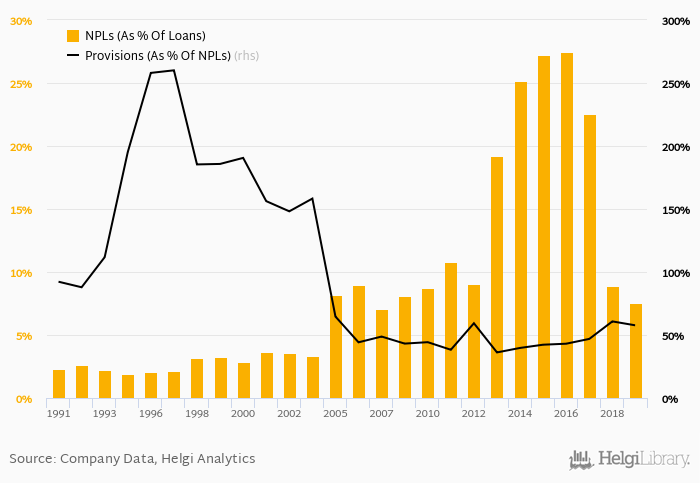

Credito Valtellinese's non-performing loans reached 7.52% of total loans at the end of 2019, down from 8.91% compared to the previous year. Historically, the NPL ratio hit an all time high of 27.5% in 2016 and an all time low of 1.94% in 1995.

Provision coverage amounted to 57.7% at the end of 2019, down from 60.8% compared to a year earlier.

The bank created loan loss provisions worth of 0.776% of average loans in 2019. That's compared to 1.75% of loans the bank put aside to its cost on average in the last five years.

You can see all the bank’s data at Credito Valtellinese Profile, or you can download a report on the bank in the report section.