mBank announced strong set of 2Q23 results in spite of the headline losses.

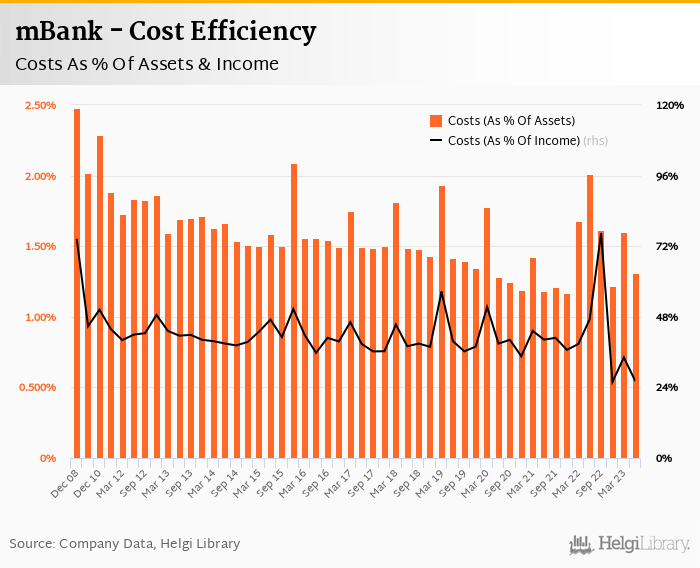

Revenues increased by a quarter thanks to strong interest income, on the other hand, wage and inflationary pressures are something to watch for. Still, adjusted cost to income of below 30% is very impressive

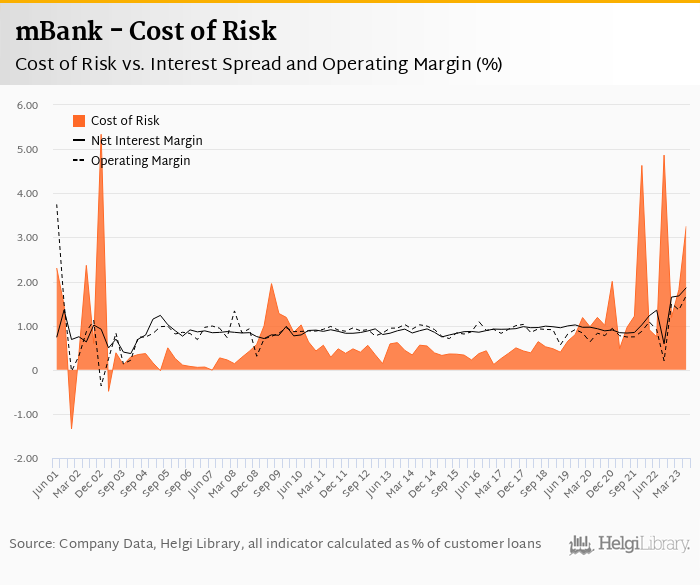

The Bank created further PLN 1.5 bil of provisions for CHF-mortgages, though underlying trends in asset quality seem positive

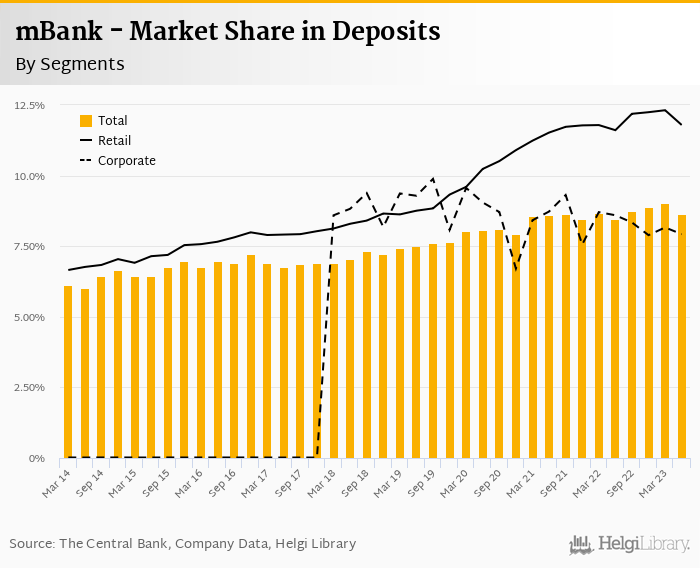

Management's focus on margin maximising helps ROE to approach 30% level, though market share losses in retail and corporate deposits are something to watch for.

