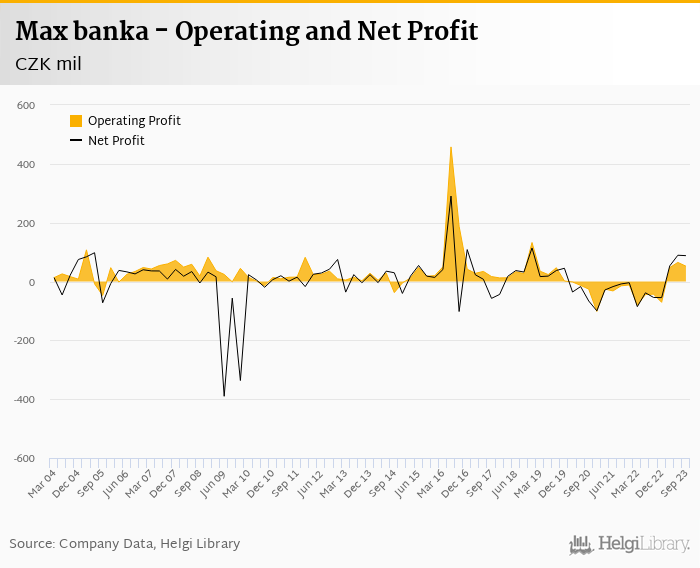

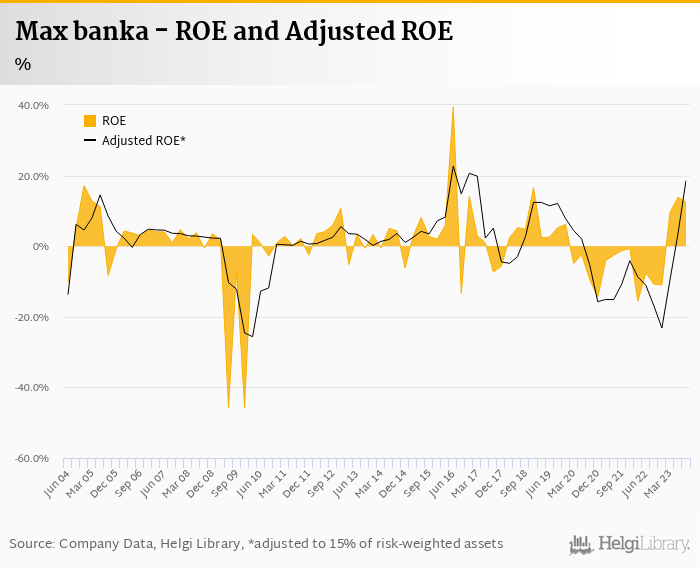

Max banka achieved a third consequtive quarterly profit of CZK 87.9 mil in 3Q2023 and generated ROE of 12.5%.

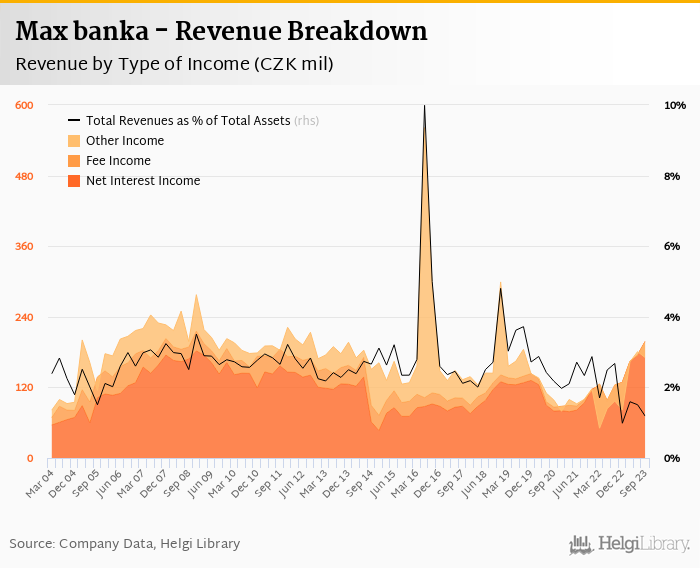

Revenues increased 76.2% yoy amid five-fold increase in deposits, though cost of funding starts biting. Costs have been cut further 15.1%, so cost to income decreased to 69.5%

Another provision write-back of CZK 36 mil and zero effective tax rate again supported Bank's bottom line in the third quarter.

