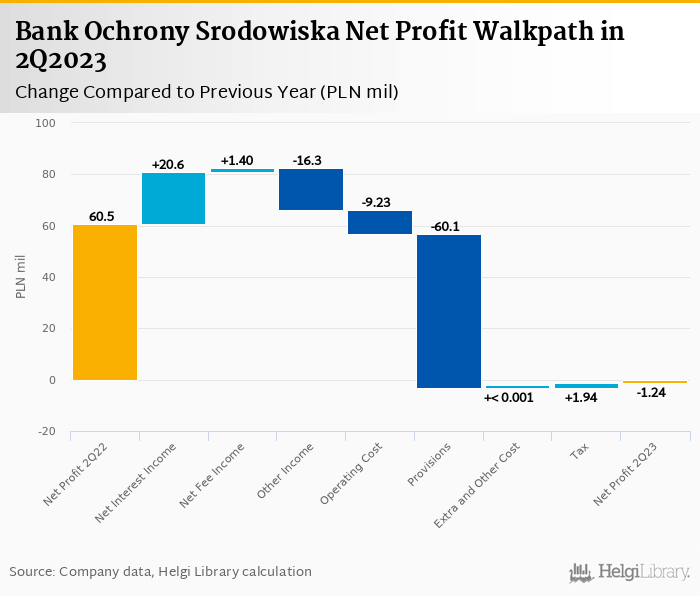

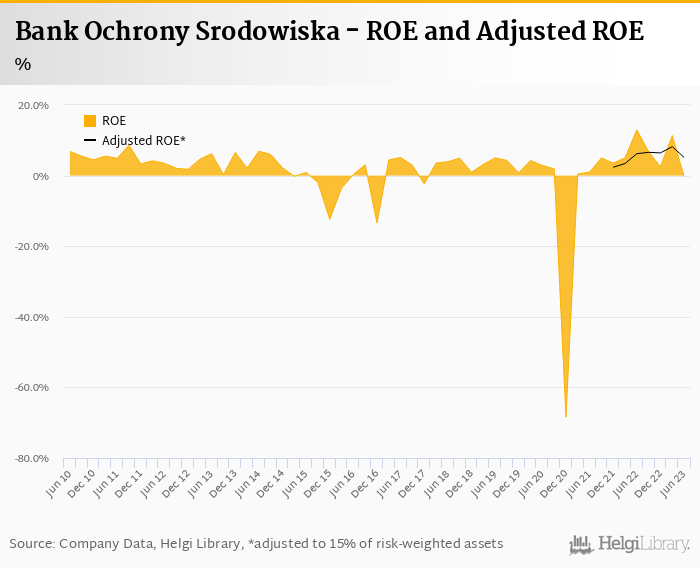

Bank Ochrony Srodowiska made a loss of PLN 1.24 mil in 2Q2023 implying ROE of -0.24%.

Revenues increased 2.2% yoy and adj. cost rose 14.4%, so cost to income increased to 45.8%

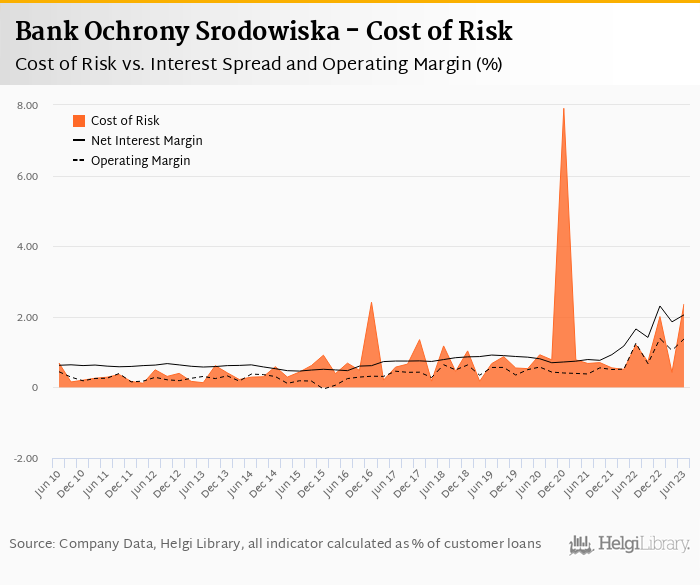

Cost of risk amounted 5.0% as PLN 119 mil of provisions were created for CHF-mortgage portfolio.

