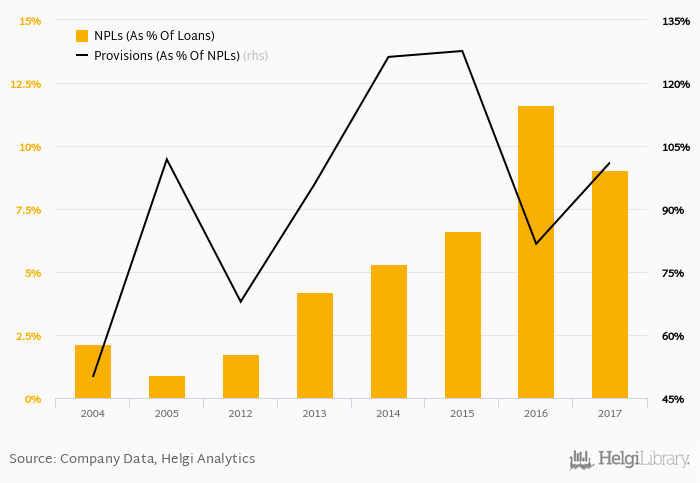

D Commerce Bank's non-performing loans reached 9.03% of total loans at the end of 2017, down from 11.6% compared to the previous year. Historically, the NPL ratio hit an all time high of 11.6% in 2016 and an all time low of 0.894% in 2005.

Provision coverage amounted to 101% at the end of 2017, up from 81.7% compared to a year earlier.

The bank created loan loss provisions worth of 0.407% of average loans in 2017. That's compared to 2.90% of loans the bank put aside to its cost on average in the last five years.

Comparing D Commerce Bank with its closest peers, United Bulgarian Bank operated at the end of 2017 with NPL ratio of 23.6% and provision coverage of 67.0%, Raiffeisenbank Bulgaria with 4.33% and 89.0% respectively and UniCredit Bulbank had 8.10% of bad loans covered with 82.5% by provisions at the end of 2017.

You can see all the bank’s data at D Commerce Bank Profile, or you can download a report on the bank in the report section.