Follow us for the latest automotive news.

Paccar made a net profit of USD 2,388 mil with revenues of USD 25,600 mil in 2019, up by 8.78% and up by 8.95%, respectively, compared to the previous year.

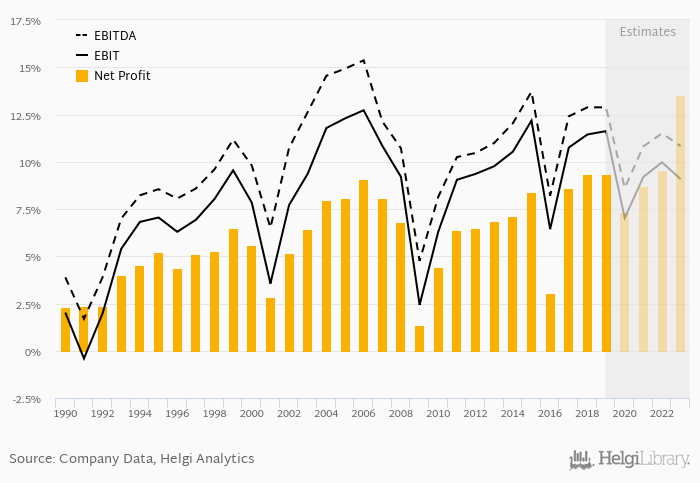

This translates into a net margin of 9.33%. Historically, between 1987 and 2019, the firm’s net margin reached a high of 9.34% in 2018 and a low of 1.38% in 2009. The average net margin in the last five years amounted to 7.75%.

On the operating level, the EBITDA margin reached 12.9% and EBIT amounted to 11.6% of sales in 2019.

You can see all the company’s data at Paccar profile, or you can download a report on the company in the report section.