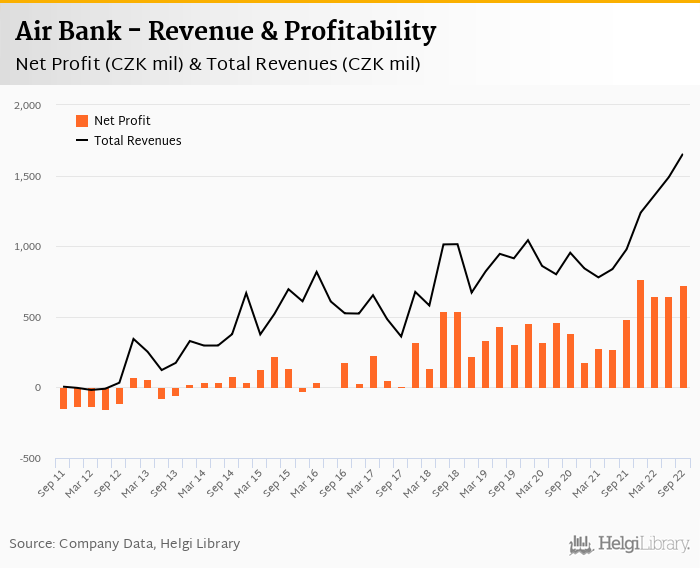

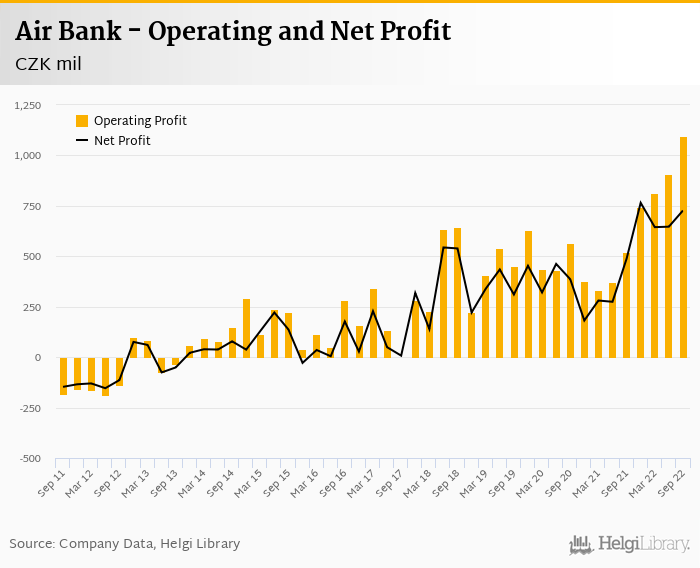

Air Bank reported record numbers in 3Q2022 with CZK 727 mil net profit and ROE of 25.2%.

Revenues increased 69.1% yoy and cost rose 22.6%, so cost to income decreased to only 33.8%

