Raiffeisenbank Czech Republic decreased its net profit 17.0% to CZK 1.5 bil in 2Q2023 and generated ROE of 11.4%.

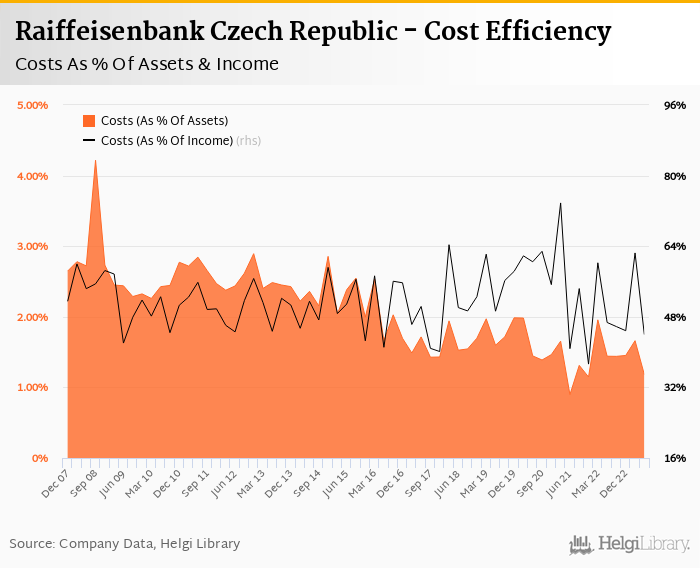

Revenues decreased 1.1% yoy, but cost fell impressive 6.9%, so cost to income decreased to 44.0%

Asset quality improved with bad loans falling to 1.45% and provision coverage rose to 76%.

Strong liquidity and capital with loan to deposits at 66.5% and capital adequacy at 25.0%

