mBank Czech Republic served almost 750,000 customers in the middle of 2023 through a network of 32 light branches and mKiosks

From almost 2.0% market share in retail lending and deposits in 2021, the Bank has been losing its market position since 2022

In the middle of 2023, the Bank held 1.51% share in consumer, 1.15% in mortgage lending and 1.39% in retail deposits

Average balance on deposits has been stagnating at around CZK 90,000 per account since 2021

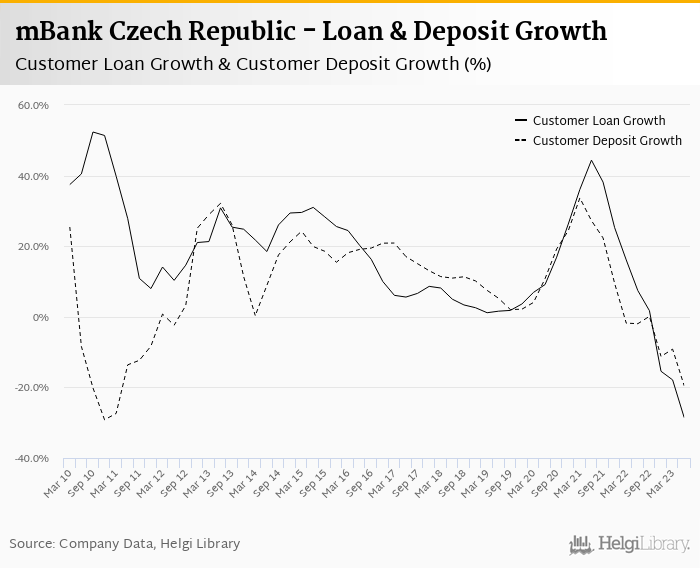

mBank Czech Republic's customer loans decreased 12.1% qoq and 28.6% yoy in the second quarter of 2023 while customer deposit fell 8.7% qoq and 19.5% yoy, respectively. That’s compared to average of 12.5% and 7.73% average annual growth seen in the last three years.

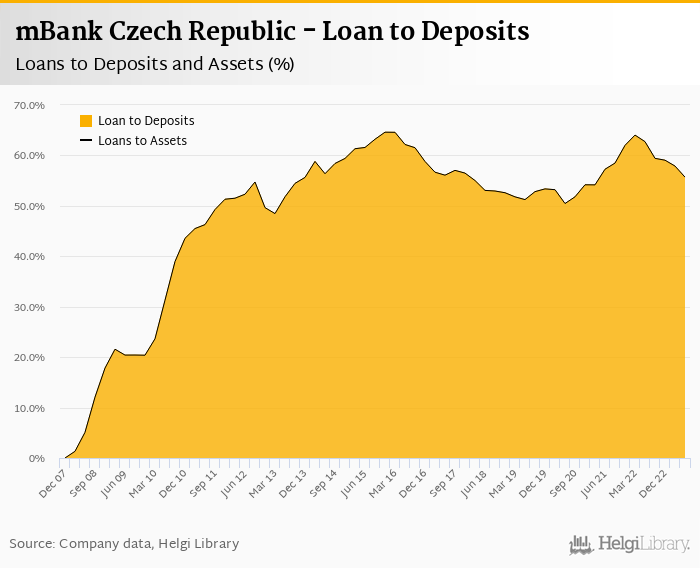

At the end of second quarter of 2023, mBank Czech Republic's loans accounted for 55.7% of total deposits and 55.7% of total assets.

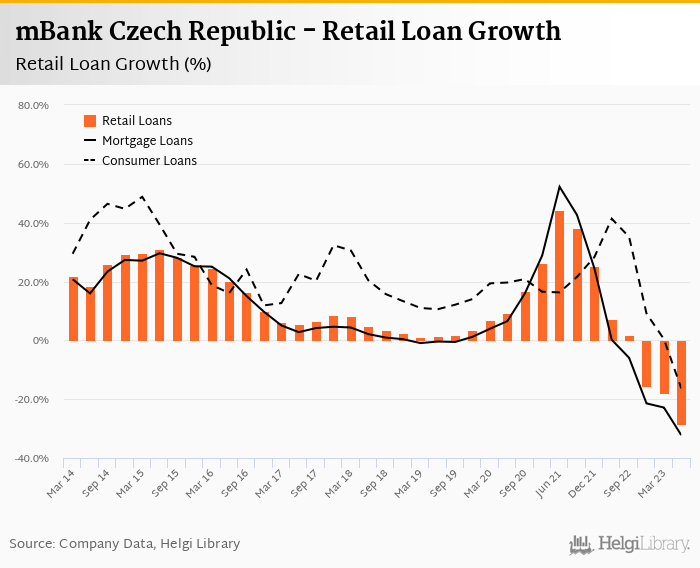

Retail loans fell 12.1% qoq and were 28.6% up yoy. Mortgages represented 72.9% of the mBank Czech Republic's loan book while consumer loans added further 27.1% to total loans:

From almost 2.0% market share in retail lending and deposits in 2021, the Bank has been losing its market position since 2022

In the middle of 2023, the Bank held 1.51% share in consumer, 1.15% in mortgage lending and 1.39% in retail deposits

We estimate that the Bank has lost 0.315 pp market share in the last twelve months in terms of loans (holding 0.645% of the market at the end of 2Q2023). On the funding side, the bank seems to have lost 0.242 pp and held 0.713% of the deposit market:

Conclusion

Similar to the development on its home market in Poland, Czech mBank's momentum in both, retail lending as well as funding, remains negative. Tough decisions ahead...