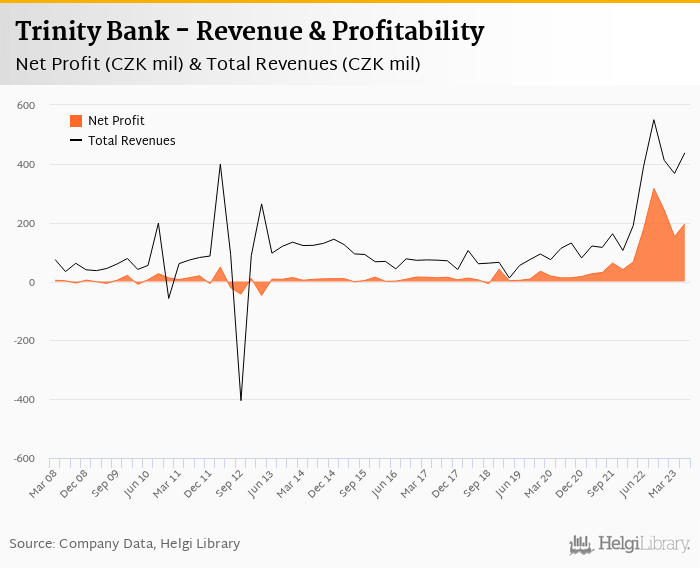

Trinity Bank rose its net profit 10.4% yoy to CZK 196 mil in 2Q2023 and generated ROE of 15.6%.

Revenues increased 12.1% yoy, but cost rose 39.0% due to a jump in non-personnel. Cost to income increased to still solid 44.2%

Lower provisions were the main profit driver when compared to last year. Cost of risk amounted to 0.043% only, so we assume bad loans fell further to 4.0-4.5% of total loans.

With loan to deposit ratio at 26% and capital adequacy at around 23%, the Bank is well positioned for loan expansion.

Trinity Bank's net profit increased CZK 18.5 mil in absolute terms in 2Q23. The whole improvement in bank's bottom line came however from lower provisions when compared to last year. Despite of a solid revenue growth, operating profit fell 2.8% yoy due to a CZK 40 mil increase in administrative costs:

Revenues increased solid 12.1% yoy to CZK 438 mil in the second quarter of 2023. The growth was nicely spread across all the main areas from net interest income (up 12.0%), fees (up 11.4%) as well as trading and other income (up 12.4%). When compared to three years ago, revenues were up 288%:

Net interest margin and spread increased by 4-6 bp last quarter as average asset yield reached 6.46% (up from 5.08% a year ago) and cost of funding amounted to 5.11% in 2Q2023 (up from 3.63%) in the second quarter of 2023.

The 39% increase in administrative costs seems to be the biggest disappointment in the 2Q23 results. While 19% growth in personnel cost is understandable given the increase in staff and wage and inflationary pressure, 66% increase in admin cost looks high. Still, the bank operated with a solid cost to income of 44.2% in the last quarter:

Without official details, we estimate that Trinity Bank's customer loans grew around 6.0% qoq and 40-45% yoy in the second quarter of 2023. We also assume customer deposit to grow to 5-6% qoq. That’s compared to average of 10.5% and 93.6% average annual growth seen in the last three years.

At the end of second quarter of 2023, Trinity Bank's loans might have accounted for approximately 26% of total deposits and 24% of total assets, on our estimates.

We estimate that Trinity Bank has gained some 0.10 pp market share in the last twelve months in terms of loans (holding 0.40% of the market at the end of 2Q2023). On the funding side, we assume the bank might have lost 0.12 pp and held 0.97% of the deposit market:

Cost of risk reached 0.043% of average loans last quarter, so we assume Trinity Bank's non-performing loans reached 4.0-4.5% of total loans in the middle of 2023, down from 6.4% when compared to the previous year. Due mainly to large exposure to real estate segment, we assume provisions covered some 20% of NPLs at the end of the second quarter of 2023:

We "guesstimate" Trinity Bank's capital adequacy ratio reached 22-23% in the second quarter, up from 18.8% for the previous year. The Tier 1 ratio might have amounted to around 21% at the end of the second quarter of 2023 while bank equity accounted for 29.5% of loans:

Overall, Trinity Bank made a net profit of CZK 196 mil in the second quarter of 2023, up 10.4% yoy. This means an annualized return on equity of 15.6%, or 33.0% when equity "adjusted" to 15% of risk-weighted assets:

Without having much needed details about Bank's loans and deposits including asset quality, for example, Trinity Bank seems to have achieved solid set of results in 2Q23. That's assuming the jump in administrative cost was a one-off and will not repeat again.