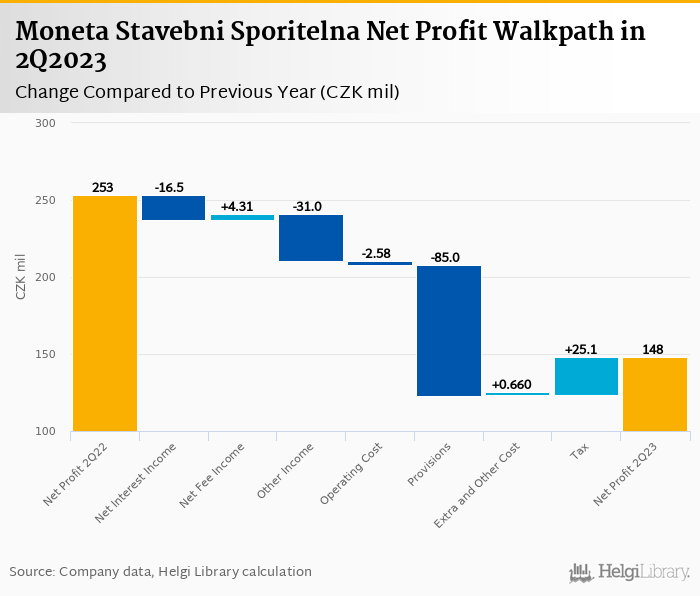

Moneta Stavebni Sporitelna decreased its net profit 41.5% to CZK 148 mil in 2Q2023 and generated ROE of 21.7%.

Revenues decreased 15.9% yoy and cost rose 6.51%. Still, cost to income reached impressive 18.5%

Cost of risk amounted only 0.1%, so we assume asset quality remained good.

The Bank seems to have paid out CZK 556 mil in dividends, so capital adequacy might have dropped to 13-14.0%

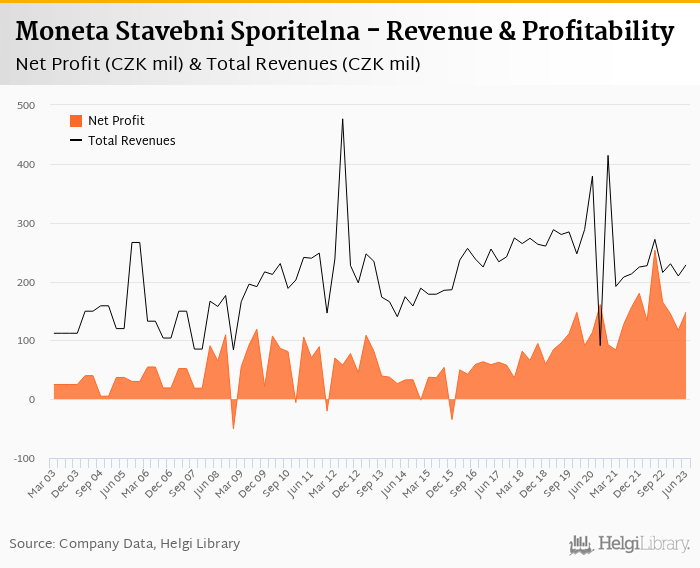

Moneta Stavebni Sporitelna made a net profit of CZK 148 mil in the second quarter of 2023, down 41.5% yoy, or decrease of CZK 105 mil in absolute terms. Operating profit fell almost a fifth. However, the second quarter of 2022 was exceptional due mainly to a strong other income, a fall in costs and a hefty release of provisions. When compared to a longer timespan, the operating profit in 2Q2023 was a third higher than the average from 2021 and approximately 1.0% lower when compared to 2022:

Revenues decreased 15.9% yoy to CZK 228 mil in the second quarter of 2023. Net interest income fell 8.50% yoy as net interest margin decreased 0.092 pp to 2.23% of total assets. Fee income grew 11.1% yoy while an absence of CZK 38.5 mil other income made the biggest difference whe compared to last year. Compared to three years ago, revenues are down almost 40%:

Average asset yield was 3.85% in the second quarter of 2023 (up from 3.58% a year ago) while cost of funding amounted to 1.77% in 2Q2023 (up from 1.36%). More importantly, the margin improved 20 bp compared to previous quarter as pressure from cost of funding eased and loan yield improved. The 3Q2023 results could show if this was an one-off or a change of a trend:

