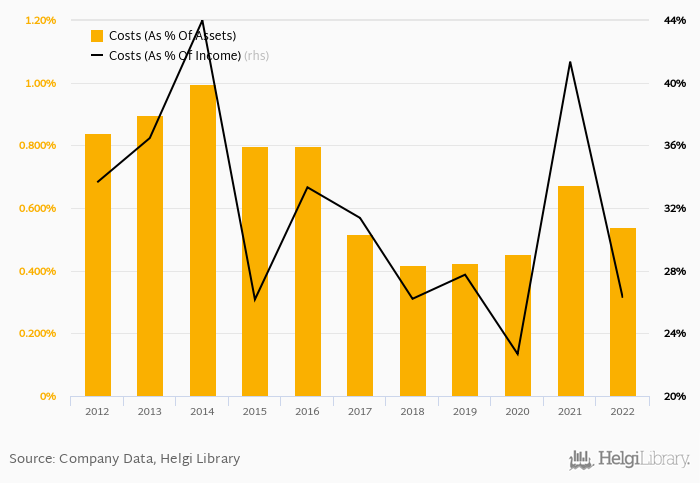

PPF Banka's cost to income ratio reached 25.0% in 2023, down from 26.3% compared to the previous year.

Historically, the bank’s costs reached an all time high of 44.0% of income in 2014 and an all time low of 22.7% in 2020.

When compared to total assets, bank's cost amounted to 0.511% in 2023, down from 0.538% a year earlier.

Staff accounted for 32.9% of total operating expenditures in 2023. The bank operated a network of 2.00 branches and employed 258 persons in 2023.

Comparing PPF Banka with its closest peers, Ceska Sporitelna operated in 2023 with a cost to income ratio of 47.9% in 2023, CSOB reached 54.7% and Komercni Banka some 47.8%.

You can see all the bank’s data at PPF Banka Profile, or you can download a report on the bank in the report section.