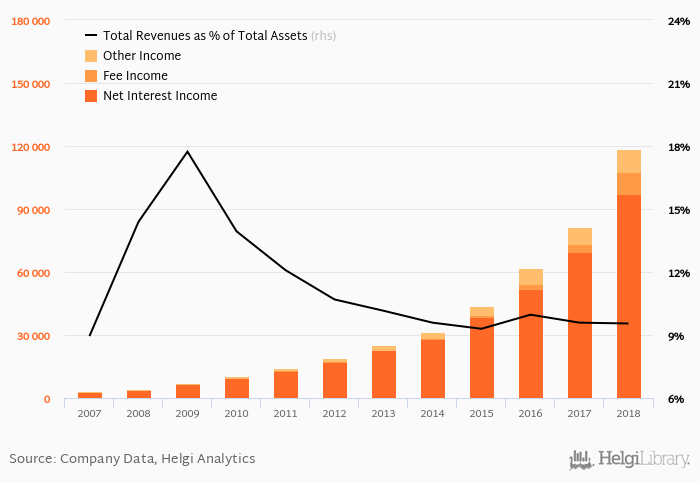

Bajaj Finance generated total banking revenues of INR 118,615 mil in 2018, up 45.9% compared to the previous year.

Historically, the bank’s revenues containing of interest, fee and other non-interest income reached an all time high of INR 118,615 mil in 2018 and an all time low of INR 3,330 mil in 2007. The average revenue in the last five years amounted to INR 67,350 mil.

Net interest income represented 82.0% of total revenues, fee income contributed 8.75% and other non-interest income added further 9.26% to the overall revenue generation in 2018.

Bank's total revenues accounted for 9.55% total assets in 2018, down from 9.59% a year earlier.

Comparing Bajaj Finance with its closest peers, Sundaram Finance generated total revenues of 5.88% of assets in 2018, and Tata Capital Financial Services operated with 4.78% revenue margin.

You can see all the bank’s data at Bajaj Finance Profile, or you can download a report on the bank in the report section.