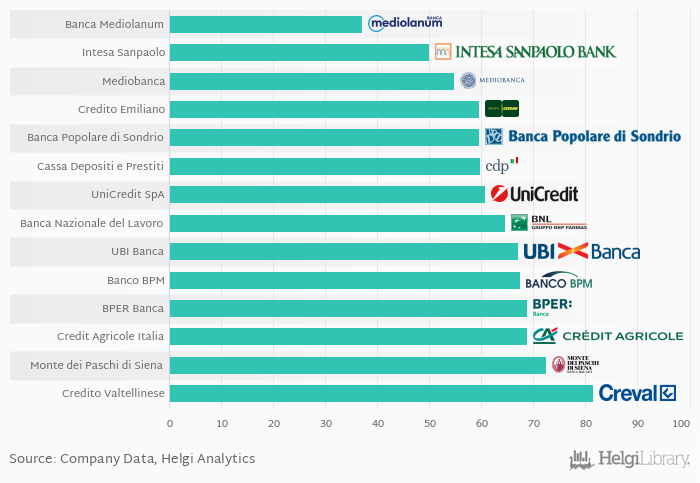

Based on a comparison of 14 banks in Italy in 2018, Banca Mediolanum was the most cost efficient bank, followed by Intesa Sanpaolo and Mediobanca.

Banca Mediolanum's cost to income ratio reached 37.1% in 2018, down from 35.2% when compared to the last year. Historically, the bank’s costs reached an all time high of 2,546% in 2001 and an all time low of -1,574% in 2002.

When compared to total assets, bank's cost amounted to 1.39% in 2018, down from 6.57% a year earlier.

Comparing Banca Mediolanum with its closest peers, Intesa Sanpaolo operated in 2018 with a cost to income ratio of 50.0%, Mediobanca reached 54.7% and Banca Popolare di Sondrio some 59.6%.

You can see all the banks cost efficiency data on the Costs (As % Of Income) indicator page or you can download a report on the Italian banks in the report section.