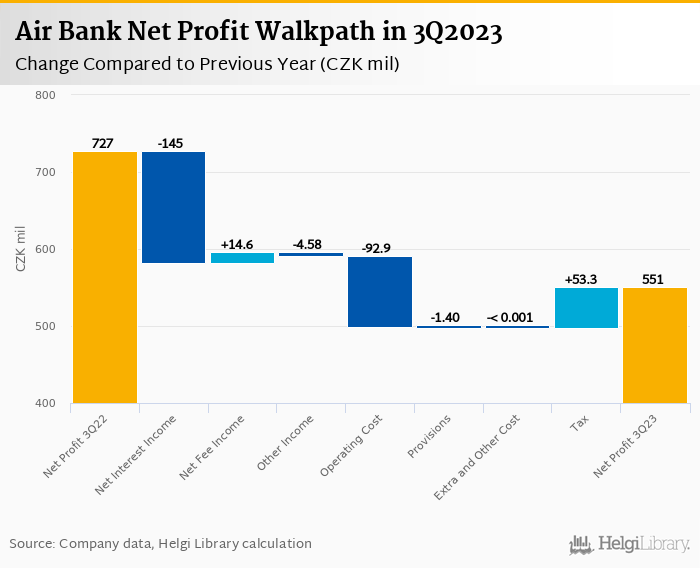

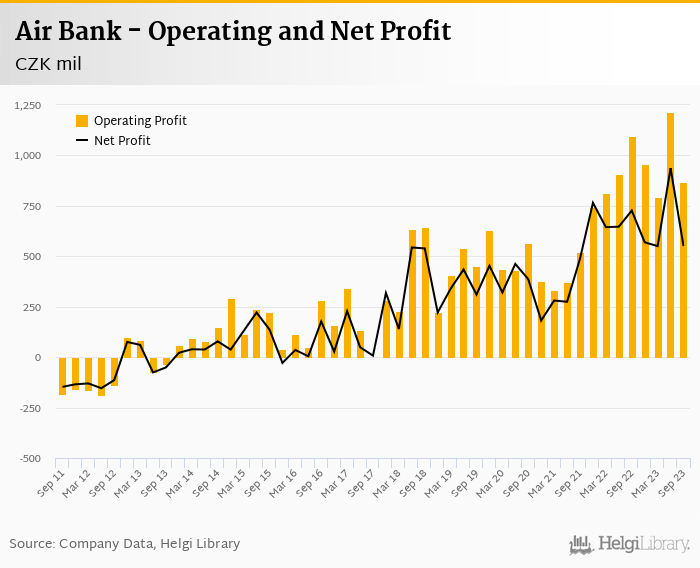

Air Bank decreased its net profit 24.3% to CZK 551 mil in 3Q2023 and generated ROE of 15.5%.

Revenues decreased 8.2% yoy amid lower interest margin while cost rose 16.6%, so cost to income increased to 42.9%

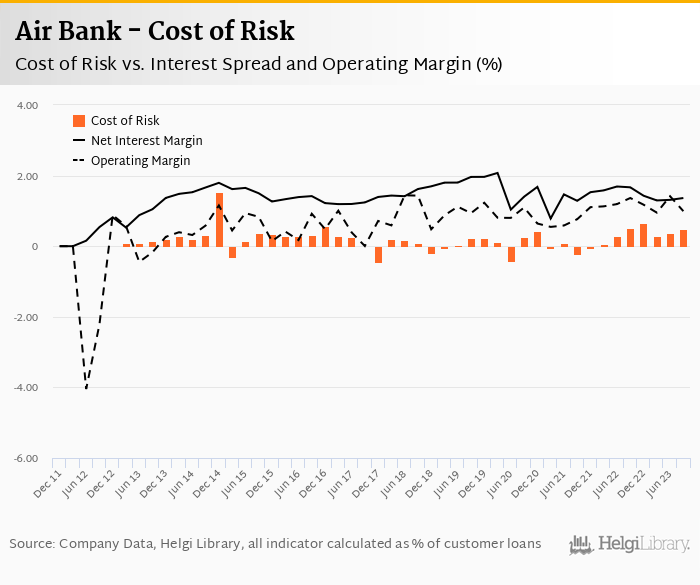

Cost of risk increased to 0.9% of loans, so provisions has eaten a fifth of operating profit last quarter.

