UniCredit Bank Czecho-Slovakia announced strong 3Q2023 results with net profit rising 31% to CZK 2.76 bil and ROE at 14.4%.

Revenues increased 17.1% yoy thanks mainly to strong interest income while cost fell 7.1%. Cost to income therefore decreased to impressive 36.2%

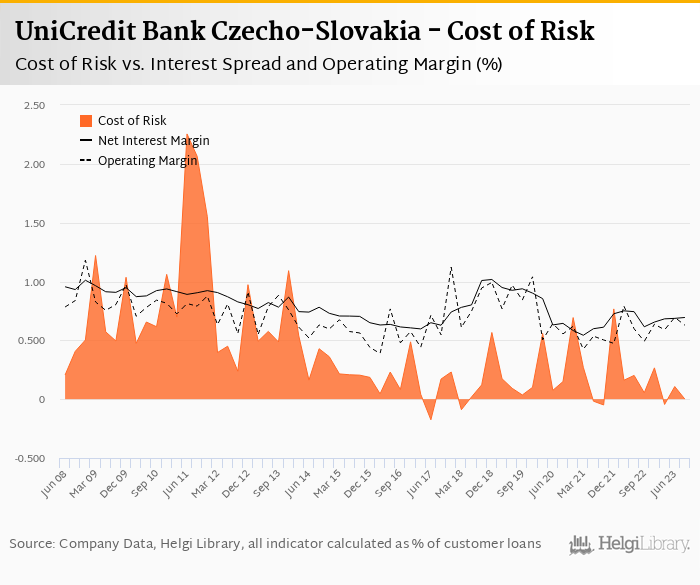

Asset quality seems to be good with no provisions created last quarter, so we assume bad loans stayed at around 1.8% of total loans.

Good momentum unlike other banks reporting 3Q2023 results so far. Similar to other banks, however, weak demand for loans and reduction in interest rates will make the next year more challenging.

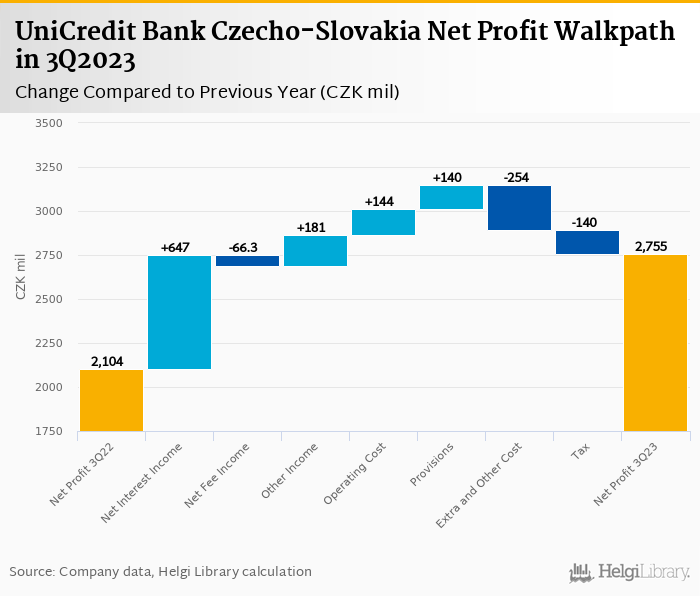

UniCredit Bank Czecho-Slovakia made a net profit of CZK 2.76 bil in the third quarter of 2023, up 30.9% yoy, or increase of CZK 651 mil in absolute terms. Similar to the previous quarter, these were one of the best results seen in the Bank in the last 15 years. Operating profit increased impressive 37% yoy and with the exception of fee income, all the main core items improved when compared to the previous year:

Revenues increased 17.1% yoy to CZK 5.22 bil in the third quarter of 2023 driven heavily by higher net interest income (accounting for 85% of the overall revenue growth). Fee income fell 8.4% yoy and remains under pressure since 2022, on the other hand, trading and other income perform strongly generating extra CZK 181 mil when compared to last year:

Net interest income rose strong 21.3% yoy driven by rising net interest margin (up 0.187 pp to 1.42% of total assets). This is partly a base effect since net interest income was relatively weak in 3Q2022, though 4.5% qoq increase compared to previous quarter confirms the general story of a margin stabilisation.

With CZK 328 bil, or more than 30% of its assets (and 42% of its customer deposits) placed with Central Banks, however, UniCredit Bank seems to be more than other large banks exposed to the interbank interest rate development, something to watch closely in the coming quarters:

Operating costs decreased by 7.1% yoy and the bank operated with impressive cost to income of 36.2% in the last quarter. Staff cost rose 13.5% amid stable workforce, so non-personnel costs (down 30.2% yoy) delivered the whole improvement, similar to the previous quarter:

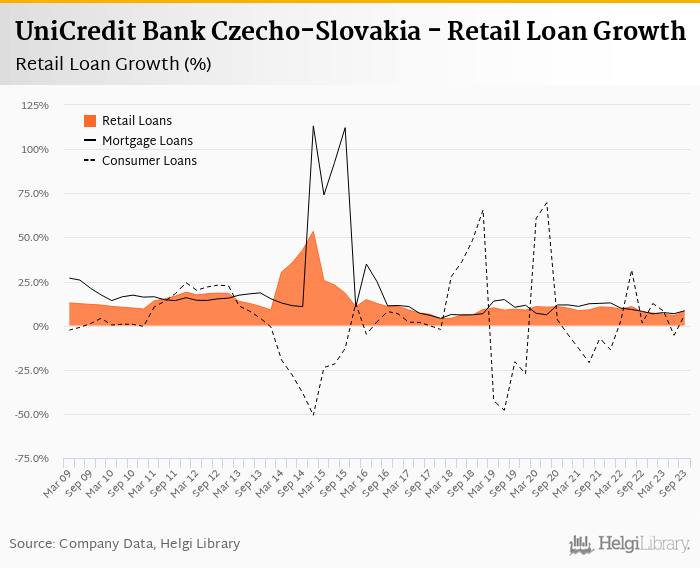

Core loan and deposit growth remained low in line with the market when adjusted for the CZK depreciation. Customer loans grew 3.34% qoq and 7.51% yoy in the third quarter of 2023 while customer deposit growth amounted to 10.1% qoq and 2.42% yoy (a decrease of 0.9% qoq when adjusted for other/public deposits).

