Trust Finance Indonesia stock traded at IDR 272 per share at the end 2018 implying a market capitalization of USD 15.1 mil.

Since the end of 2013, the stock has appreciated by 24.8 % implying an annual average growth of 4.53 %. In absolute terms, the value of the company rose by USD 0.785 mil.

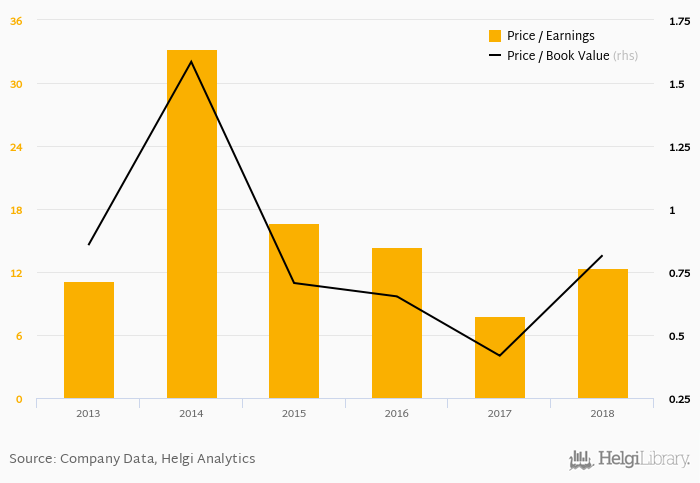

At the end of 2018, the bank traded at price to earnings of 12.3x. Within the last five years, the multiple reached an all time high of 33.3x in 2014 and an all time low of 7.79x in 2017 with an average of 16.9x.

In terms of price to book value, the stock reached 0.816x at the end of 2018. Since 2013, the multiple reached an all time high of 1.58x in 2014 and an all time low of 0.418x in 2017 with an average of 0.836x.

You can see all the bank’s data at Trust Finance Indonesia profile, or you can download a report on the bank in the report section.