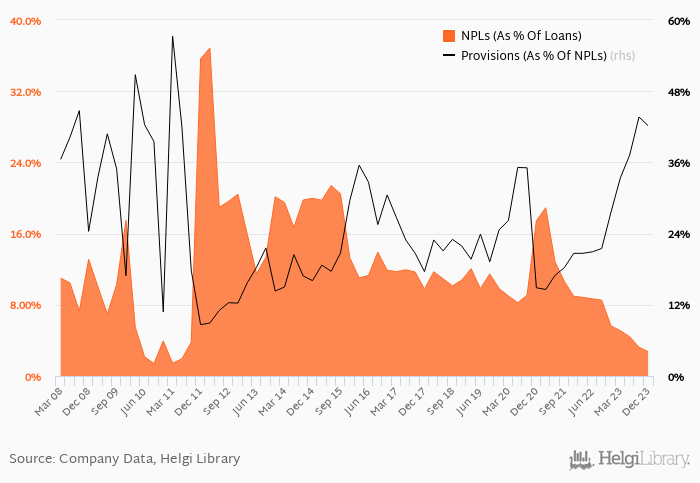

Banka Creditas's non-performing loans reached 2.74% of total loans at the end of 2023-12-31, down from 5.62% compared to the previous year. Historically, the NPL ratio hit an all time high of 36.9% in 2012-03-31 and an all time low of 1.40% in 2010-09-30.

Provision coverage amounted to 42.2% at the end of 2023-12-31, up from 27.6% compared to a year earlier.

The bank created loan loss provisions worth of 1.05% of average loans in 2023-12-31. That's compared to 0.161% of loans the bank put aside to its cost on average in the last five years.

Comparing Banka Creditas with its closest peers, CSOB operated at the end of 2023-12-31 with NPL ratio of 1.51% and provision coverage of 45.2% and Komercni Banka with 1.85% and 47.1% respectively.

You can see all the bank’s data at Banka Creditas Profile, or you can download a report on the bank in the report section.