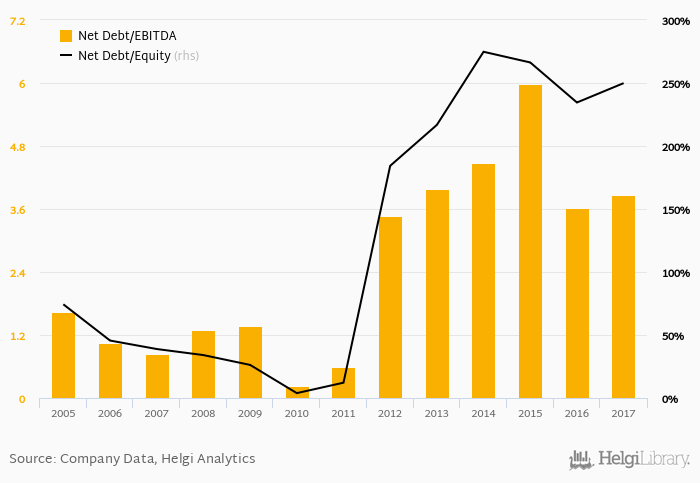

EMCO's net debt stood at CZK 281 mil and accounted for 250% of equity at the end of 2017. The ratio is up 15.4 pp compared to the previous year.

Historically, the firm’s net debt to equity reached a high of 275% in 2014 and a low of 3.86% in 2010 between 2005 and 2017. The average for the last five years was 248%.

Net debt to EBITDA was calculated at 3.87x at the end of the year. That is up from 3.47x seen in 2012. The ratio reached a high of 5.98x in 2015 and a low of 0.229x in 2010.

The company’s cost of funding amounted to 3.96% in 2017, down which is above the 5-year of 4.13%. Funding costs have “eaten” some 30.7% of the operating profit generated in 2019.

You can see all the company’s data at EMCO profile, or you can download a report on the company in the report section.