Immofinanz made a net profit of EUR -357 mil in 2014, down 306% compared to the previous year. Historically, between 1999 and 2014, the company's net profit reached a high of EUR 458 mil in 2006 and a low of EUR -1,968 mil in 2008.

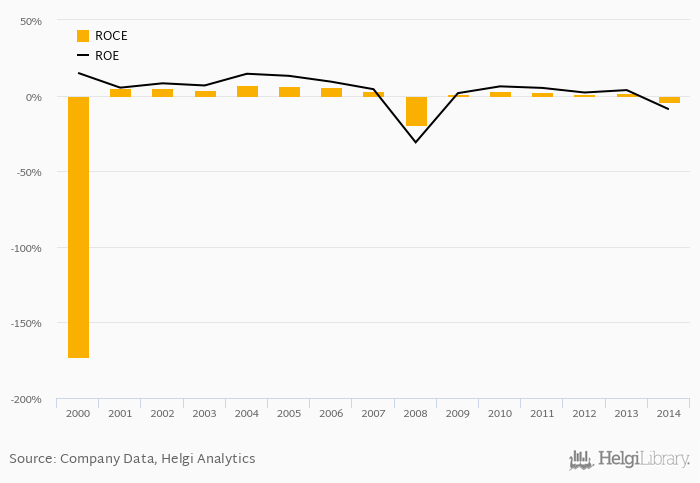

The result implies a return on equity of -9.03% and a return on invested capital of -4.48% in 2014. That is compared to an average of 1.57% and 0.773% over the last five years.

The company has been operating with average EBITDA margin of 46.2% in the last 5 years and an average net margin of 10.8%.

Since 2009, the firm's net profit increased by -542% or an average of nan% a year.

As far as Immofinanz's peers are concerned, CA Immo generated ROE of 3.78% and ROCE of 2.12% in 2014. Conwert's profitability reached -1.07% and -0.458%, respectively. ORCO Property Group operated with -10.1% and -3.49% returns in 2014.

You can see all the company’s data at Immofinanz profile, or you can download a report on the company in the report section.