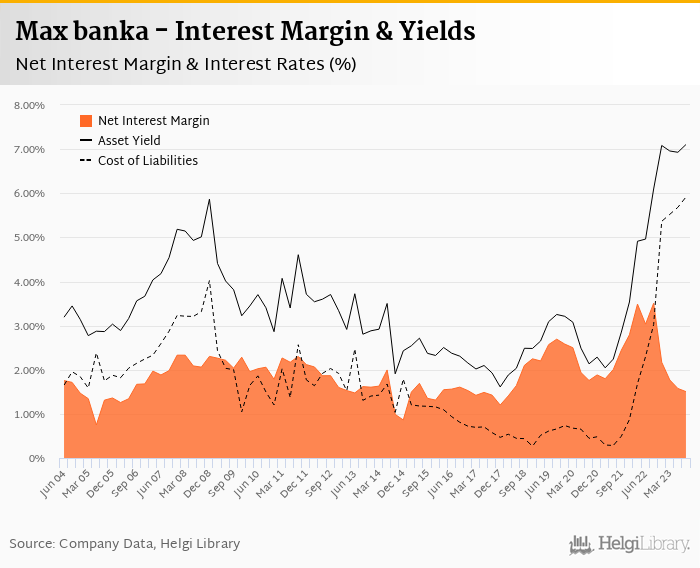

With 100% of deposits placed with the Central Bank and all the revenues coming from interest income, Max banka is heavily exposed to interbank-rate development, something to watch closely in the coming quarters.

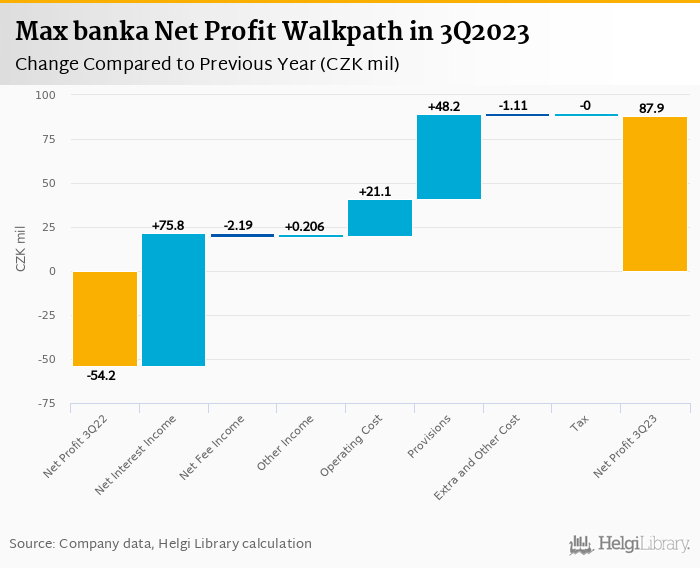

Max banka made a net profit of CZK 87.9 mil in the third quarter of 2023, an increase of CZK 142 mil in absolute terms. Two thirds of the profit growth has been generated by higher operating profitability while a third came from provision write-back when compared to last year:

Revenues increased 76.2% yoy to CZK 171 mil in the third quarter of 2023. The growth was driven purely by interest income (as both fee and other non-interest income were negative in absolute terms) and volume growth as deposits increased more than five-fold. Net interest margin fell again when compared to last year as cost of funding rises:

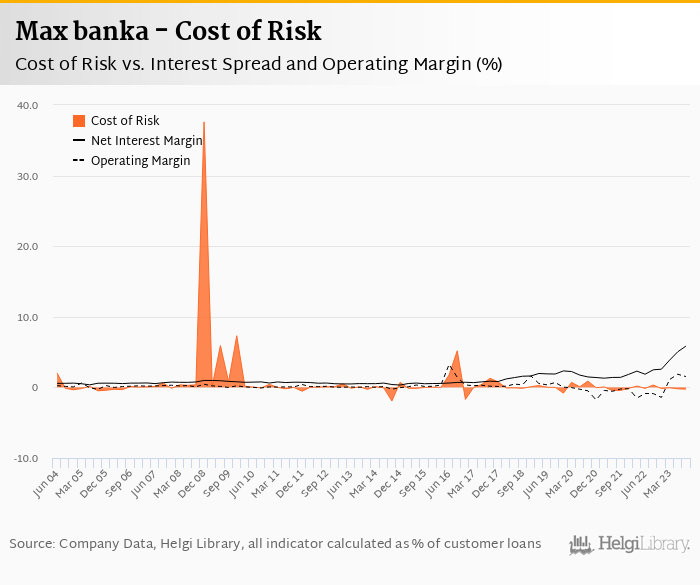

Net interest margin fell further 8 bp qoq to 1.50% (or compared to 3.51% last year), though with assets four times as big as a year ago. The net interest income therefore reached another all-time high of CZK 198 mil last quarter. Average asset yield was 7.10% in the third quarter of 2023, but cost of funding has risen faster at 23 bp to 5.91% in 3Q2023 eating increasingly into the margin:

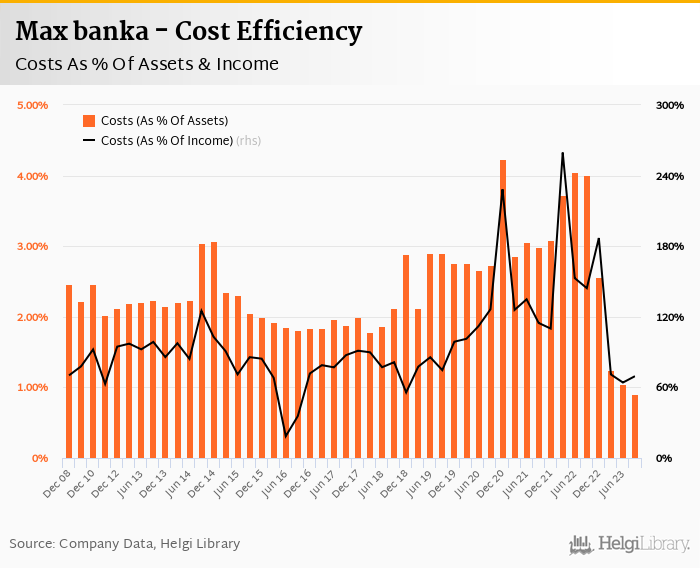

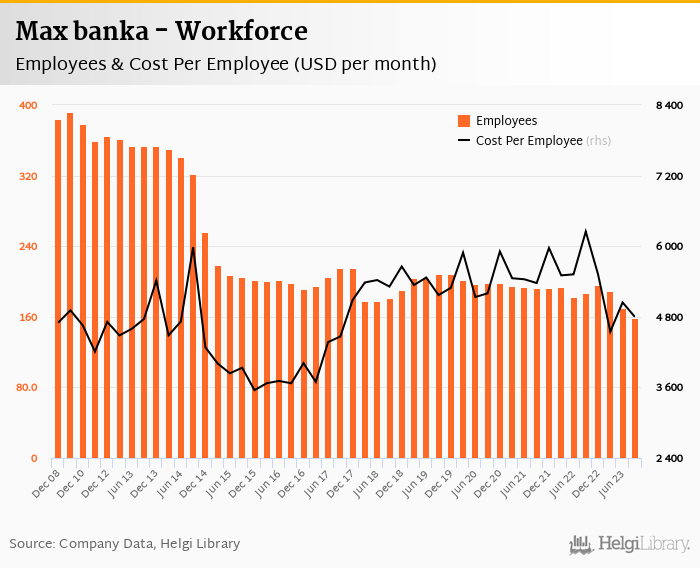

Costs decreased by 15.1% yoy and were slightly lower when compared to the previous quarter when adjusted for contribution to the Bank Guarantee Fund. However impressive so far, the bank still operates with relatively high cost to income of almost 70% due partly to a lack of scale and a limited product portfolio (ot non-interest income generation), so management still faces challenges ahead:

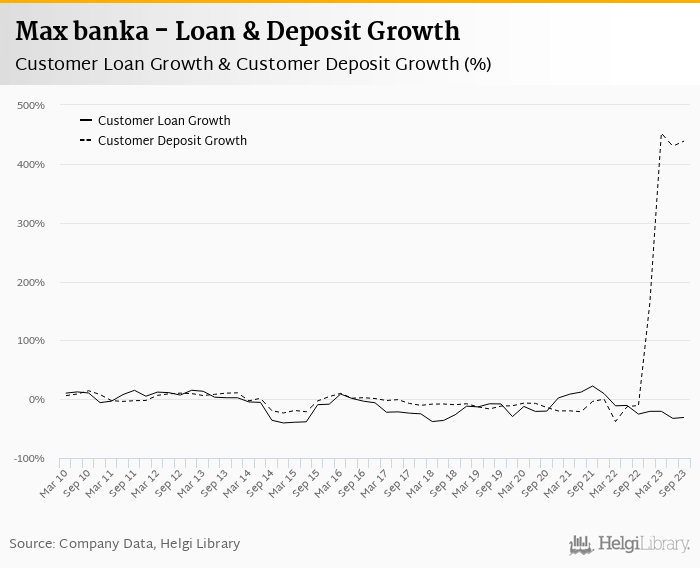

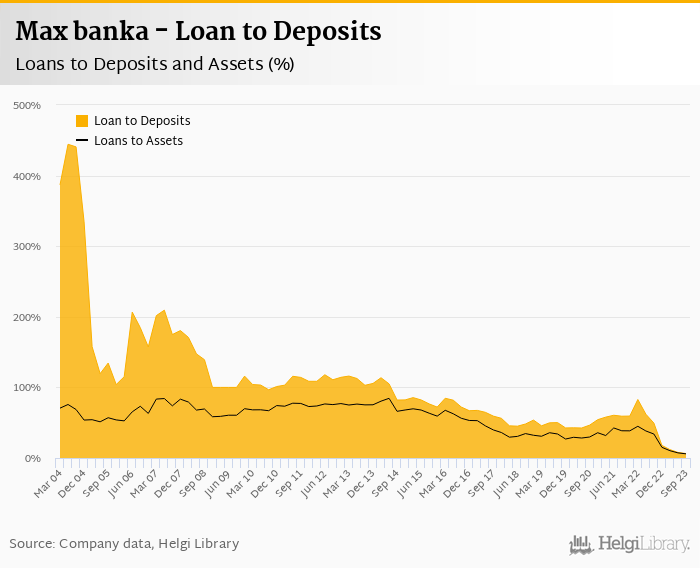

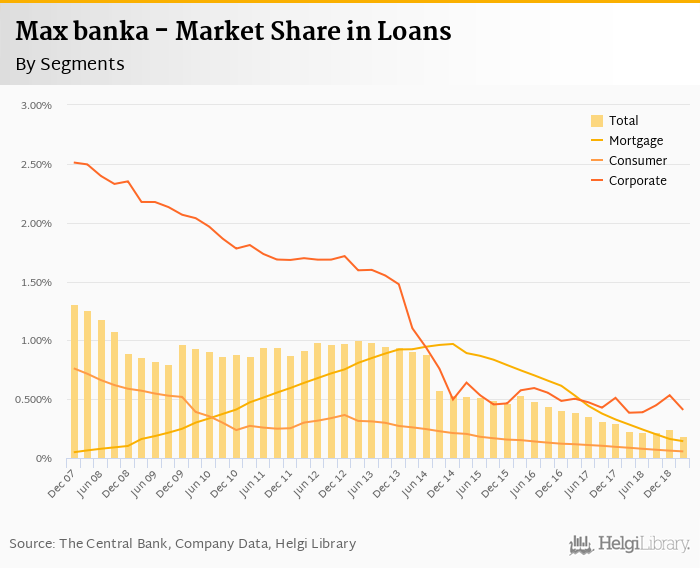

Loan portfolio continues shrinking as part of its post-acquisition clean up process, we assume. Customer loans decreased another 2.5% qoq and were by 31% lower when compared to last year.

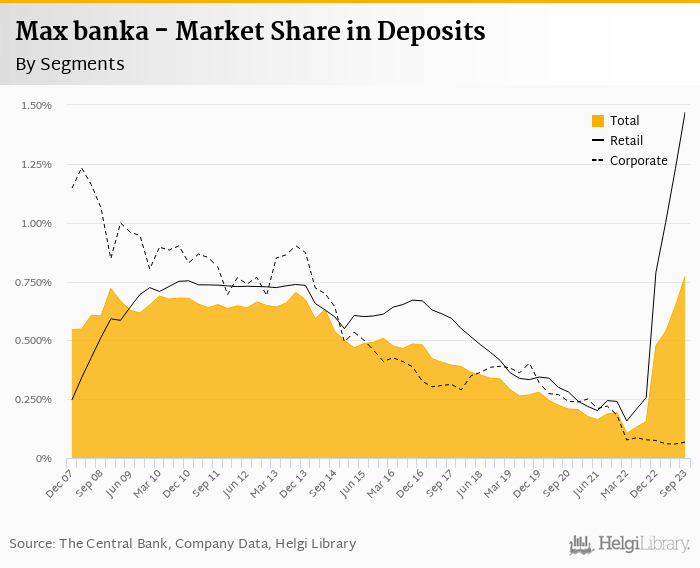

Deposits, on the other hand, continue flying. They increased further 21.5% qoq and were more than four-fold higher when compared to last year.

At the end of third quarter of 2023, Max banka's loans accounted for 6.3% of total deposits and less than 6.0% of total assets.