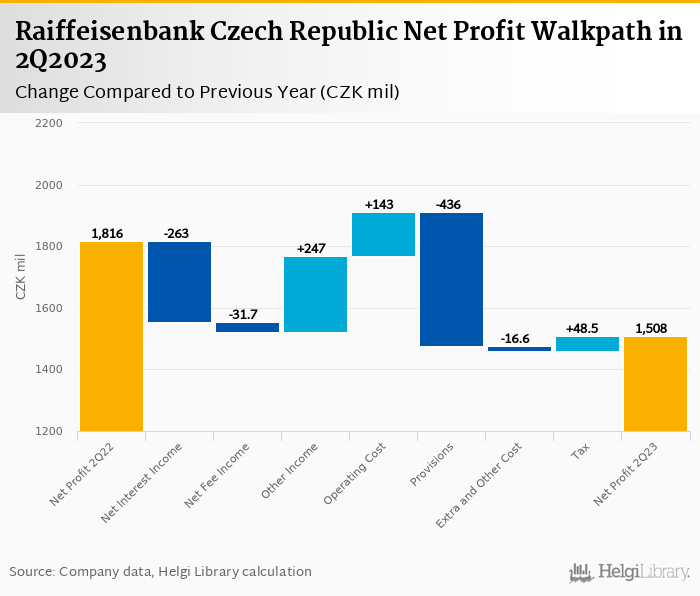

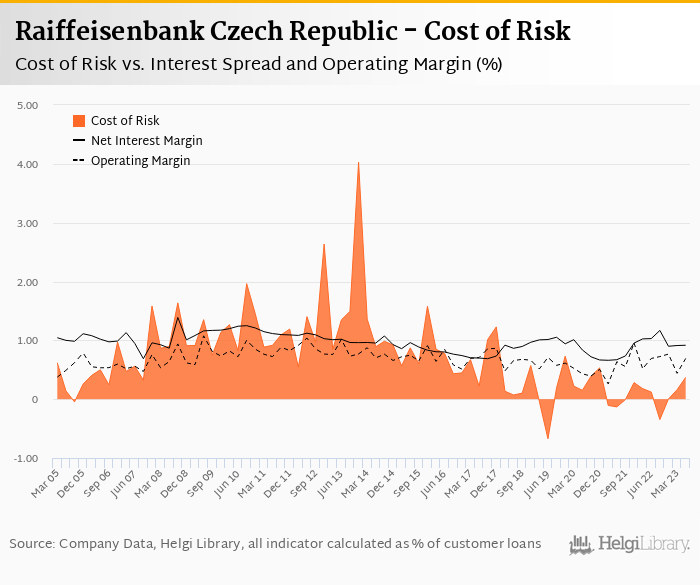

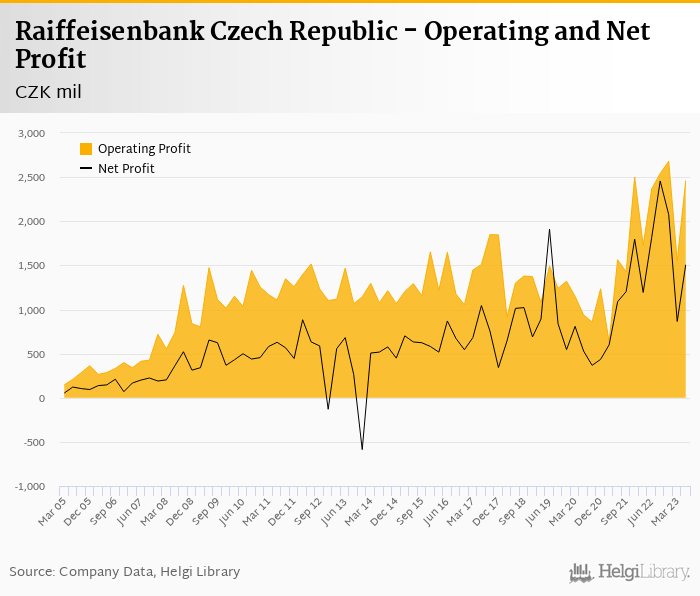

Raiffeisenbank Czech Republic made a net profit of CZK 1,508 mil in the second quarter of 2023, or a decrease of CZK 309 mil. Core revenues fell, though the negative was more than offset by impressive reduction in operating costs, across the board. In the end, operating profit increased 4.0% yoy in the second quarter, so the fall in profits was due to a hefty CZK 616 mil provisioning, the biggest quarterly hit since the end of 2019:

