Pension funds’ assets exceeded USD 25 trillion in OECD countries in 2014. With the exception of Poland where assets fell more than 50% yoy, in all the OECD countries pension funds’ assets grew in 2014.

The five biggest countries in the OECD area in terms of pension funds’ assets were the United States, the United Kingdom, Australia, Canada and the Netherlands, altogether totalling USD 21.7 trillion or more than 85% of OECD pension funds’ assets.

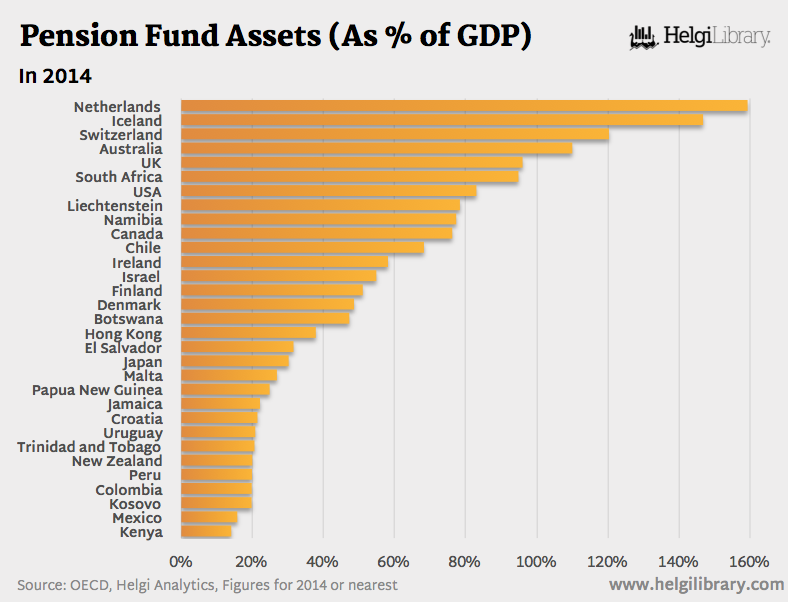

The OECD weighted average asset-to-GDP ratio reached 86%. Five OECD countries achieved asset-to-GDP ratios above this average: the Netherlands (161%), Iceland (146%), Switzerland (126%), Australia (113%) and the United Kingdom (96%).

Pension funds in all the reporting OECD countries recorded positive real returns between in 2014, ranging from 1.3% in the Czech Republic to 16.7% in Denmark, with an OECD weighted average at 4.5%.