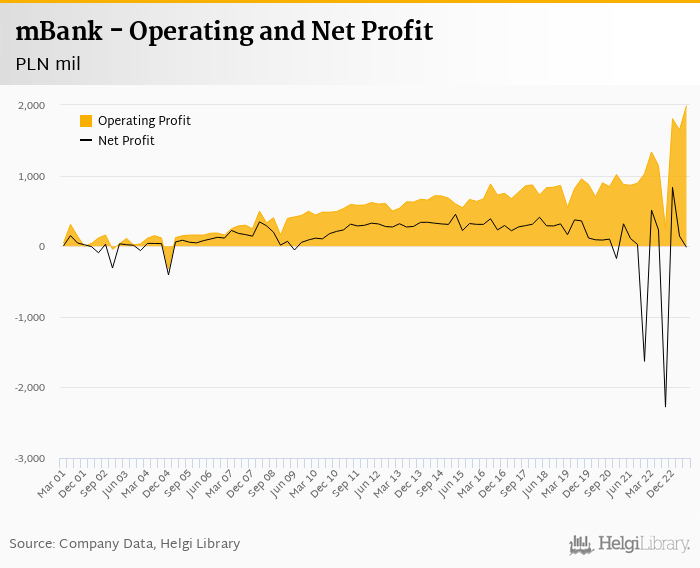

mBank made a net profit of PLN -15.5 mil in the second quarter of 2023, or decrease of PLN 245 mil in absolute terms. In spite of the negative headline figures, operating performance was strong and underlying asset quality numbers good.

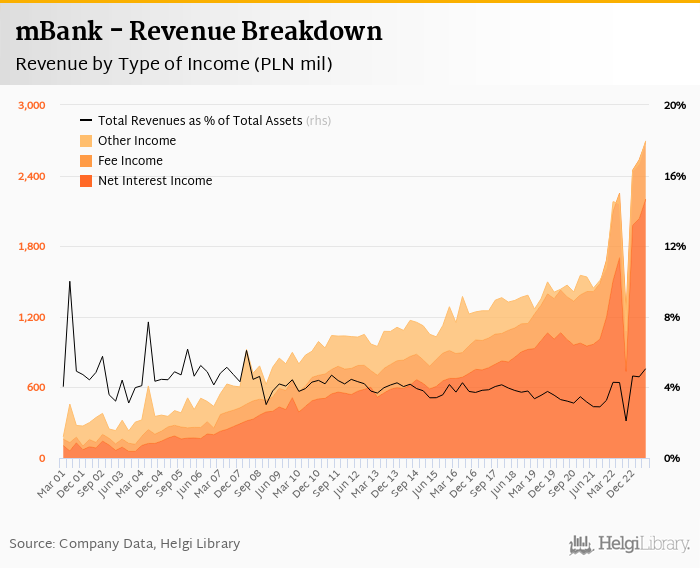

Revenues increased by almost 25% thanks to higher interest rates and aggressive pricing policy. Excluding the contribution to the BGF and IPS (regulatory charges), operating cost would have grown 12% and operating profit before provisioning would have increased by 30% yoy.

As such, cost to income ratio would have dropped from 47% in 2Q22 to 34% in 1Q23 and 26% in 2Q23:

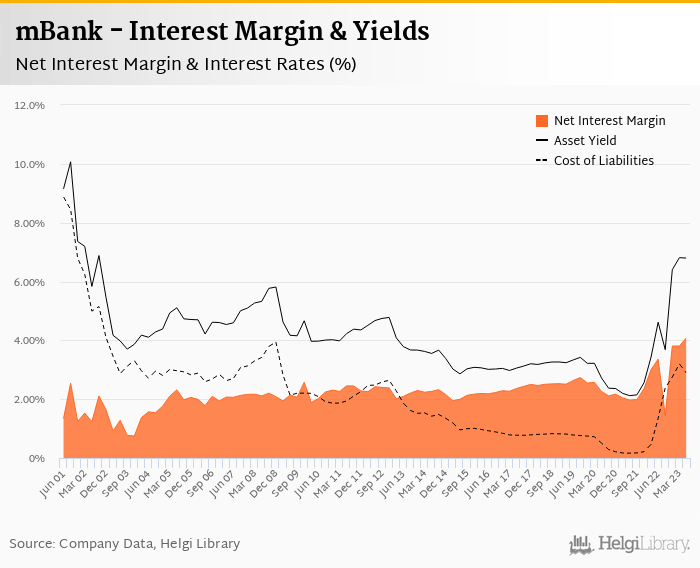

Revenues increased 24.7% yoy to PLN 2,695 mil in the second quarter of 2023. Net interest income rose 29.2% yoy as net interest margin increased 0.730 pp to 4.09% of total assets. Fee income fell 11.0% yoy due partly to weaker brokerage fees. When compared to three years ago, revenues were up 83.4%:

Average asset yield was 6.80% in the second quarter of 2023 (up from 4.62% a year ago) while cost of funding amounted to 2.89% in 2Q2023 (up from 1.35%). Apart from higher rates, margin improvement was further supported by active repricing of deposits, which caused a 40-50 bp loss in market share last quarter.

