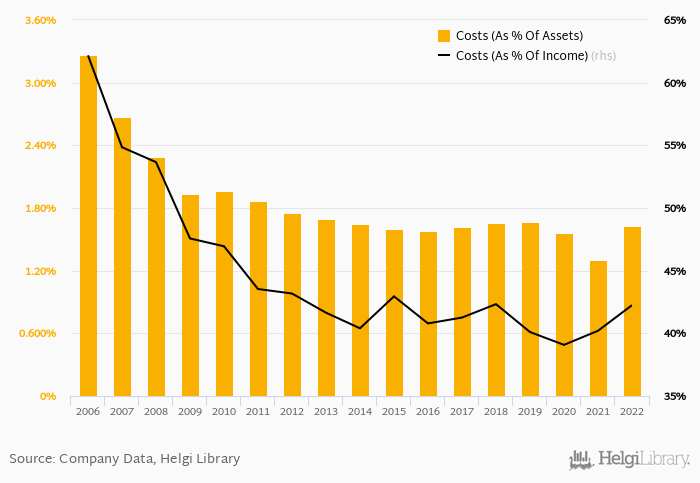

mBank's cost to income ratio reached 42.2% in 2022, up from 40.2% compared to the previous year.

Historically, the bank’s costs reached an all time high of 62.2% of income in 2006 and an all time low of 39.1% in 2020.

When compared to total assets, bank's cost amounted to 1.63% in 2022, up from 1.30% a year earlier.

Staff accounted for 37.0% of total operating expenditures in 2022. The bank operated a network of 365 branches and employed 7,014 persons in 2022.

Comparing mBank with its closest peers, PKO BP operated in 2022 with a cost to income ratio of 45.1% in 2022, Pekao reached 54.5% and ING Bank Slaski some 55.7%.

You can see all the bank’s data at mBank Profile, or you can download a report on the bank in the report section.