HARDWARIO stock traded at CZK 15.0 per share at the end 2022 translating into a market capitalization of USD 9.80 mil. Since the end of 2017, the stock has appreciated by 0% representing an annual average growth of %.

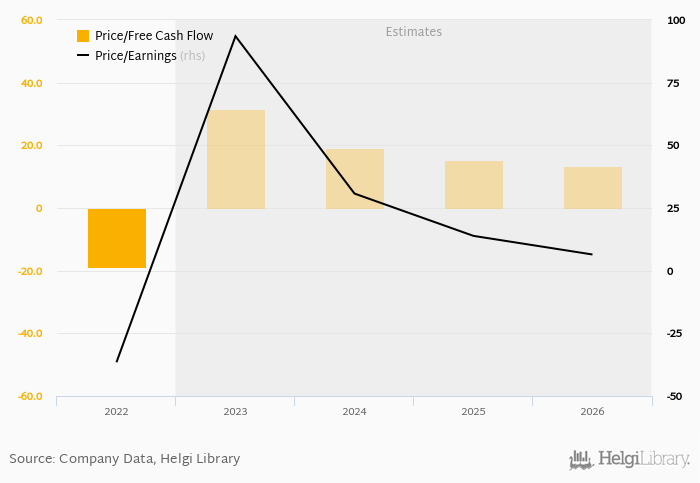

At the end of 2022, the firm traded at price to earnings of -36.5x. Over the last five years, this multiple achieved a high of -36.5x in 2022 and a low of -36.5x in 2022 with an average of -36.5x.

Regarding cash generated defined by the sum of net profit and depreciation, the stock traded at -349x at the end of 2022. When investments are excluded to get free cash flow, HARDWARIO traded at -18.9x.

At the end of 2022, the company had a net debt of CZK -19.6 mil, or 30.6x of EBITDA and -28.0% of equity. The firm generated an average return on equity of 24.9% for its shareholders in the last five years and an average dividend yield of 0%.

You can see all the company’s data at HARDWARIO profile, or you can download a report on the company in the report section.