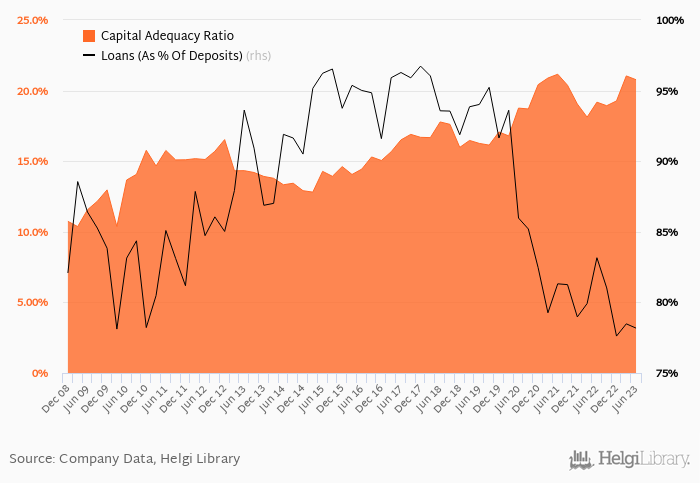

Santander Bank Polska's capital adequacy ratio reached 20.8% at the end of second quarter of 2023, down from 21.0% when compared to the previous quarter. Historically, the bank’s capital ratio hit an all time high of 21.2% in 2Q2021 and an all time low of 10.4% in 1Q2010.

The Tier 1 ratio amounted to 19.2% at the end of second quarter of 2023, up from 17.3% compared to the same period of last year and down from 19.4% when compared to the the previous quarter.

Bank's loan to deposit ratio reached 78.2% at the end of 2Q2023, down from 83.2% when compared to the same period of last year. Some 10 years ago, loan to deposit ratio of the bank amounted to 93.6%.

When compared to bank's main peers, PKO BP ended the second quarter of 2023 with a capital adequacy ratio at 19.8% and loans to deposits of 64.5%, Pekao with 17.1% and 72.0% respectively and ING Bank Slaski some 17.0% in terms of capital adequacy and 78.2% of loans to deposits at the end of the second quarter of 2023.

You can see all the bank’s data at Santander Bank Polska Profile, or you can download a report on the bank in the report section.