Noodles & Co stock traded at USD 9.23 per share at the end 2021 translating into a market capitalization of USD 422 mil. Since the end of 2016, the stock has appreciated by 128% representing an annual average growth of 17.9%.

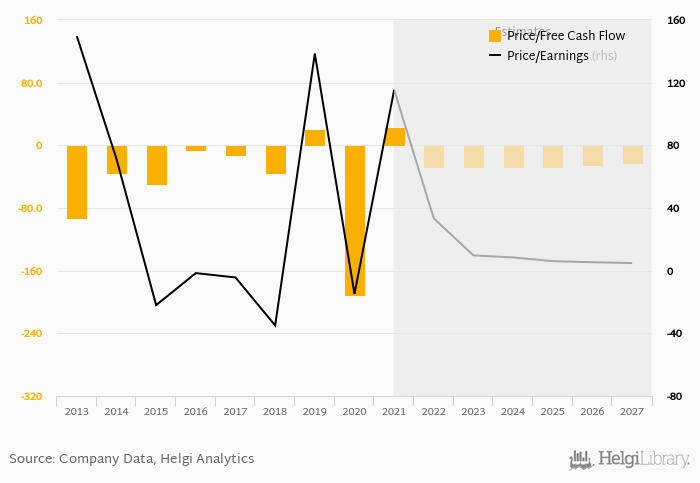

At the end of 2021, the firm traded at price to earnings of 115x. Over the last five years, this multiple achieved a high of 139x in 2019 and a low of -35.0x in 2018 with an average of 40.0x.

Regarding cash generated defined by the sum of net profit and depreciation, the stock traded at 6.57x at the end of 2021. When investments are excluded to get free cash flow, Noodles & Co traded at 23.9x.

At the end of 2021, the company had a net debt of USD 252 mil, or 3.76x of EBITDA and 670% of equity. The firm generated an average return on equity of -42.1% for its shareholders in the last five years and an average dividend yield of 0%.

You can see all the company’s data at Noodles & Co profile, or you can download a report on the company in the report section.