EuroVast made a net profit of EUR 1.23 mil in 2018, down 47.5% compared to the previous year. Historically, between 2006 and 2018, the company's net profit reached a high of EUR 3.33 mil in 2016 and a low of EUR 0.423 mil in 2006.

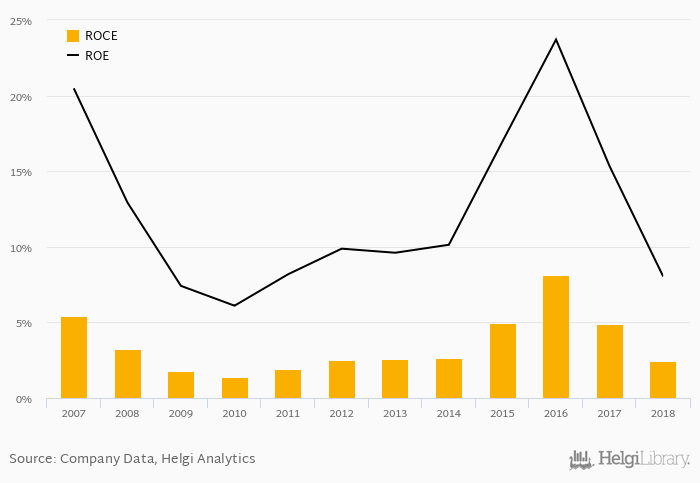

The result implies a return on equity of 8.04% and a return on invested capital of 2.43% in 2018. That is compared to an average of 14.8% and 4.63% over the last five years.

The company has been operating with average EBITDA margin of 4.18% in the last 5 years and an average net margin of 1.66%.

Since 2013, the firm's net profit increased by 42.2% or an average of 7.30% a year.

You can see all the company’s data at EuroVast profile, or you can download a report on the company in the report section.