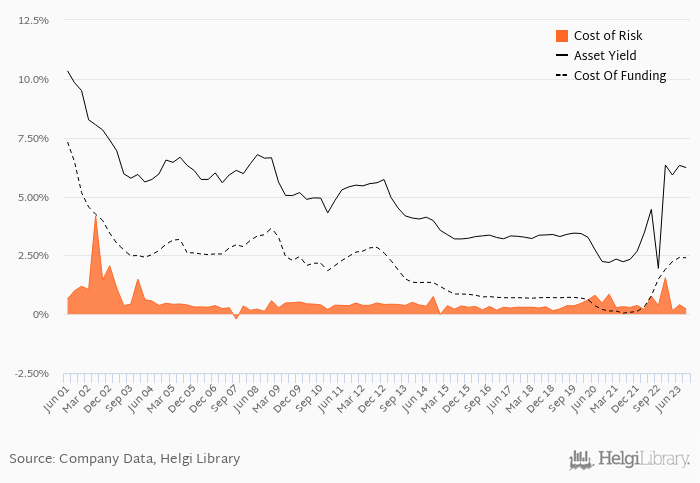

Pekao's Cost of Risk (loan loss provisions as % of total assets) amounted to 0.216% in the third quarter of 2023, down from 0.404% when compared to the previous quarter.

Historically, the bank’s cost of risk reached an all time high of 4.18% in 2Q2002 and an all time low of -0.212% in 3Q2007. The average cost of risk in the last six quarters amounted to 0.575%.

On the other hand, average asset yield was 6.22% in 3Q2023, up from 1.95% when compared to the same period last year. Cost of funding amounted to 2.39% in 3Q2023, up from 1.49%.

When compared to bank's main peers, ING Bank Slaski operated in the third quarter of 2023 with a cost of risk of 0.260%.

You can see all the bank’s data at Pekao Profile, or you can download a report on the bank in the report section.