At the end of third quarter of 2023, UniCredit Bank Czecho-Slovakia's loans accounted for 68.4% of total deposits and 48.8% of total assets.

Retail loans grew 3.47% qoq and were 8.24% up yoy while corporate loans increased 3.52% qoq and 5.77% yoy, respectively. Mortgages represented more than 30% of the UniCredit Bank Czecho-Slovakia's loan book, consumer loans added a further 2.6% and corporate loans formed around half of total loans, on our estimates:

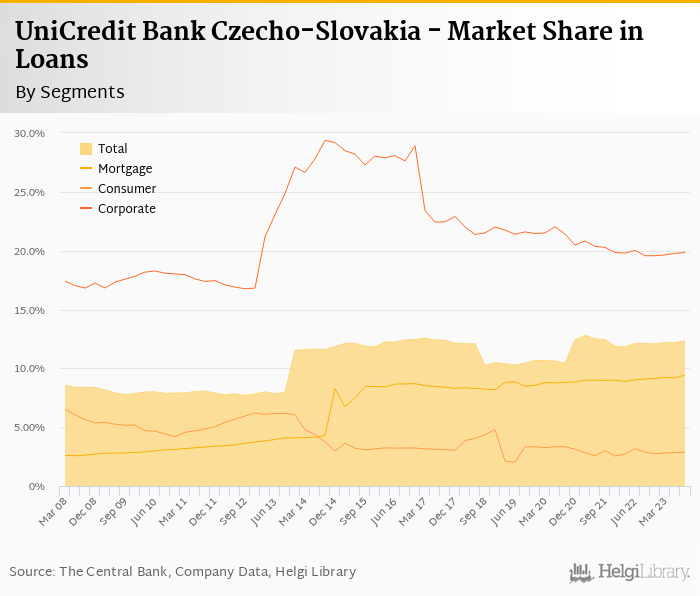

We estimate that UniCredit Bank Czecho-Slovakia has gained 0.226 pp market share in the last twelve months in terms of loans (holding 12.4% of the market at the end of 3Q2023). On the funding side, the bank seems to have lost 0.613 pp and held 11.2% of the deposit market, when data for Czech banking market is taken into account only:

Since no provisions have been created last quarter, we assume UniCredit Bank Czecho-Slovakia's asset quality remained good. We assume non-performing loans reached 1.7-1.8% of total loans, down from 2.7% when compared to the previous year. Provisions are expected to cover more than 110% of NPLs at the end of the third quarter of 2023:

We guesstimate UniCredit Bank Czecho-Slovakia's capital adequacy ratio reached more than 23.5% in the third quarter of 2023 while bank equity accounted for 14.7% of loans:

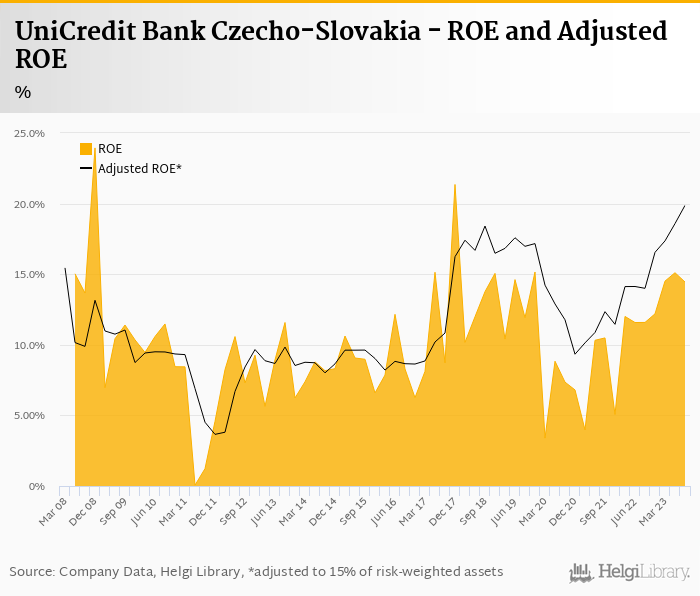

Overall, UniCredit Bank Czecho-Slovakia made a net profit of CZK 2,755 mil in the third quarter of 2023, up 30.9% yoy. This means an annualized return on equity of 14.4% in the last quarter or 14% when the last four quarters are taken into account:

Solid set of 3Q2023 results with another almost-record quarterly profitability of CZK 2.76 bil resulting in ROE of 14.4% and cost to income at 36%. Operating profit increased impressive 37% yoy and with the exception of fee income, all the main core items improved when compared to the previous year.

With more than 30% of assets (and 42% of deposits) placed at Central Bank, however, UniCredit Czecho-Slovakia is heavily exposed to the interbank interest rate environment, something to watch for in the coming quarters.