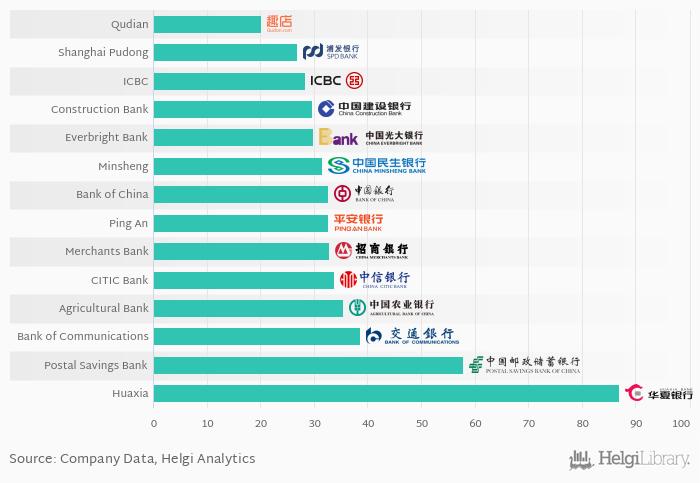

Based on a comparison of 14 banks in China in 2018, Qudian was the most cost efficient bank, followed by Shanghai Pudong Development Bank and Industrial & Commercial Bank of China.

Qudian's cost to income ratio reached 20.1% in 2018, down from 19.7% when compared to the last year. Historically, the bank’s costs reached an all time high of 315% in 2015 and an all time low of 19.7% in 2017.

When compared to total assets, bank's cost amounted to 1.39% in 2018, down from 5.80% a year earlier.

Comparing Qudian with its closest peers, Shanghai Pudong Development Bank operated in 2018 with a cost to income ratio of 26.8%, Industrial & Commercial Bank of China reached 28.4% and China Construction Bank some 29.8%.

You can see all the banks cost efficiency data on the Costs (As % Of Income) indicator page or you can download a report on the Chinese banks in the report section.