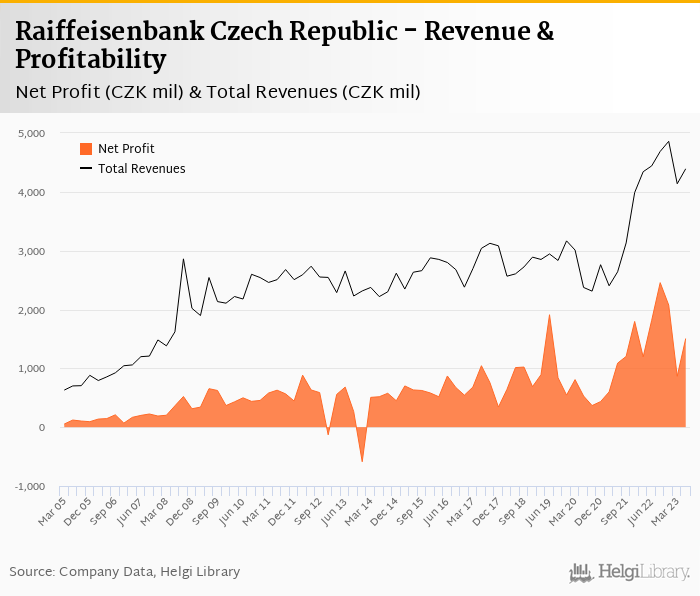

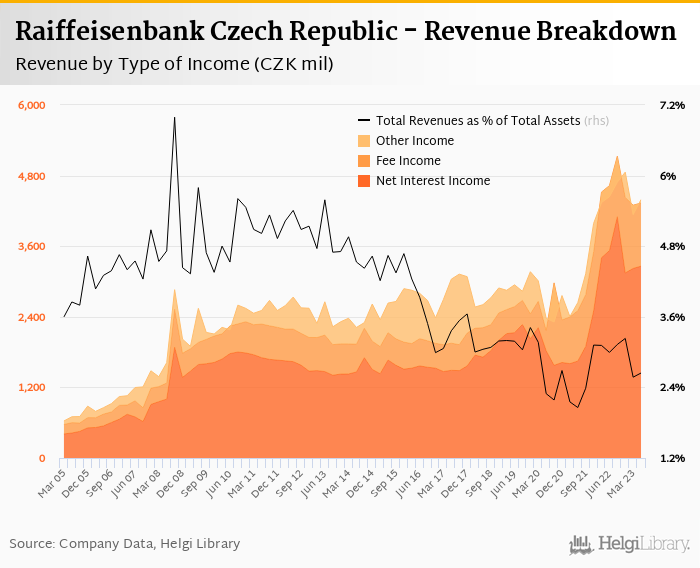

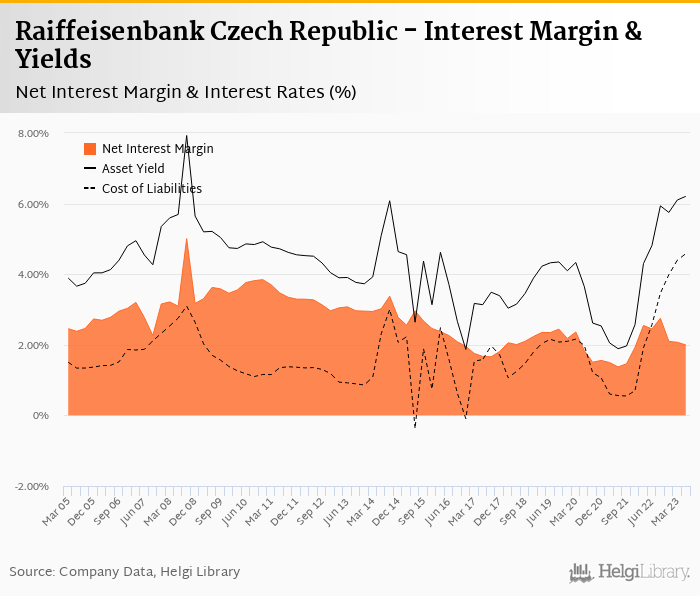

Revenues decreased 1.1% yoy to CZK 4,393 mil in the second quarter of 2023 as higher cost of funding continued taking their toll. Net interest income fell 7.5% yoy with net interest margin decreasing 0.454 pp to 2.00% of total assets. Fee income fell 2.9% yoy, so CZK 247 mil improvement in other/trading income was the main positive message on the revenue side last quarter. When compared to three years ago, revenues were up 85%:

Average asset yield was 6.21% in the second quarter of 2023 (up from 4.81% a year ago and 6.10% in 1Q23) while cost of funding rose to 4.58% in 2Q2023 (up from 2.57% and 4.40% previous quarter).

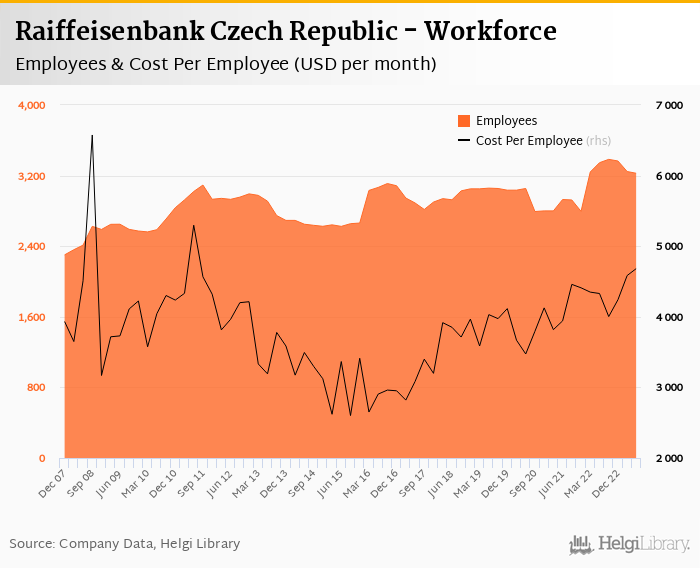

Costs decreased impressive 6.9% yoy (flattish qoq when adjusted for contribution to Guarantee Fund in 1Q23) and the bank operated with average cost to income of 44.0% in the last quarter. We assume that some of the cost savings are an after-effect of the Equa Bank acquisition made in 1Q2022. Staff cost fell 1.6% as the bank reduced number of personnel 3.6% to 3,226 persons and managed to keep the staff cost per person stable at CZK 101,170 per person per month:

