The volume of non-performing loans decreased 3.85% qoq to CZK 81.2 bil but their share rose to 1.43% of total loans at the end of September 2022. Specific provisions covered 85.9% of non-performing loans, up from 75.2% seen a year ago.

Mortgage loans traditionally represent the best level of quality with only 0.705% of them not performing (down from 0.959% a year ago). On the other hand, some 3.33% of corporate loans were classified (from 4.02% last year) as well as 5.73% of consumer loans (compared to 7.57% a year ago).

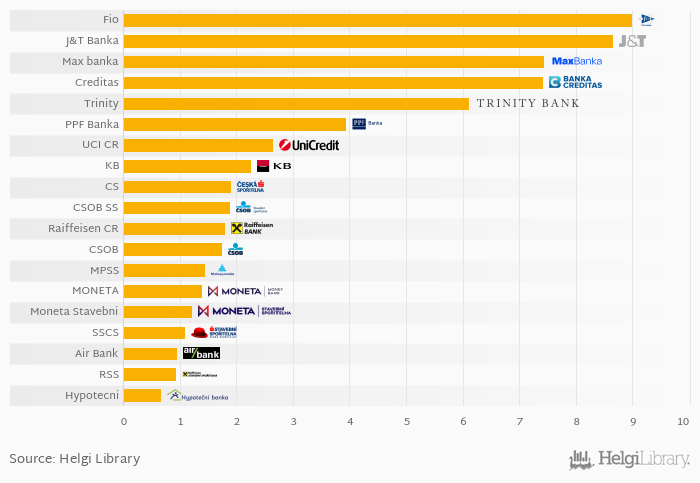

Hypotecni Banka operated with the highest-quality performing loan portfolio - only 0.675% of loans were not performing at the end of September 2022. On the other hand, Fio banka reported the highest NPL ratio with 8.98%.