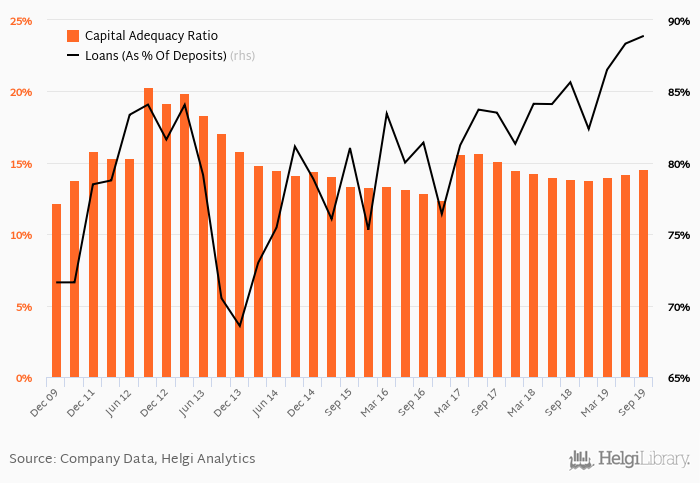

Banco de Oro's capital adequacy ratio reached 14.6% at the end of third quarter of 2019, up from 14.2% when compared to the previous quarter. Historically, the bank’s capital ratio hit an all time high of 20.3% in 3Q2012 and an all time low of 12.2% in 4Q2009.

The Tier 1 ratio amounted to 13.1% at the end of third quarter of 2019, up from 12.5% compared to the same period of last year and up from 12.6% when compared to the the previous quarter.

Bank's loan to deposit ratio reached 88.9% at the end of 3Q2019, up from 85.6% when compared to the same period of last year.

You can see all the bank’s data at Banco de Oro Profile, or you can download a report on the bank in the report section.