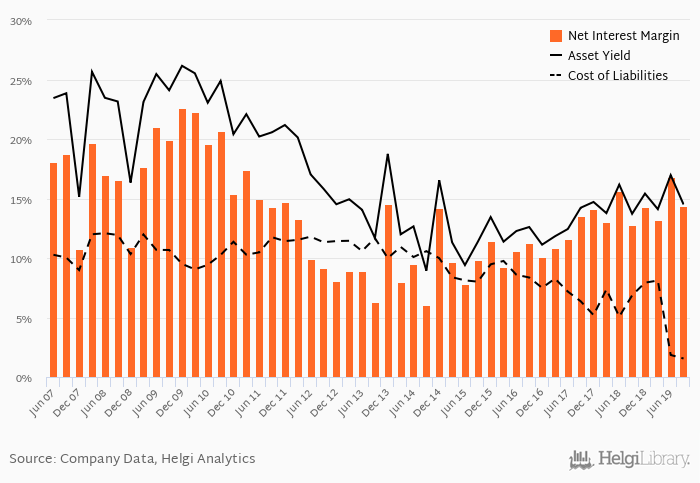

Trust Finance Indonesia's net interest margin amounted to 14.4% in the third quarter of 2019, down from 16.8% when compared to the previous quarter.

Historically, the bank’s net interest margin reached an all time high of 22.6% in 4Q2009 and an all time low of 6.05% in 3Q2014. The average margin in the last six quarters amounted to 14.5%.

Average asset yield was 14.5% in 3Q2019, up from 13.7% when compared to the same period last year. On the other hand, cost of funding amounted to 1.55% in 3Q2019, down from 6.86%.

You can see all the bank’s data at Trust Finance Indonesia Profile, or you can download a report on the bank in the report section.