Erste Group Bank rose its net profit 30.2% to EUR 896 mil in 2Q2023 and has beaten market expectations by 15-20%.

Higher than expected interest income, a few one-offs and lower than expected cost of risks are behind the strong performance

Management upgraded its 2023 profit guidance with ROTE of >15% and announced a EUR 300 mil share byuback programme.

Trading at PE of around 7.0x, PBV of 0.8x and offering potential dividend yield of 8-10%, Erste Bank share looks attractive.

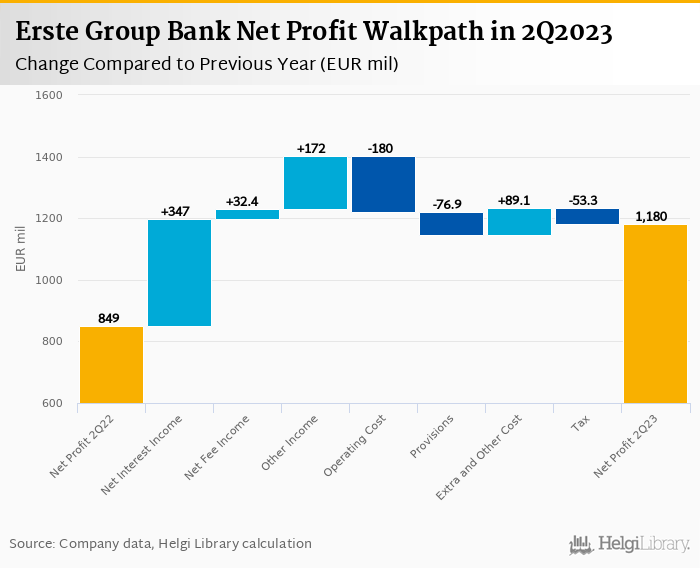

Erste Group Bank increased its net profit 30% yoy, or by EUR 208 mil in the second quarter of 2023. The net increase was purely driven by higher revenues as lower cost of risk was offset by other operating costs. Very strong performance in Austria on the back of rising interest rate environment. The results were further supported by a EUR 40 mil one-off in Austria and EUR 18.5 mil in Czechia on the back of Sberbank's acquisition.:

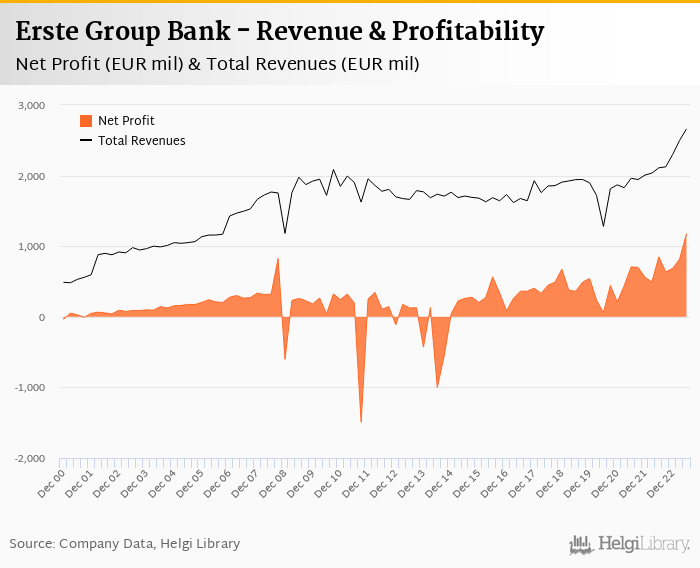

Revenues increased 26.2% yoy to EUR 2,662 mil in the second quarter of 2023. Net interest income rose 24.0% yoy as net interest margin increased 0.316 pp to 2.09% of total assets. Fee income grew 5.4% yoy and other income added further EUR 172 mil yoy increase due partly to absence of losses from last year. When compared to three years ago, revenues were up 108%:

Average asset yield was 5.74% in the second quarter of 2023 (up from 2.99% a year ago) while cost of funding amounted to 3.96% in 2Q2023 (up from 1.31%). Austrian business delievered virtually the while growth in the net interest income as margin increased to 1.78% from 1.15% a year earlier.

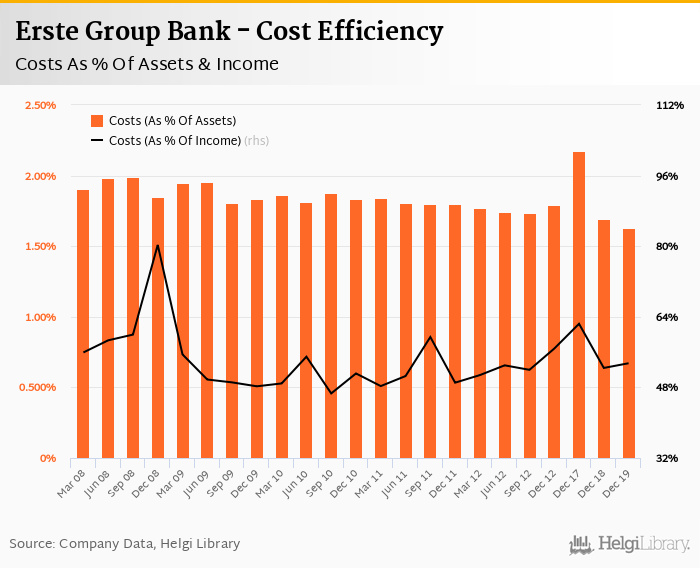

Costs increased by 17.1% yoy and the bank operated with average cost to income of 46.2% in the last quarter. Staff cost rose 14.7% as the bank employed 45,667 persons (up 2.0% yoy) and paid EUR 5,559 per person per month including social and health care insurance cost:

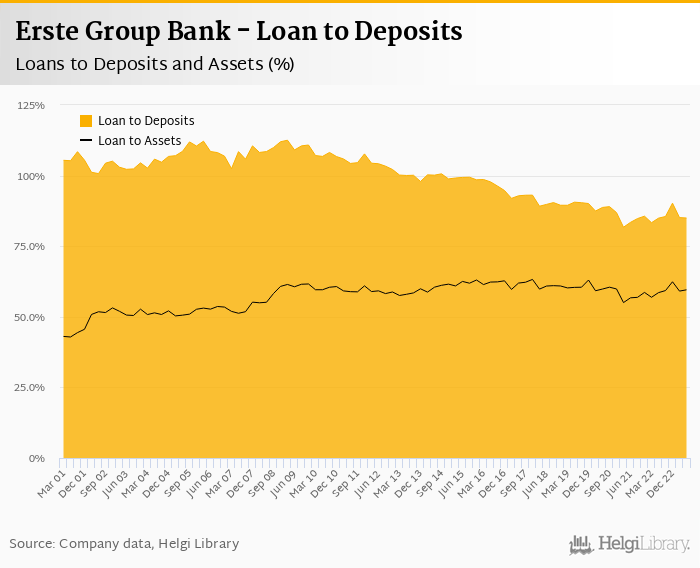

Erste Group Bank's customer loans grew 1.1% qoq and 7.0% yoy in the second quarter of 2023 while customer deposit growth amounted to 1.3% qoq and 6.9% yoy. That’s compared to average of 9.2% and 10.3% average annual growth seen in the last three years. CEE continues to grow 2-3x faster than the Austrian markets across the board, from loans, to deposits or risk-weighted assets.

At the end of second quarter of 2023, Erste Group Bank's loans accounted for 85.0% of total deposits and 59.6% of total assets.

Retail loans grew 1.4% qoq and were 4.7% up yoy and accounted for 46% of the loan book at the end of the second quarter of 2023. Corporate loans increased 1.1% qoq and 9.6% yoy, respectively:

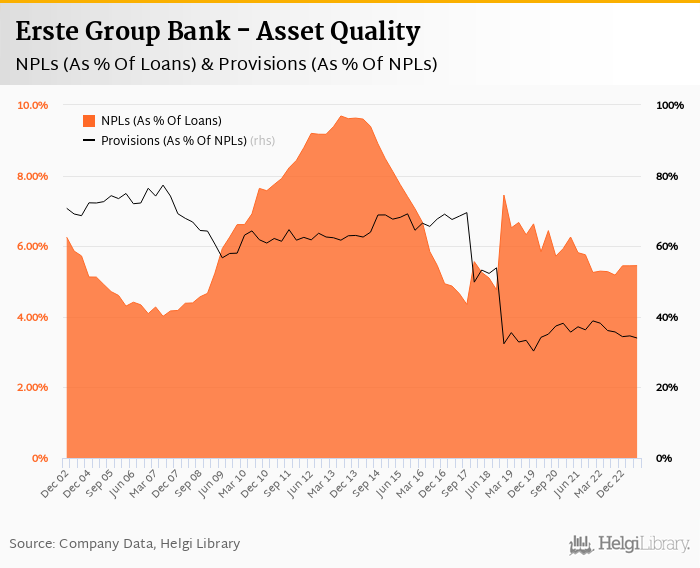

Asset quality remains good with ongoing provision write-backs and recoveries. Non-performing loans reached 5.45% of total loans, up from 5.28% when compared to the previous year. Provisions covered some 34.0% of NPLs at the end of the second quarter of 2023, down from 36.1% for the previous year:

Erste Group Bank's capital adequacy ratio reached 19.0% in the second quarter of 2023, up from 18.5% for the previous year. The Tier 1 ratio amounted to 16.4% at the end of the second quarter of 2023 while bank equity accounted for 7.8% of loans:

Overall, Erste Group Bank made a net profit of EUR 896 mil in the second quarter of 2023, up 30.2% yoy. This means an annualized return on equity of 17.7%, or 15.3% when equity "adjusted" to 15% of risk-weighted assets:

Following the strong 1H2023 results, the management upgraded its profit guidance for 2023 to achieve ROTE of more than 15% (up from 13-15%). The main ingredients and changes in the forecast are:

- 5% of loan portfolio growth (unchanged)

- increase in net interest income growth 20% (from 15% after 1Q23 and the initial guidance of 10%)

- operating expenses to grow at around 9% to push cost to income to below 50%

- cost of income at below 50%

- cost of risk of less than 10 bp (compared to <25bps in the previous guidance)

- strong dividend guidance of as much as EUR 2.7 per share from 2023 profits implying a 8% yield

- a plan for a share buyback of up to EUR 300 mil adding potentially further 2% to the yield

Strong results beating market estimates by 15-20% due mainly to higher than expected interest income, a few one-offs and lower than expected cost of risks. Upgraded 2023 profit guidance and EUR 300 mil share buyback should add further plus points to the overall picture.

Trading at PE of around 7.0x, PBV of 0.8x and offering potential dividend yield of 8-10%, Erste Bank share looks attractive compared to the past as well as within the CEE banking universe.