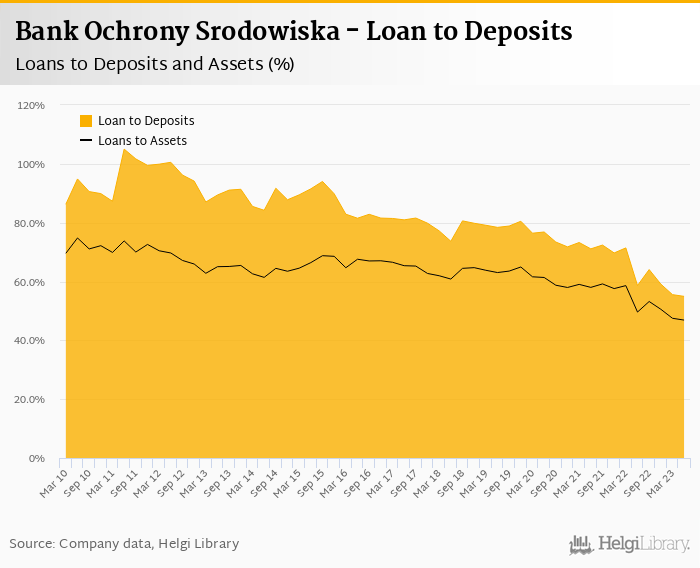

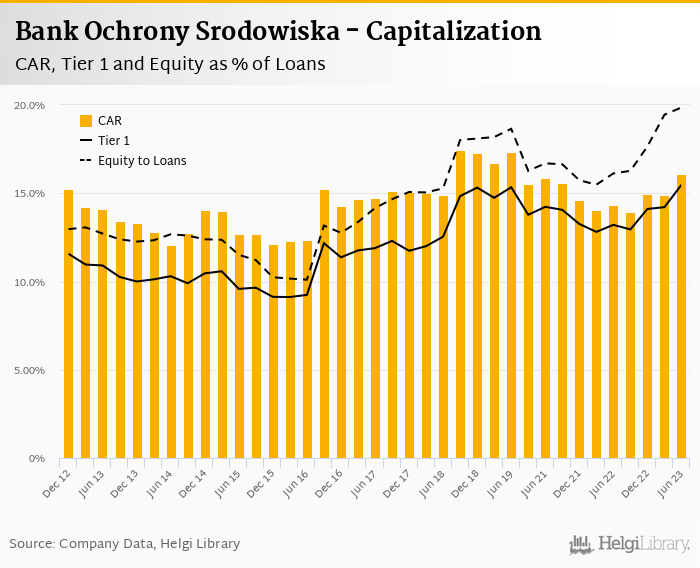

Loan to deposit ratio decreased to 54.9% and capital adequacy increased to 16.1%

Bank Ochrony Srodowiska made a net loss of PLN 1.24 mil in the second quarter of 2023, or a decrease of PLN 61.7 mil in absolute terms. Higher provisions for CHF-mortgages were the single reason for the deterioration as operating profit was 2.4% off last year's numbers only:

