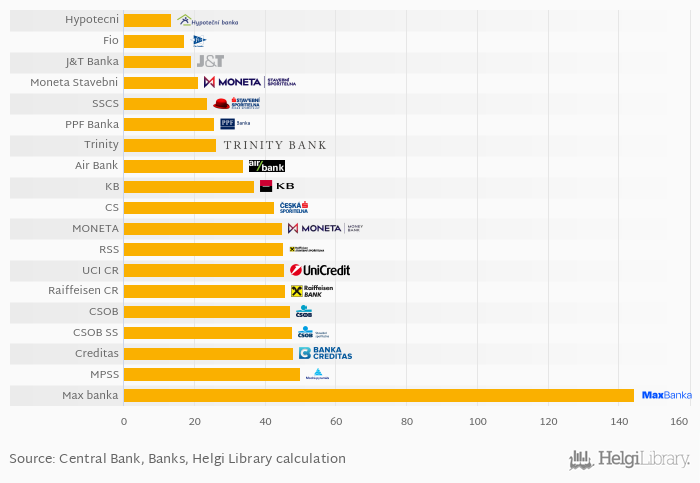

Hypotecni Banka achieved the lowest costs when compared to income followed by Fio banka and J&T Banka:

When cost efficiency is adjusted for balance sheet utilization, i.e. when operating costs are compared to the sum of loans and deposits instead of total assets, Hypotecni Banka and PPF Banka had the highest efficiency from this point of view, as seen above.