Costs decreased by 30.9% yoy and the bank operated with average cost to income of 26.1% in the last quarter, though underlying growth was closer to 12% when adjusted for one-offs:

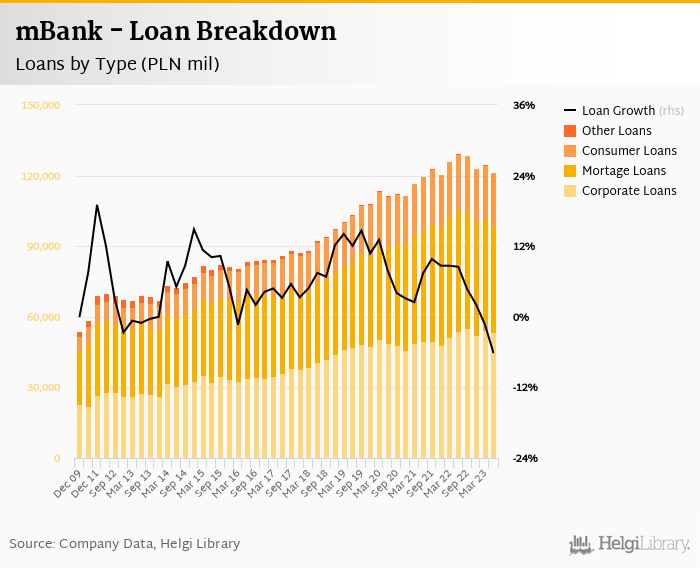

Demand for loans remains low in spite of early signs of stabilisation while deposit side is negatively affected by management's repricing policy. As a resultm loans decreased further 2.6% qoq and were down 6.2% yoy while customer deposit fell 2.4% qoq and 9.7% yoy.

At the end of second quarter of 2023, mBank's loans accounted for 67.0% of total deposits and 55.6% of total assets.

Retail loans fell 2.95% qoq while corporate loans decreased 1.9% qoq. Retail loans accounted for 58% of the loan book at the end of the second quarter of 2023 while corporate loans 45% of total:

We estimate that mBank has lost 0.534 pp market share in the last twelve months in terms of loans (holding 7.47% of the market at the end of 2Q2023). On the funding side, the bank seems to have gained 0.165 pp and held 8.64% of the deposit market. Having said that, Bank's market share in both, retail loans and deposits is still higher than at the end of 2021.

mBank's non-performing loans reached 4.08% of total loans, up from 3.84% when compared to the previous year. Provisions covered some 68.6% of NPLs at the end of the second quarter of 2023, up from 67.6% for the previous year.

With additional PLN 1.54 bil of provisions created for CHF-mortgages last quarter, provision coverage increased to 75% (from 54% in 2022 and 32% in 2021). This leaves the Bank with an open position of PLN 2.4 bil, or 17% of its equity.

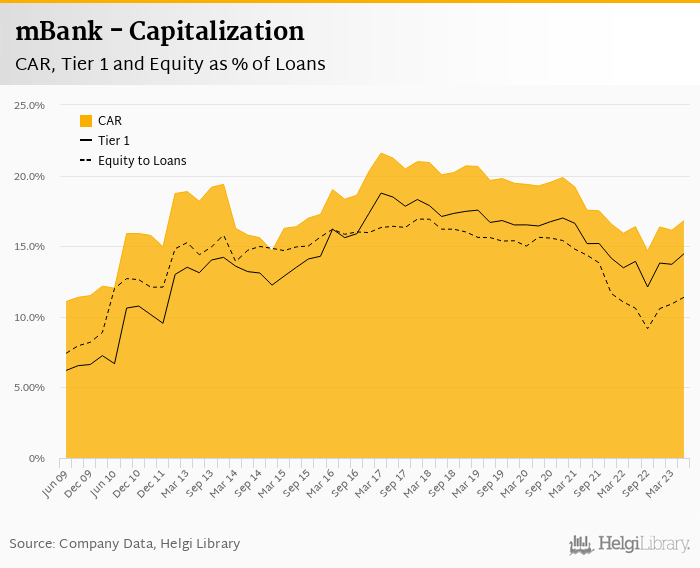

mBank's capital adequacy ratio reached 16.8% in the second quarter of 2023, up from 16.4% for the previous year. The Tier 1 ratio amounted to 14.5% at the end of the second quarter of 2023 while bank equity accounted for 11.4% of loans:

mBank made a net loss of PLN 15.5 mil in the second quarter of 2023 due to hefty provisioning. However, the underlying performance was better than market expected and net profit of core business has more than doubled when compared to first half of last year.

mBank announced strong set of 2Q23 results when adjusted for the one-offs. Management focus on profitability and clean up of CHF-mortgage portfolio might have some side-effects, but the overall direction is positive, in our view.

With underlying ROE and cost to income ratios approaching 30%, the Bank deserves a valuation premium, something already reflected in relatively high PBV of 1.5x the mBank stock is trading at.

Apart from the CHF-mortgage saga, interest margin/market share development and recovery in new lending are the main areas to watch for at mBank in the coming quarters.