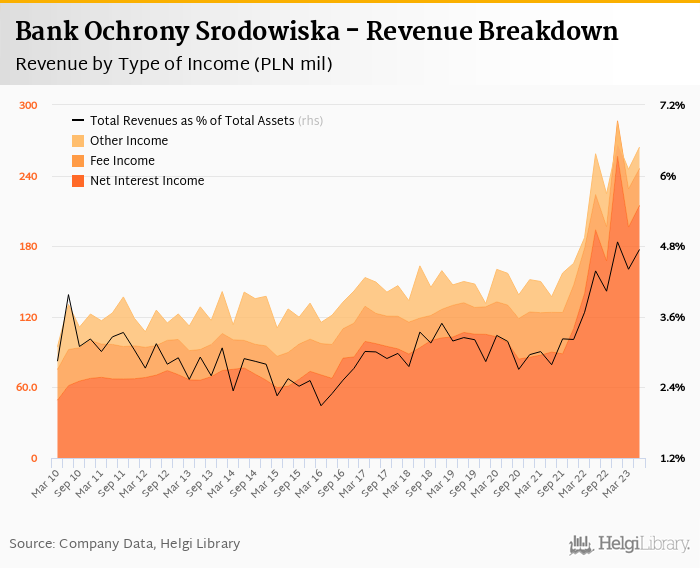

Revenues increased 2.2% yoy to PLN 264 mil in the second quarter of 2023. Net interest income rose 10.6% yoy as net interest margin increased to impressive 3.86% of total assets last quarter. While fees grew 4.7% yoy, other/trading income was PLN 16.3 mil lower. Still, when compared to three years ago, revenues were up 68.4%:

Average asset yield was 7.44% in the second quarter of 2023 (up from 4.96% a year ago) and average yield of customer loans increased to 9.41%. Cost of funding increased slower to to 3.95% in 2Q2023 (up from 1.57%) and the Bank paid on average 2.51% to its depositors:

Costs increased by 14.4% yoy when adjusted for a contribution to the Bank Guarantee Fund last year (or 8.26% yoy reported) and the bank operated with average cost to income of 45.8% in the last quarter. Staff cost rose 17.5% as the bank employed almost 11% more people than last year while other costs rose 6.9% yoy:

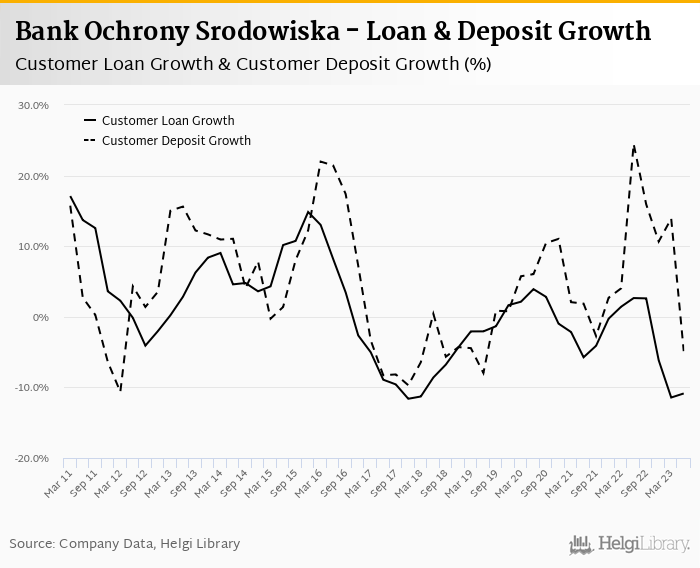

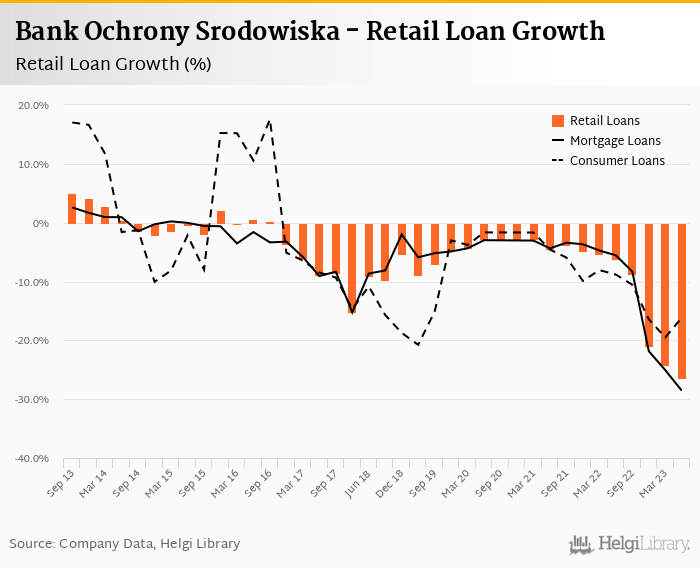

Loan portfolio continues to shrink falling further 1.23% qoq (down 10.9% yoy). Customer deposit also fell, by 0.17% qoq and 4.9% yoy respectively.

At the end of second quarter of 2023, Bank Ochrony Srodowiska's loans accounted for 54.9% of total deposits and 46.9% of total assets.

Retail loans fell 6.2% qoq and were 26.4% down yoy accounting for a fitfh of the loan book at the end of the second quarter of 2023. Mortgages represented 18% of the Bank Ochrony Srodowiska's loan book, consumer loans added a further 4.28% and corporate loans formed 77.6% of total loans:

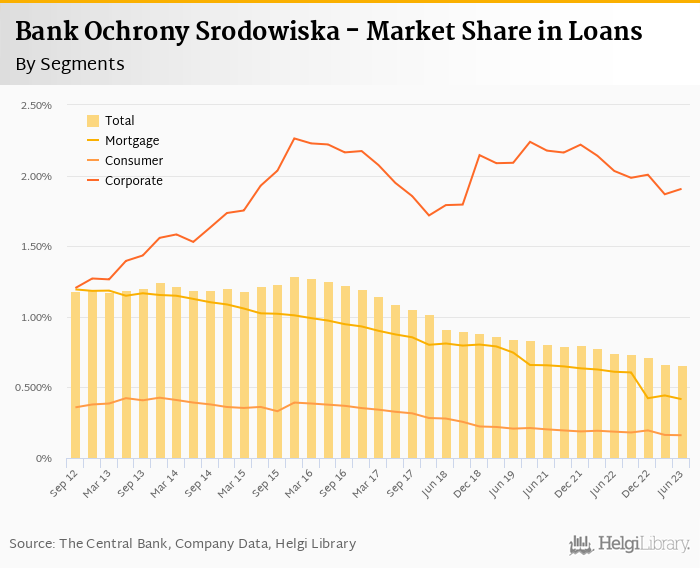

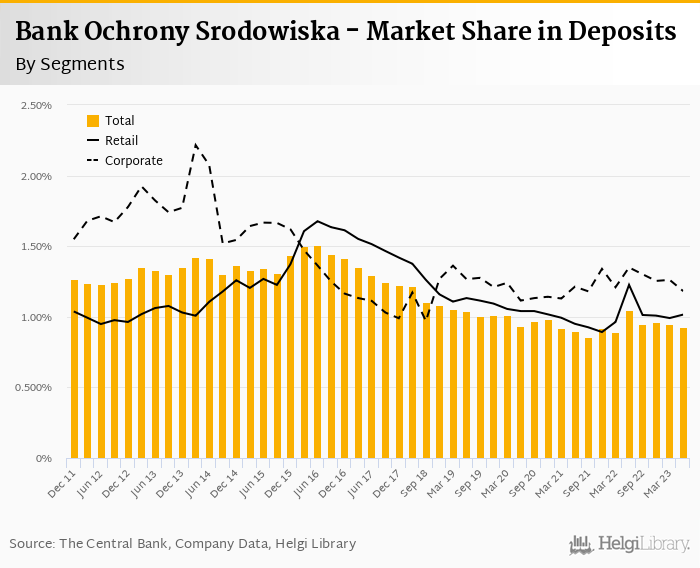

We estimate that Bank Ochrony Srodowiska has lost 0.084 pp market share in the last twelve months in terms of loans (holding 0.659% of the market at the end of 2Q2023). On the funding side, the bank seems to have lost 0.122 pp and held 0.929% of the deposit market:

Bank Ochrony Srodowiska created further PLN 119 mil provisions for its CHF-denominated mortgage portfolio in the last quarter. As a result, loan loss provisions have "eaten" almost 92% of operating profit and cost of risk reached 5.0% of average loans.

