mBank Czech Republic gained further 25,000 customers since the beginning of the year servicing 775,701 clients

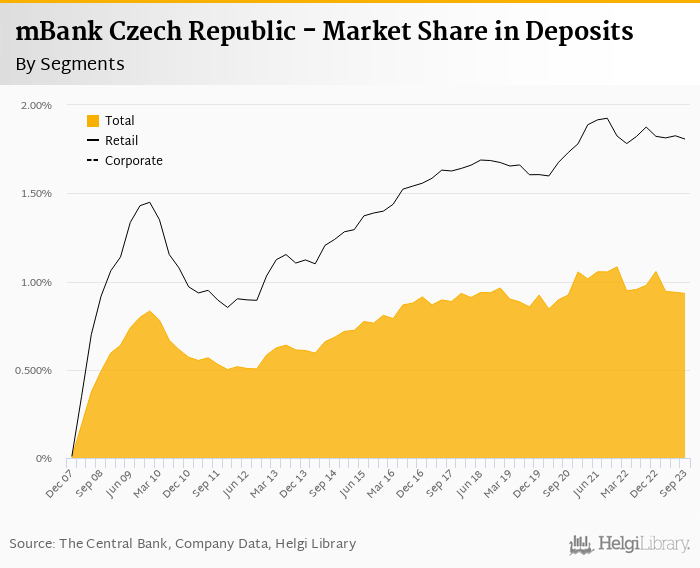

Average balance remains stable at around CZK 91,000 per account meaning the Bank has been slightly losing market share

On the lending market, Bank's position is stable in consumer loans (at around 2.0% of the market) while continue to lose in mortgage business (1.5% market share)

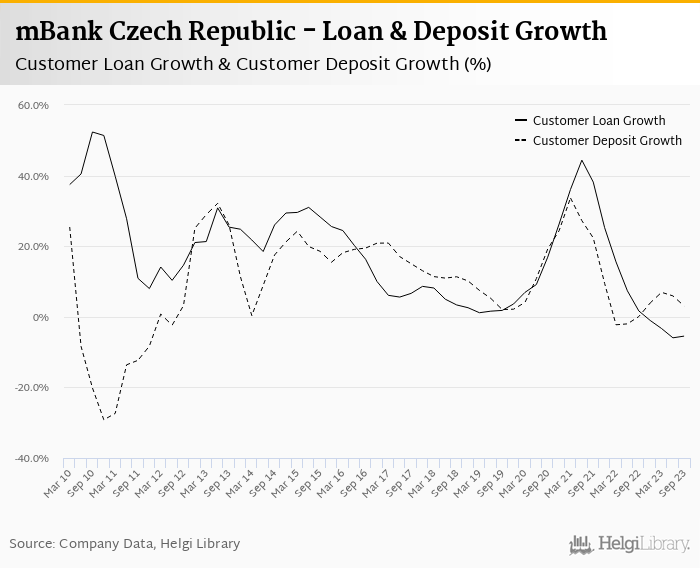

Based on the numbers reported by its Poland's owner, mBank Czech Republic's customer loans decreased 1.3% qoq and 5.5% yoy in the third quarter of 2023 while customer deposit growth amounted to 0.8% qoq and 3.0% yoy. That’s compared to average of 14.9% and 11.1% average annual growth seen in the last three years.

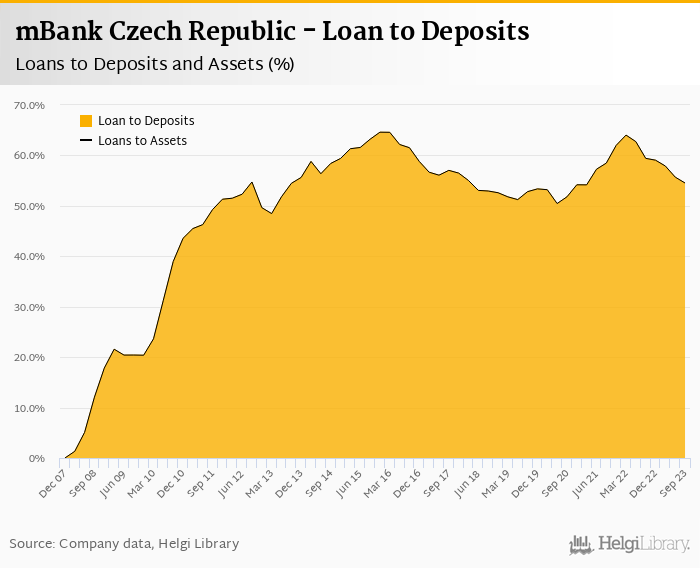

At the end of third quarter of 2023, mBank Czech Republic's loans accounted for 54.5% of total deposits and 54.5% of total assets.

Momentum in lending remains negative. Mortgage loans fell 2.33% qoq and were 9.16% down yoy while consumer loans increased 1.38% qoq and 5.71% yoy. Mortgages represented 72.2% of the mBank Czech Republic's loan book with consumer loans the remainder.

On the other hand, deposits (household only) continued to increase by some 0.80% when compared to previous quarter and by 3.02% yoy.

We estimate that mBank Czech Republic has lost 0.096 pp market share in the last twelve months in terms of loans (holding 0.822% of the market at the end of 3Q2023). On the funding side, the bank seems to be losing slightly as well holding 0.932% of the deposit market at the end of September 2023:

Based on the few numbers provided by Poland's mBank, we think, calculate and estimate that:

- mBank Czech Republic gained further 25,000 customers, or 3.5% since the beginning of the year. At the end of September, it had 757,701 clients (and 710,436 accounts).

- average balance remained stable at around CZK 91,000 per account meaning the Bank has been losing market share slightly (0.93%)

- market share in mortgages fell further to 1.50% while Bank's position seems stable in consumer loans at around 2.0% of the market