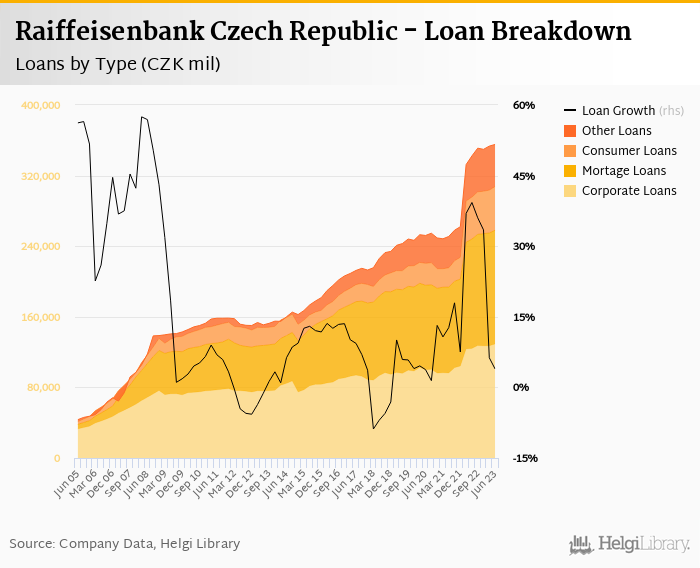

Customer loans grew 0.7% qoq and 3.9% yoy in the second quarter of 2023 while customer deposit growth amounted to 5.0% qoq and 10.5% yoy. That’s compared to average of 18.3% and 19.9% average annual growth seen in the last three years.

At the end of second quarter of 2023, Raiffeisenbank Czech Republic's loans accounted for 66.5% of total deposits and 53.5% of total assets.

Retail loans grew 1.2% qoq and were 4.0% up yoy. They accounted for half of the loan book at the end of the second quarter of 2023 while corporate loans increased 1.6% qoq and 4.1% yoy, respectively. Mortgages represented more than a third of the Raiffeisenbank Czech Republic's loan book, consumer loans added a further 13.9% and corporate loans formed 36.3% of total loans:

We estimate that Raiffeisenbank Czech Republic has lost 0.19 pp market share in the last twelve months in terms of loans (holding 8.46% of the market at the end of 2Q2023). On the funding side, the bank seems to have gained 0.194 pp and held 7.83% of the deposit market:

The Bank created CZK 616 mil of new provisions in 2Q23, or 0.69% of average loans. This is the biggest quarterly amount of provisions since the end of 2019. Provisions have therefore "eaten" a quarter of operating profit the Bank created in the second quarter of 2023.

The overall asset quality improved however. Non-performing loans fell to 1.45% of total loans (down from 1.92% last year) and provison coverage rose to hefty 76% of NPLs (from 64.5%):

Raiffeisenbank Czech Republic's capital adequacy ratio reached 25.0% in the second quarter of 2023, up from 19.6% for the previous year. The Tier 1 ratio amounted to 22.6% at the end of the second quarter of 2023 while bank equity accounted for 15.1% of loans:

Overall, Raiffeisenbank Czech Republic made a net profit of CZK 1,508 mil in the second quarter of 2023, down 17.0% yoy. This means an annualized return on equity of 11.4%, or 20.3% when equity "adjusted" to 15% of risk-weighted assets:

Mixed set of results with revenue side under pressure, very good cost control and hefty provisioning. The latter two might have something to do with absorbing Equa Bank in 2022, in our view, though we have to wait for more details in Bank's 1H2023 report. With enough liquidity, capital and enlarged client base, the Bank is well positioned to be a challenge to the bigger players.

For more details, download the data in excel format at https://www.helgilibrary.com/reports/