PKO BP rose its adjusted net profit 23.8% to PLN 2.78 bil in 3Q2023 beating market expectations by more than 10% and generating ROE of 25.7%.

Revenues increased 13.6% yoy when adjusted for credit moratoria and cost rose 10.2% when adjusted for lower contribution to the Guarantee Fund, so cost to income decreased to impressive 34.0%

Asset quality remains good with 3.62% of total non-performing while fully covered by provisions. FX mortgages are 71% covered by provisions now

Trading at PE of less than 9x and PBV of 1.2x expected in 2024 while delivering ROE of more than 15%, PKO BP offers a good value. Still, we are bigger fans of Pekao at these prices.

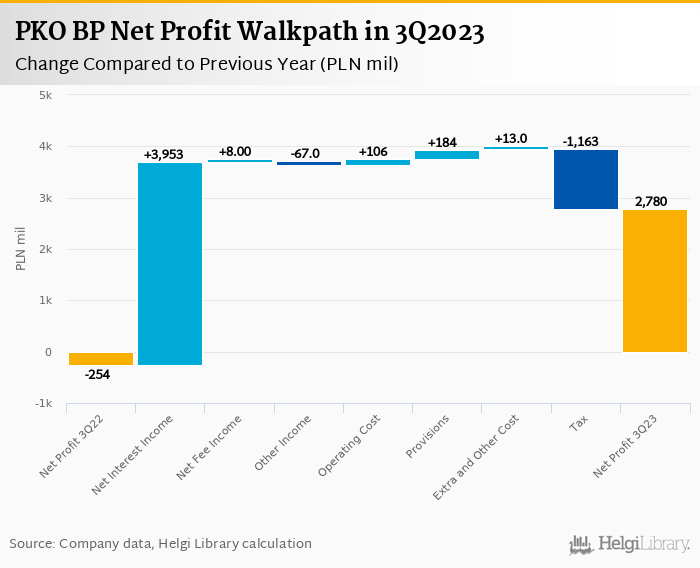

PKO BP made a net profit of PLN 2.78 bil in the third quarter of 2023, up 23.8% yoy when compared to last year and adjusted for credit moratoria and lower contribution to the Bank Guarantee Fund. Most of the profit increase came from higher revenues (or interest margin) while lower provisions helped as well:

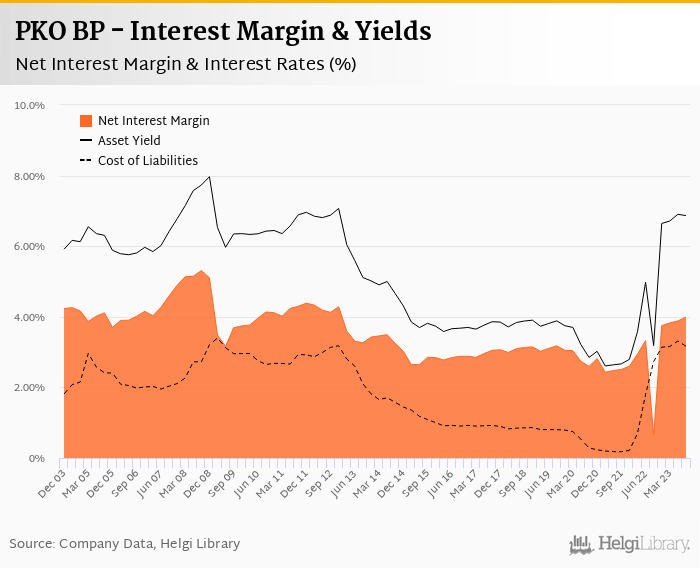

Revenues increased 13.6% yoy when adjusted for credit moratoria last year to PLN 6.16 bil in the third quarter of 2023. With net fee income stagnating (5.9% qoq pick up) and other/trading income being lower yoy, the whole revenue growth came from interest income and higher interest margin, respectively. When compared to three years ago, revenues were up 76.9%:

Net interest margin increased further 11 bp to 3.99% and was the highest since 2012. When compared to previous quarter, two thirds of the increase in the net interest income was generated by asset side. In relative terms, however, average asset yield fell 3 bp 6.87% while cost of funding was 14 bp lower at to 3.17% in 3Q2023:

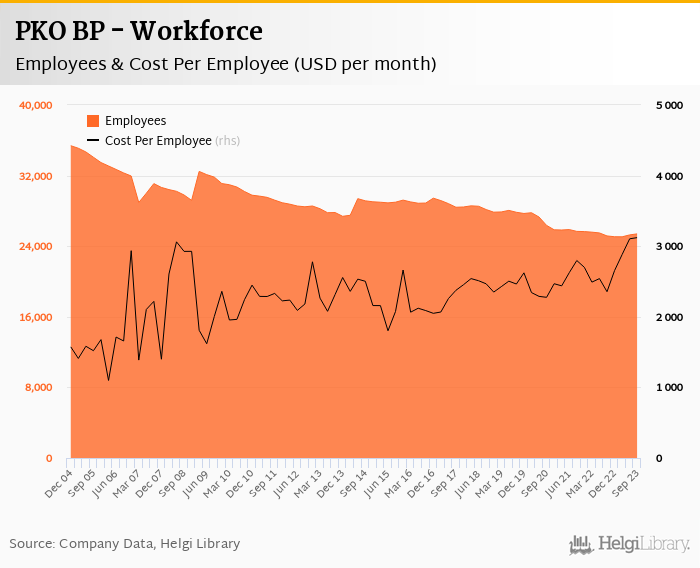

Headline operating costs decreased by 4.8% yoy but were 10.2% yoy higher when adjusted for the lower contribution to the Bank Guarantee Fund. Still, the bank operated with impressive cost to income of 34.0% in the last quarter.