We need to wait for full year results to see the big picture, especially, details of Bank's loan portfolio to see the progress in utilization of Bank's clients.

Air Bank made a net profit of CZK 551 mil in the third quarter of 2023, down 24.3% yoy, or decrease of CZK 176 mil in absolute terms. Operating profit fell almost 21% yoy as revenues were still lower when compared to last year's abnormally high interest margin and costs were pushed up significantly. Stabilisation of net interest margin and double digit growth in fees are the main positives to be taken from last quarter's numbers, in our view:

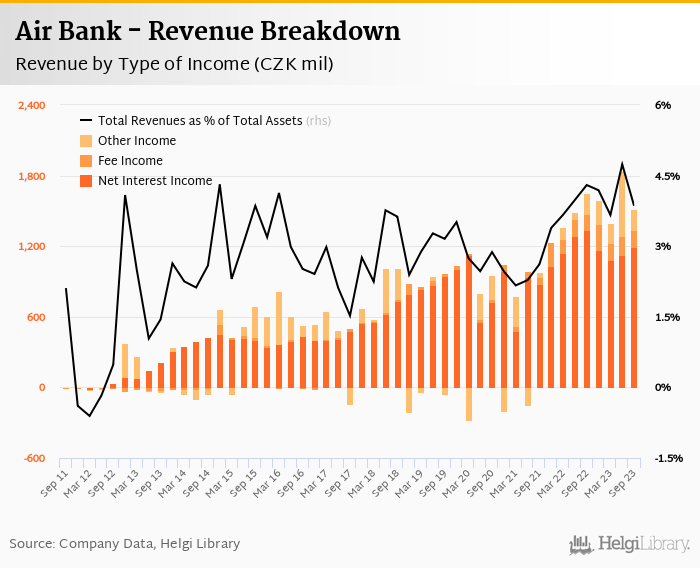

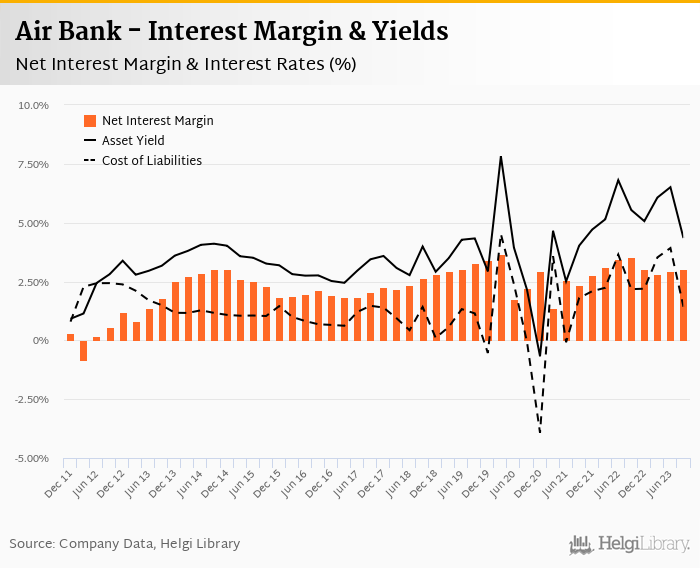

Revenues decreased 8.2% yoy to CZK 1.52 bil in the third quarter of 2023 due mainly to a comparison with a record high 3Q2022 quarter. Net interest income fell 10.9% yoy as net interest margin fell 0.48 pp to 3.05% of total assets, though improvement in both, net interest income as well as interest margin has been seen for two quarters now. Fee income added solid 11% yoy while other/trading income fell only slightly. When compared to three years ago, revenues were up 59.3%:

Net interest margin fell from record high 3.54% seen in 3Q2022, though a recovery has been seen since the second quarter in all, margin, spread as well as absolute net interest income. Average asset yield and liabilities fell heavily in the third quarter of 2023 (to 4.35% and 1.42%, respectively), though these might be a result of accounting for hedging operations, in our view:

