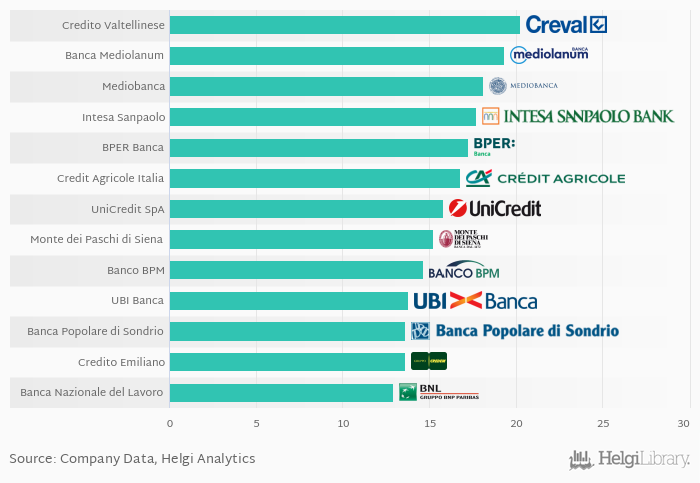

Based on a comparison of 13 banks in Italy in 2018, Credito Valtellinese was the best capitalised bank, followed by Banca Mediolanum and Mediobanca.

Credito Valtellinese's capital adequacy ratio reached 20.3%, up from 12.5% when compared to the previous year. Historically, the bank’s capital ratio hit an all time high of 20.6% in 1994 and an all time low of 8.03% in 2004.

Comparing Credito Valtellinese with its closest peers, Banca Mediolanum ended the year 2018 with a capital adequacy ratio at 19.3%, Mediobanca with 18.1% and Intesa Sanpaolo some 17.7% at the end of 2018.

The average capital adequacy reached 16.1% in the Italian banking sector in 2018.

You can see all the banks capital adequacy ratio data on the Capital Adequacy Ratio indicator page or you can download a report on the Italian banks in the report section.