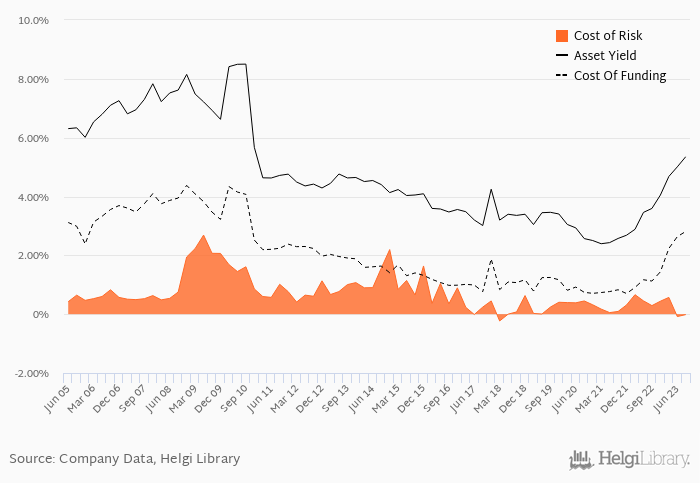

Raiffeisen Bank Int.'s Cost of Risk (loan loss provisions as % of total assets) amounted to -0.015% in the third quarter of 2023, up from -0.081% when compared to the previous quarter.

Historically, the bank’s cost of risk reached an all time high of 2.69% in 2Q2009 and an all time low of -0.231% in 1Q2018. The average cost of risk in the last six quarters amounted to 0.276%.

On the other hand, average asset yield was 5.35% in 3Q2023, up from 3.59% when compared to the same period last year. Cost of funding amounted to 2.81% in 3Q2023, up from 1.13%.

You can see all the bank’s data at Raiffeisen Bank Int. Profile, or you can download a report on the bank in the report section.