BNP Paribas Bank Polska announced strong net profit of PLN 460 mil in 2Q2023 implying ROE of 14.9%.

Revenues increased 16.4% yoy and cost rose only 7.2%, so cost to income fell below 40%

Cost of risk was high at 1.50% due to further provisioning for CHF-mortgages, though overall asset quality remains good.

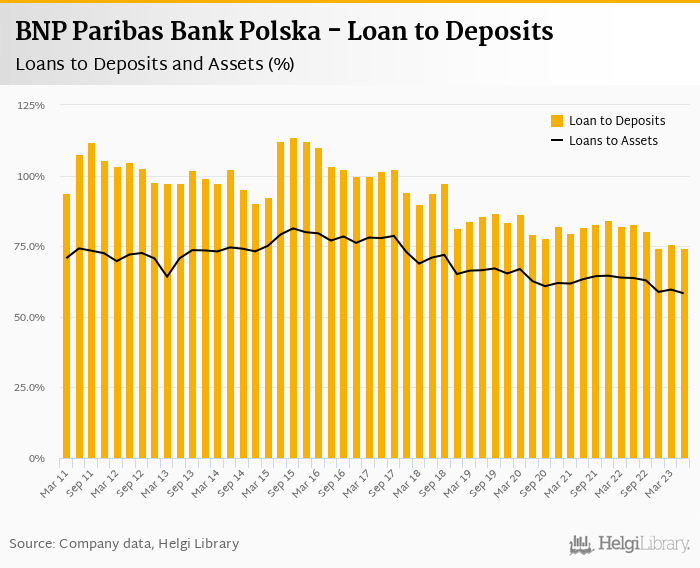

Loan to deposit ratio decreased to 74.5% and capital adequacy increased to 16.4%

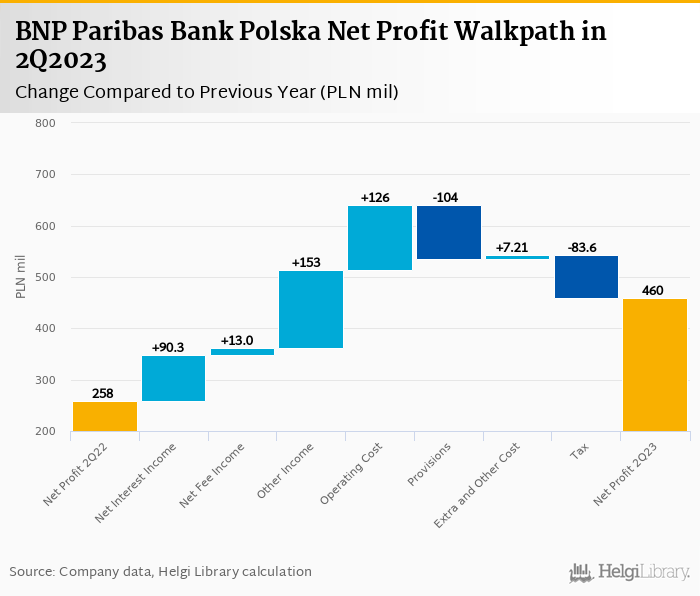

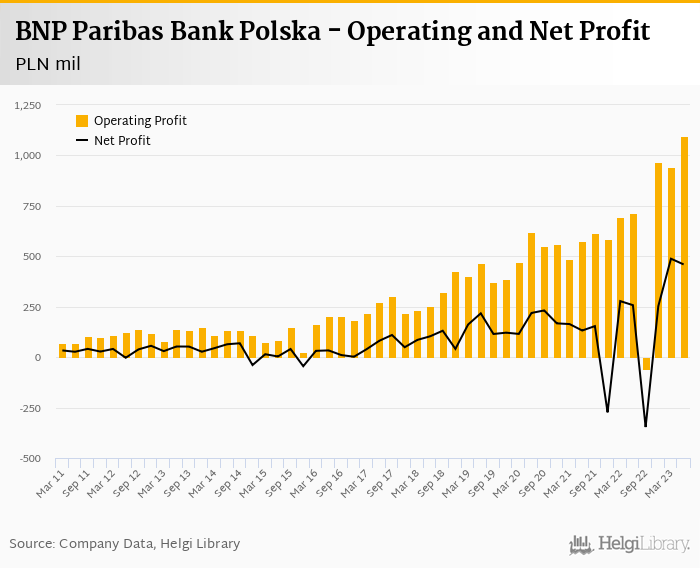

BNP Paribas Bank Polska made a net profit of PLN 460 mil in the second quarter of 2023, up 78.4% yoy, or increase of PLN 202 mil in absolute terms. On the operating level, the Bank generated the record-breaking profit of PLN 1.11 bil, up 23% yoy when adjusted for contribution to the Depository Fund. Most of the pre-tax profit improvement came from higher revenues (both interest and other), while higher provisions for CHF-mortgages were the main obstacle to show even better numbers:

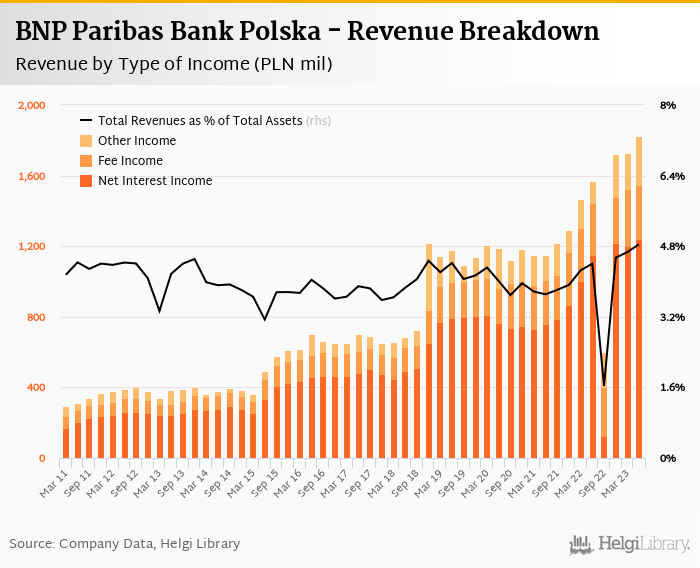

Revenues increased 16.4% yoy to PLN 1,823 mil in the second quarter of 2023. Net interest income rose 7.9% yoy as net interest margin increased further 12 bp to 3.32% of total assets and fee income grew 4.4% yoy. Most of the revenue growth came however from other income (trading, hedging and investments). When compared to three years ago, revenues were up 53%:

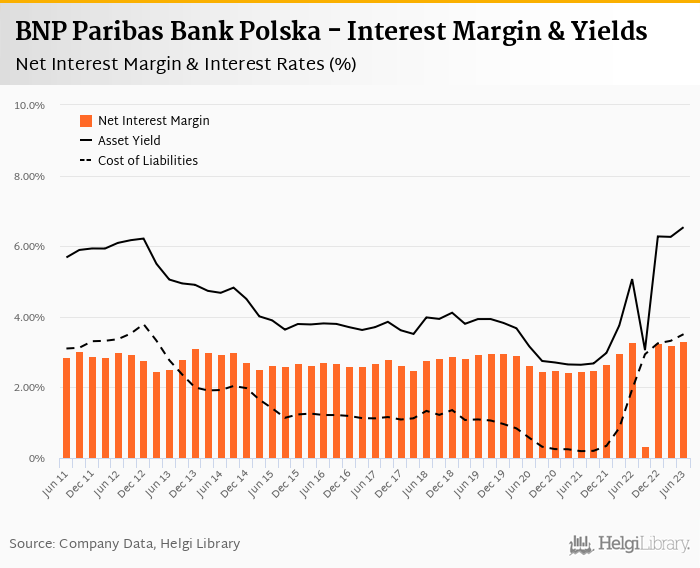

Average asset yield was 6.54% in the second quarter of 2023 (up from 5.07% a year ago) as average yield on loans increased to 8.14% (from 6.15% a year ago) while cost of funding amounted to 3.51% in 2Q2023 (up from 1.94%). Average cost of deposits increased from 1.08% in 2Q22 to 2.36% in the last quarter:

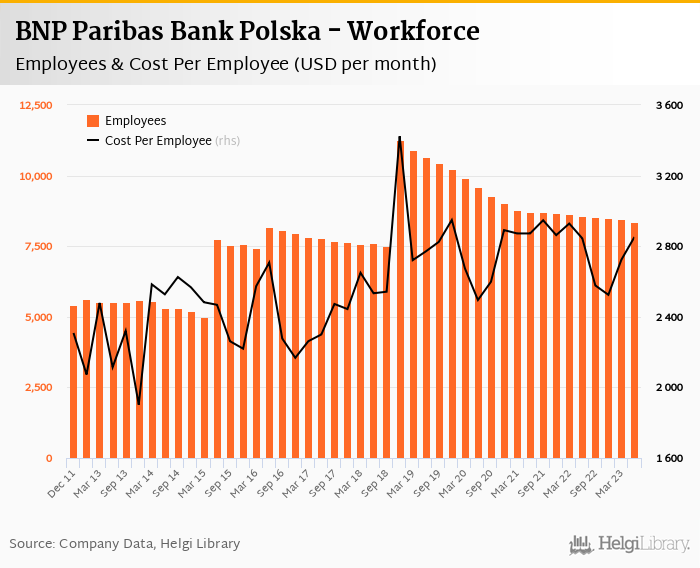

Costs decreased by 14.8% yoy and the bank operated with average cost to income of 39.8% in the last quarter. The reduction is due mainly to a PLN 188 mil contribution to the Bank Guarantee Fund made last year. When adjusted, operating costs have increased 7.2%, still well below inflation rate. Staff cost rose 11.8% in spite of laying off 217 persons (or 2.5% of total) during the year:

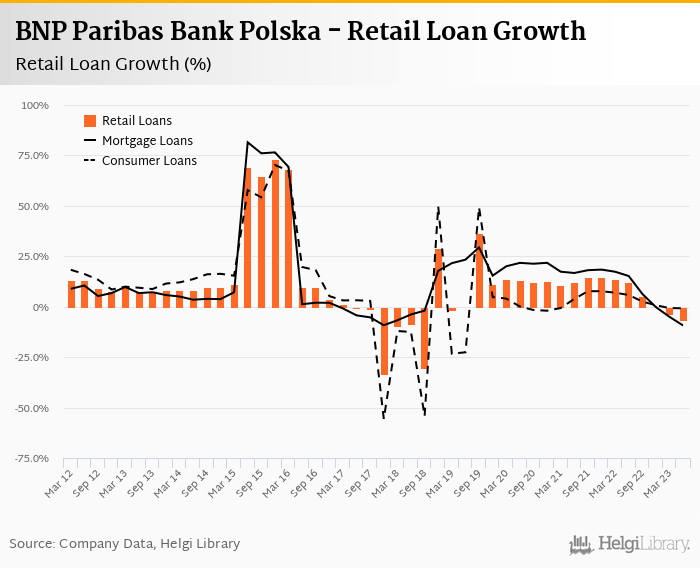

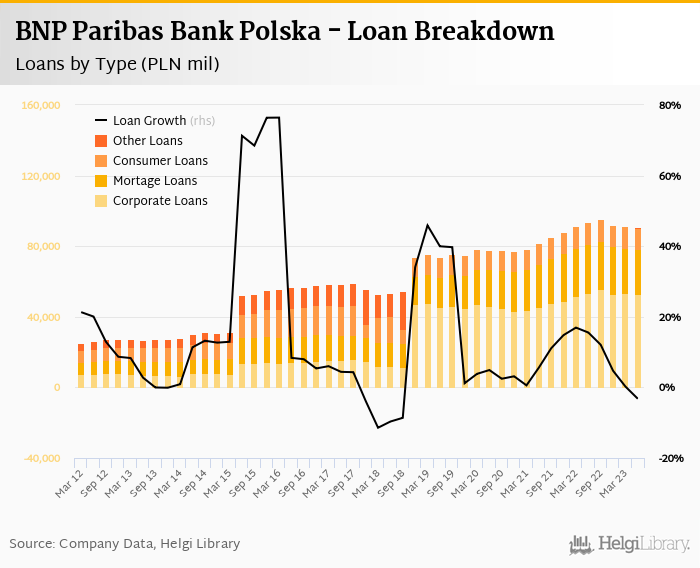

Loan and deposit growth slowed down significantly alongside the whole sector. BNP Paribas Bank Polska's customer loans decreased 0.68% qoq and 3.2% yoy in the second quarter of 2023 while customer deposit grew only 0.86% qoq and 7.8% yoy. That’s compared to average of 7.0% and 10.4% average annual growth seen in the last three years.

At the end of second quarter of 2023, BNP Paribas Bank Polska's loans accounted for 74.5% of total deposits and 58.3% of total assets.