Staff cost rose hefty 20.1% due mainly to wage-adjustments (bank employed 25,398 persons, or less than 1.0% more than last year) while very good cost control was seen in non-personnel:

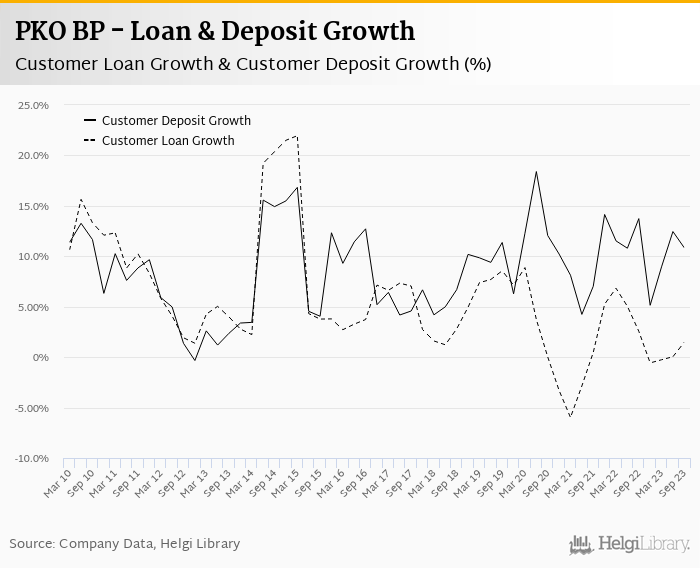

Deposits again outpaced loan growth last quarter. PKO BP's customer loans grew 1.56% qoq and 1.48% yoy in the third quarter of 2023 while customer deposit growth amounted to 2.85% qoq and 10.8% yoy.

At the end of third quarter of 2023, PKO BP's loans accounted for 63.7% of total deposits and 50.7% of total assets. This is the lowest figure since 2006:

Retail loans fell 2.29% qoq and were 1.44% down yoy while corporate loans increased 6.66% qoq and 5.60% yoy, respectively. Mortgages represented 43.4% of the PKO BP's loan book, consumer loans added a further 14.4% and corporate loans formed 46.4% of total loans:

Asset quality remains good with non-performing loans accounting for 3.62% of total loans, down from 3.78% when compared to the previous year. Provisions covered some 112% of NPLs at the end of the third quarter of 2023 (with 71% of FX mortgages being covered).

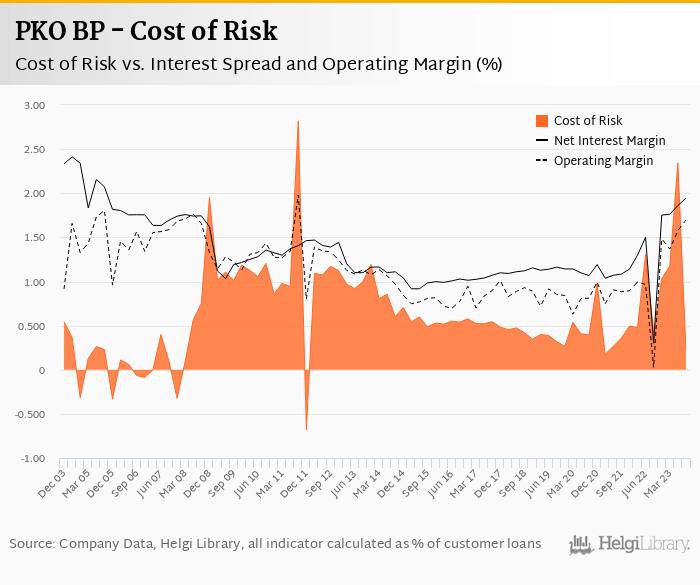

Provisions have "eaten" some 6.79% of operating profit in the third quarter of 2023 as cost of risk reached 0.464% of average loans:

PKO BP's capital adequacy ratio reached 20.3% in the third quarter of 2023, up from 17.2% for the previous year and the highest in the last twenty years. The Tier 1 ratio amounted to 19.3% at the end of the third quarter of 2023 while bank equity accounted for 18.9% of loans.

There is clearly a room for a hefty dividend to be paid out (possibly 100% of this year's profits), especially, after Santander has been granted a permission to do so, though we will have to wait for the decision.

Overall, PKO BP made a net profit of PLN 2.78 bil in the third quarter of 2023, up 1,199% yoy and 23.8% when adjusted for credit moratoria and lower contribution to the Bank Guarantee Fund. This means an annualized return on equity of 25.7% in the last quarter or when the last four quarters are taken into account:

Strong set of results driven heavily by higher net interest margin and lower provisions. When adjusted for a number of one-offs, revenues have grown 13.6%, operating profit by 15.3% and pre-tax profit by 23.8% when compard to last year.

The detailed look is somewhat less exciting as non-interest income has been stagnating, wage pressure significant, loan growth subdued and FX mortgages covered less than at other banks, though the big picture is clearly positive.

Trading at PE of less than 9x and PBV of 1.2x expected in 2024, PKO BP share looks still attractively valued, especially, as attractive dividend might get approved. Though Pekao SA remains our preferred option between these two stoks.