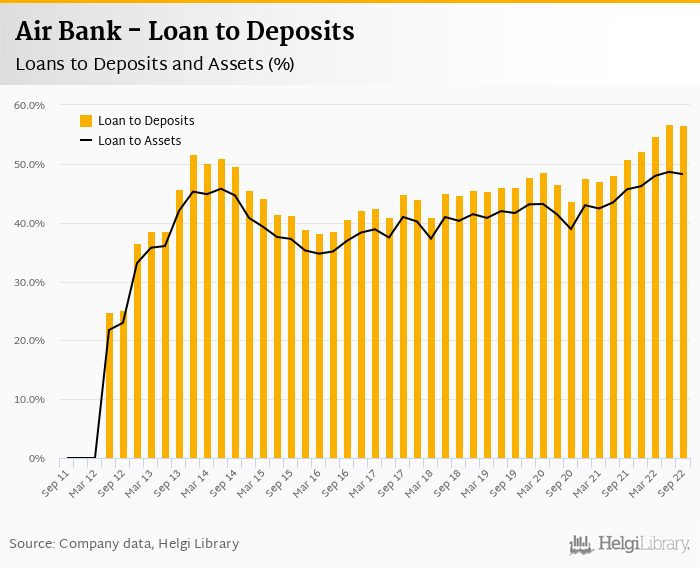

Cost of risk increased to 1.05% while loan to deposit ratio increased to 56.6%

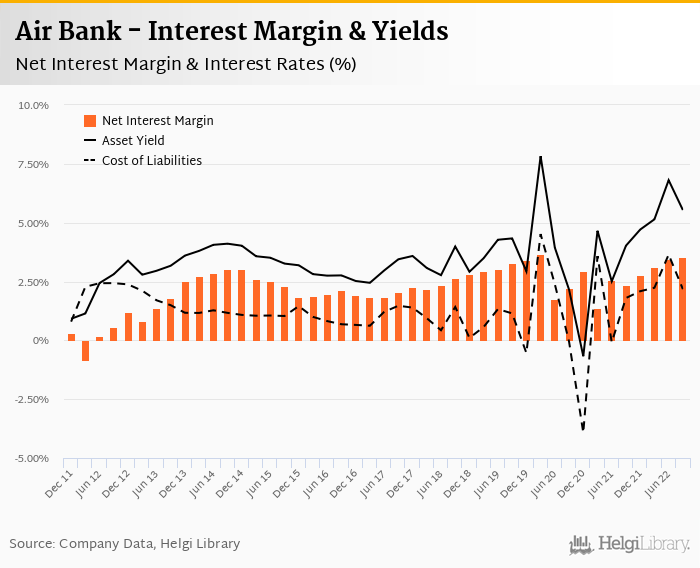

Revenues increased 69.1% yoy to record CZK 1,655 mil in the third quarter of 2022 driven mainly by net interest income (up 52.4% yoy) and trading income (up CZK 145 mil yoy). Apart from generally rising interest rates, interest income was supported by solid loan growth and a switch to a cheaper cost of funding than household deposits (we assume), so net interest margin increasing 1.16 pp to 3.53% of total assets. When compared to three years ago, revenues were up 81.0%:

Average asset yield was 5.54% in the third quarter of 2022 (up from 4.02% a year ago) while cost of funding amounted to 2.17% in 3Q2022 (up from 1.80%).

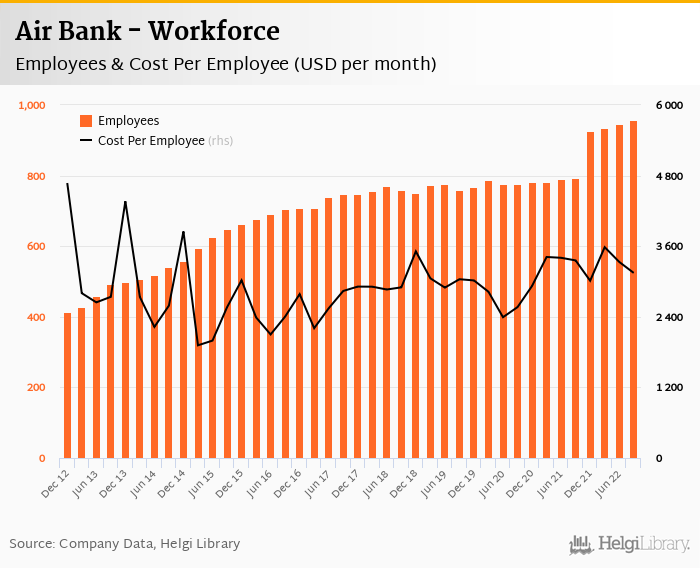

Costs increased by 22.6% yoy and the bank operated with impressive cost to income of 33.8% in the last quarter. Staff cost rose 26.6% as the bank employed 21% more people than last year (958 persons) and average cost rose 4.7% to CZK 76,374 per person per month:

Without providing any detailed breakdown, we assume Air Bank's customer loans grew 2.06% qoq and 8.64% yoy in the third quarter of 2022 while customer deposit growth amounted to 2.47% qoq and -2.40% yoy. That’s compared to average of 14.7% and 7.96% average annual growth seen in the last three years.

At the end of third quarter of 2022, we therefore expect Air Bank's loans accounted for 56.6% of total deposits and 48.2% of total assets.