Retail loans fell 1.3% qoq and were 6.7% down yoy. They accounted for 42.7% of the loan book at the end of the second quarter of 2023 while corporate loans decreased 0.36% qoq and 0.78% yoy, respectively. Mortgages represented 28.8% of the BNP Paribas Bank Polska's loan book, consumer loans added a further 13.9% and corporate loans formed 60.4% of total loans:

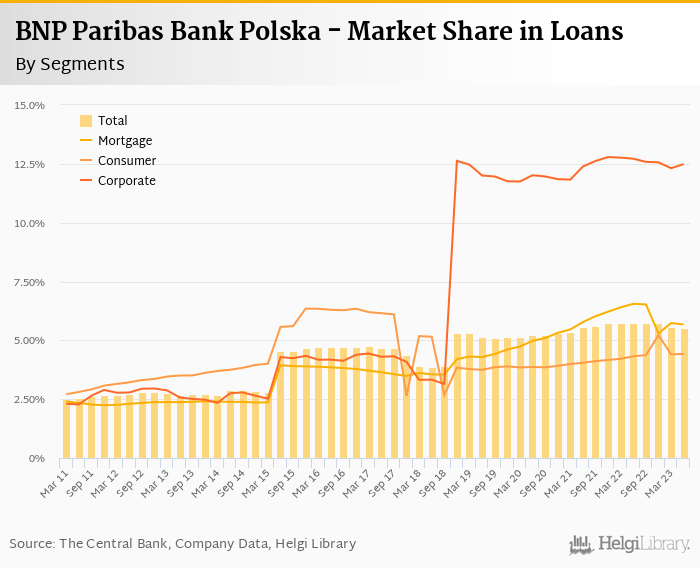

We estimate that BNP Paribas Bank Polska has lost 0.21 pp market share in the last twelve months in terms of loans (holding 5.54% of the market at the end of 2Q2023). On the funding side, the bank seems to have gained 0.01 pp and held 5.76% of the deposit market:

Non-performing loans reached 3.15% of total loans and provision coverage remained at around 100% of NPLs. The Bank however created further PLN 356 mil of provisions for its CHF-denominated mortgage portfolio (following PLN 234 mil already created in 1Q23) and increased its provision coverage from 46% at the end of 2022 to almost 63% now.

When provisions for CHF-mortgages are excluded, Bank's underlying cost of risk was positive as PLN 26 mil of provisions were released in 2Q23. That's following PLN 25 mil released in the first quarter demonstrating Bank's confidence in its asset quality.

Overall, provisions have "eaten" some 30% of operating profit in the second quarter of 2023 as cost of risk reached 1.50% of average loans:

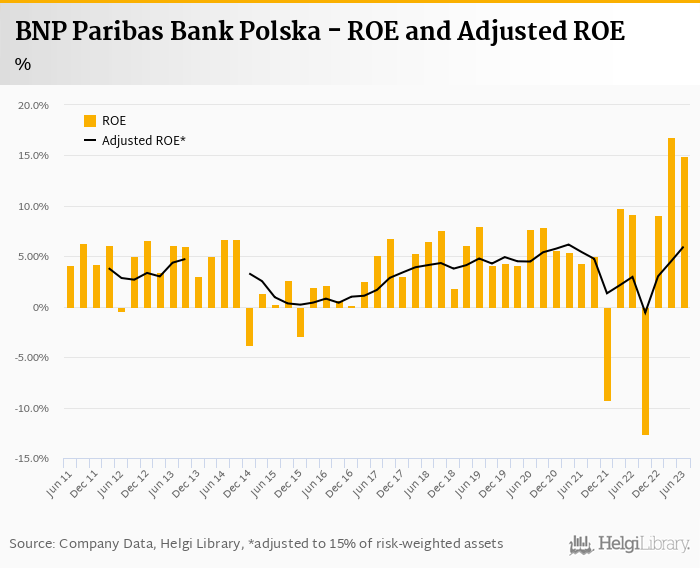

BNP Paribas Bank Polska's capital adequacy ratio reached 16.4% in the second quarter of 2023, up from 15.2% for the previous year. The Tier 1 ratio amounted to 12.1% at the end of the second quarter of 2023 while bank equity accounted for 14.4% of loans:

Overall, BNP Paribas Bank Polska made a net profit of PLN 460 mil in the second quarter of 2023, up 78.4% yoy. This means an annualized return on equity of 14.9% in 2Q2023, or 7.8% within the last four quarters:

Good set of results on the operating level partly offset by higher cost of risk due to the on-going CHF-mortgage saga. The bank stocks are trading at around 8.0x on the PE and 0.8x in terms of PBV expected in 2024, so valuation does not seem to be demanding. However, lack of growth and ongoing CHF-mortgage risk are worth watching in the coming quarters.

For more details, download the data in excel format at https://www.helgilibrary.com/reports/