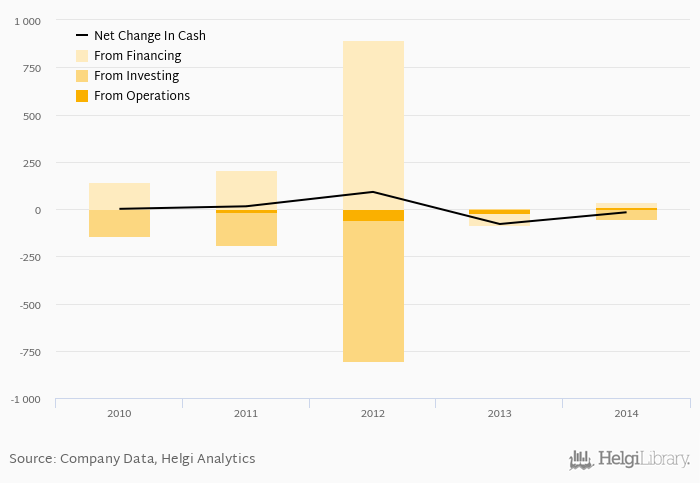

LEO Express's operating cash flow stood at CZK 11.3 mil in 2014, up 148% when compared to the previous year. Historically, between 2010 - 2014, the firm’s operating cash flow reached a high of CZK 11.3 mil in 2014 and a low of CZK -55.8 mil in 2012.

LEO Express's total investments stood at CZK -53.5 mil and accounted for 1.73% of sales in 2014. This is compared to an average of 23,108% as seen over the last five years.

Cash from financing amounted to CZK 25.0 mil, so the company generated CZK -17.3 mil net cash in 2014.

At the end of 2014, the company had a net debt of CZK 811 mil, or -233x of EBITDA and -4.78 of equity. Net working capital amounted to CZK -7.21 mil, or -4.05% of sales. The cash conversion cycle stood at -32.1 days in 2014. This is a deterioration compared to the previous year (-9.14 days), so LEO Express’s working capital was tied up for 23.0 more days.

You can see all the company’s data at LEO Express profile, or you can download a report on the company in the report section.