Based on the year-end numbers and our assumptions, we believe retail loans grew 2.33% qoq and were 11.4% up yoy. They might have accounted for 88.9% of the loan book at the end of the third quarter of 2022 while corporate loans increased 0% qoq and -4.49% yoy, respectively. Mortgages represented 17.5% of the Air Bank's loan book, consumer loans added a further 71.4% and corporate loans formed 11.1% of total loans on our estimates:

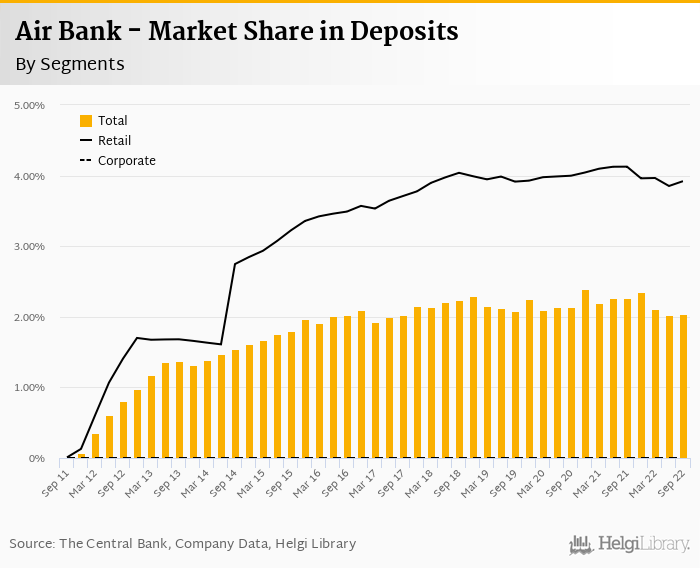

We therefore estimate that Air Bank has gained 0.017 pp market share in the last twelve months in terms of loans (holding 1.83% of the market at the end of 3Q2022). On the funding side, the bank seems to have lost 0.215 pp and held 2.04% of the deposit market:

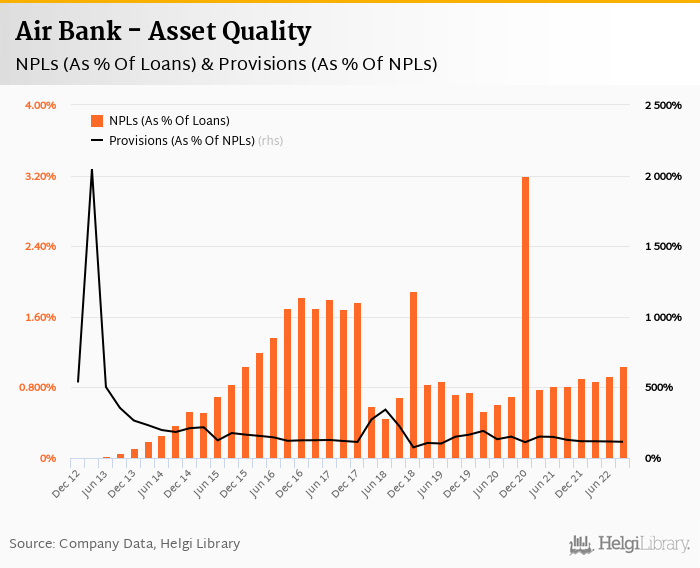

Cost of risk increased significantly to 1.05% of average loans in the third quarter as the Bank put aside CZK 193 mil in provisions, the highest since 2014. The provisions have therefore "eaten" some 17.7% of operating profit.

With no further details provided on the asset quality in 3Q2022, we will have to wait for full year's results to see if there is any increased pressure from the asset quality deterioration.

In our base-case model, we assume Air Bank's non-performing loans reached 0.9-1.1% of total loans, up from 0.819% when compared to the previous year. Provisions covered some 110-120% of NPLs on our estimates, down from 129% for the previous year.

We expect Air Bank's capital adequacy ratio might have reached approximately 18.6% in the third quarter of 2022, up from 17.3% for the previous year. The Tier 1 ratio amounted to 18.1% at the end of the third quarter of 2022 while bank equity accounted for 16.0% of loans:

Overall, Air Bank made a net profit of CZK 727 mil in the third quarter of 2022, up 49.0% yoy while the operating profit more than doubled compared to last year. This means an annualized return on equity of 25.2%, or 28.6% when equity "adjusted" to 15% of risk-weighted assets:

Impressive set of results with all-time record numbers achieved on the revenue, operating profit and pre-tax profit levels in the third quarter of 2022. Strong revenue growth driven by rising interest rates and trading income and very good cost control.

We will eagerly wait for more details on the asset quality and loan breakdown when the Bank releases its full year numbers to see more clearly the risk profile of Bank's lending.