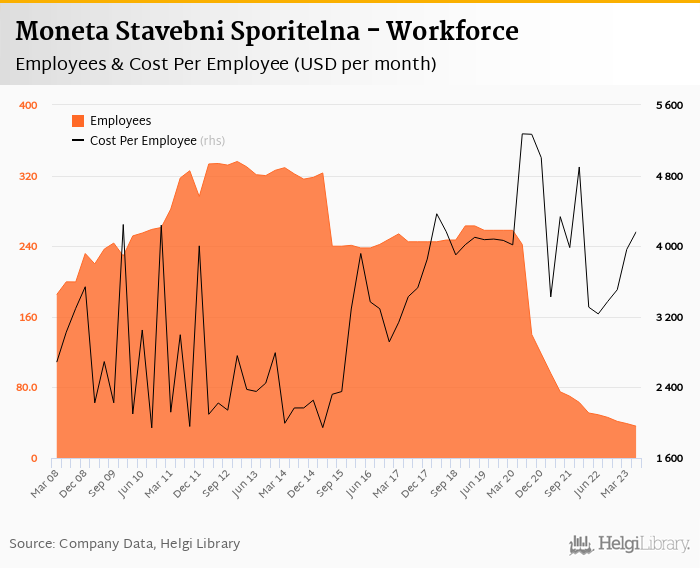

Costs increased by 6.51% yoy but the bank operated with impressive cost to income of 18.5% in the last quarter. When adjusted for higher contribution to the Bank Guarantee Fund, the cost would have fallen 3.0% yoy demonstrating pretty good control. That's especially the case with staff cost, which fell 10.7% as the bank laid off additional quarter of workforce within the last twelve months:

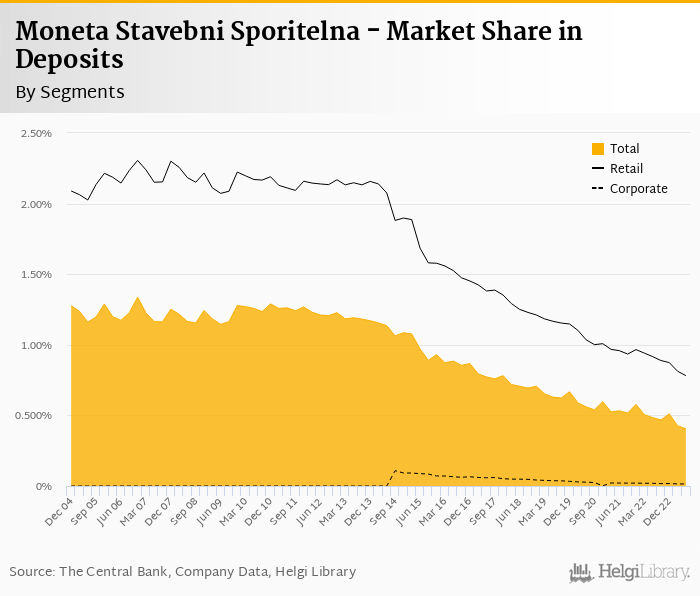

Momentum in loans and deposits remains grim. Moneta Stavebni Sporitelna's customer loans decreased 1.04% qoq and grew only 0.44% yoy while customer deposit fell another 2.01% qoq and 9.9% compared to last year.

At the end of second quarter of 2023, Moneta Stavebni Sporitelna's loans accounted for 59.9% of total deposits and 52.6% of total assets.

Residential mortgage loans fell 0.92% qoq and were 0.9% up yoy accounting for 94.3% of the loan book at the end of the second quarter of 2023:

We estimate that Moneta Stavebni Sporitelna has lost 0.023 pp market share in the last twelve months in terms of loans (holding 0.394% of the market at the end of 2Q2023). On the funding side, the bank seems to have lost 0.079 pp and held 0.405% of the deposit market. In terms of mortgage lending, the Bank held approximately 0.9% market share:

With no official data on asset quality, we assume Moneta Stavebni Sporitelna's non-performing loans reached approximately 1.2% of total loans in the middle of the year while provisions might have covered around 80% of NPLs:

The 2Q2023 results suggest the Bank has paid out CZK 556 mil on dividends in the second quarter od 2023. With relatively low capital adequacy ratio compared to the past as well as to other banks, it will be interesting to see details of Bank's capital management at the year-end and changes management might have done during the year. Based on the loan growth and profitability in the first half of 2023, we estimate Bank's capital ratio might have reached 13-14.0% in the middle of 2023:

Overall, Moneta Stavebni Sporitelna made a net profit of CZK 148 mil in the second quarter of 2023, down 41.5% yoy. This means an annualized return on equity of 21.7% in the last quarter thanks partly to a relatively low capital of the Bank or 21.0% when the last four quarters are taken into account:

Despite the pressure within the sub-sector of building savings (low demand for loans, outflow of deposits and lower margin in general) and unpleasant comparison with strong results last year, Moneta Stavebni Sporitelna's results showed a few positive signs. Apart from a good cost control, it's the stabilisation of net interest margin, so watch for 3Q2023 results to get more details on these.