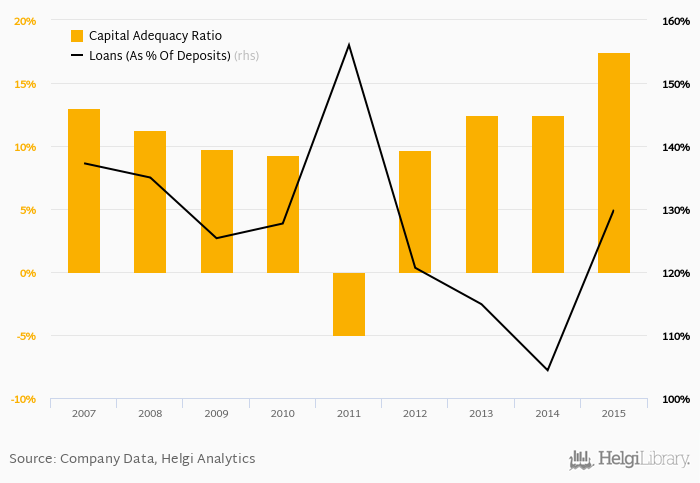

Piraeus Bank Group's capital adequacy ratio reached 17.5% at the end of 2015, up from 12.5% compared to the previous year. Historically, the bank’s capital ratio hit an all time high of 17.5% in 2015 and an all time low of -5.00% in 2011.

The Tier 1 ratio amounted to 17.5% at the end of 2015, up from 12.4% compared to a year earlier.

Bank's loan to deposit ratio reached 130% at the end of 2015, up from 104% when compared to the previous year.

Comparing Piraeus Bank Group with its closest peers, National Bank of Greece ended the year 2015 with a capital adequacy ratio at 14.6% and loans to deposits of 106%, Alpha Bank Group with 16.8% and 147% respectively and Eurobank Group some 17.4% in terms of capital adequacy and 127% of loans to deposits at the end of 2015.

You can see all the bank’s data at Piraeus Bank Group Profile, or you can download a report on the bank in the report section.