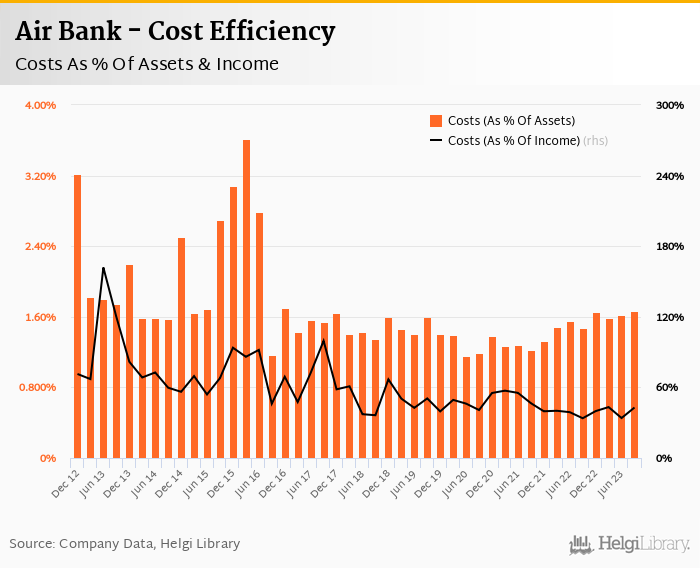

Costs increased by 16.6% yoy and the bank operated with cost to income of 42.9% in the last quarter. Staff cost rose 13.8%, so we assume a 8-10% wage increase has been made during the year given the increase of employeess to 995 persons while other costs rose hefty 27% yoy:

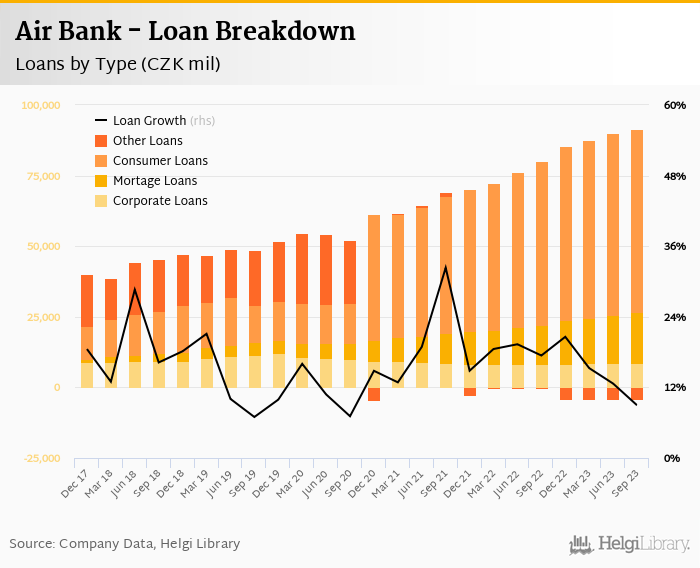

Loan and deposit growth slowed down significantly, based on our estimates. With little details provided, we assume Air Bank's customer loans grew 1-2.0% qoq and approximately 8-9.0% yoy in the third quarter of 2023 while customer deposit growth amounted to 0-1.0% qoq and less than 1.0% yoy. That’s compared to average of 17.2% and 5.19% average annual growth seen in the last three years.

If so, Air Bank's loans accounted for 66% of total deposits and 55% of total assets at the end of September 2023.

We assume retail loans grew 1.5-2.0% qoq and were approximately 15% up yoy. Mortgages might be representing a fifth of the Air Bank's loan book, consumer loans form three quarters while corporate loans a tenth of total loans:

The Bank created further CZK 195 mil of provisions last quarter implying an annualized cost of risk of 0.9%. Provisions have therefore "eaten" more than a fifth of Bank's operating profit in the third quarter of 2023.

We assume Air Bank's asset quality remains good with NPLs at below 1.50% and provision coverage at above 100%, though full-year details will be interesting to see, if there is an increased pressure on the asset quality:

With little details, we guesstimate Air Bank's capital adequacy ratio reached around 18.0% in the third quarter of 2023 while bank equity accounted for 16.6% of loans:

Overall, Air Bank made a net profit of CZK 551 mil in the third quarter of 2023, down 24.3% yoy. This means an annualized return on equity of 15.5% in the last quarter or 19.3% when the last four quarters are taken into account:

With ROE of 15.5% and cost to income ratio at 43%, Air Bank announced relatively good set of results in 3Q2023, especially, as interest margin seems to be stabilising.

The comparison with last year is heavily affected by a record-high revenue generation, though pressure on cost side and potentially asset quality is something to watch for.

We need to wait for full year results to see details of Bank's loan portfolio, i.e. to see the progress in clients' utilization, asset quality and capitalization to get a full picture.