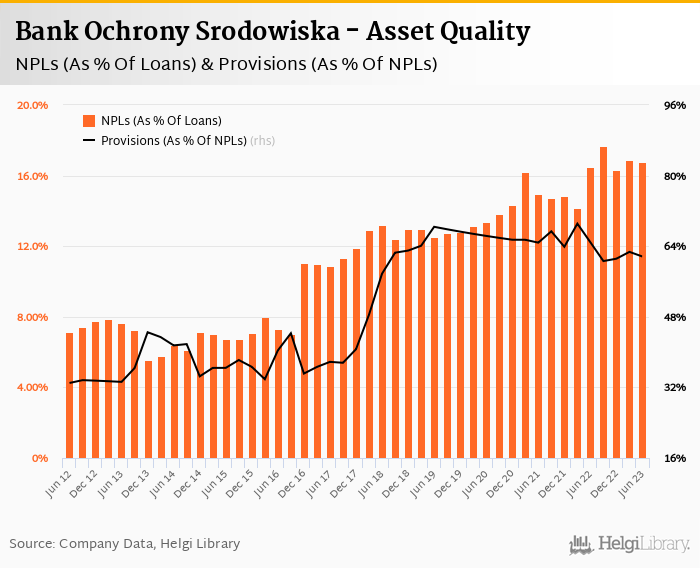

Share of non-performing loans remains high relative to the sector, it reached 16.8% of total loans while provision coverage of 62% of NPLs is at the lower end of the Polish banking universe.

Bank Ochrony Srodowiska's capital adequacy ratio reached 16.1% in the second quarter of 2023, up from 14.3% for the previous year. The Tier 1 ratio amounted to 15.5% at the end of the second quarter of 2023 while bank equity accounted for 19.9% of loans:

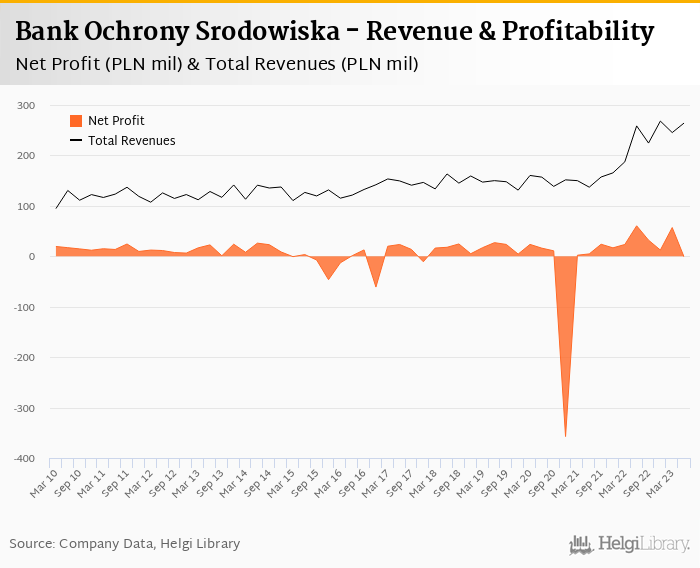

Overall, Bank Ochrony Srodowiska made a net loss of PLN 1.24 mil in the second quarter of 2023. This means an annualized return on equity of -0.239% in the last quarter or 4.99% when the last four quarters are taken into account:

BOS announced relatively weak quarterly results when compared to other Polish banks. Apart from the high provisioning on the CHF-mortgage portfolio, the main difference is seen in falling loans and deposits and high share of non-performing loans.

For more details, download the data in excel format at https://www.helgilibrary.com/reports/