We estimate that Max banka has gained 0.618 pp and held 0.77% of the deposit market at the end of September 2023:

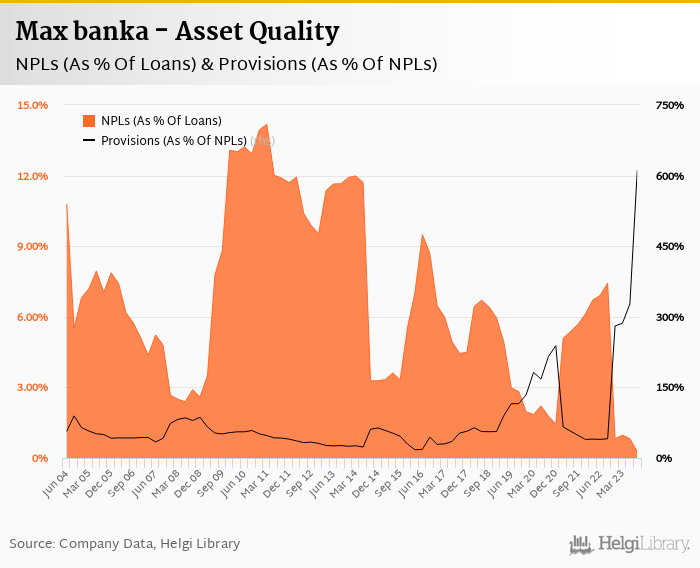

With another provision write-back in the 3Q2023 (a fourth consequtive one), we assume Max banka's asset quality improved significantly in the last year with NPL ratio at below 1.0%.

Provisions write-backs have generated almost half of total Bank's profit in the last twelve months representing an interesting buffer following Bank's takeover last year:

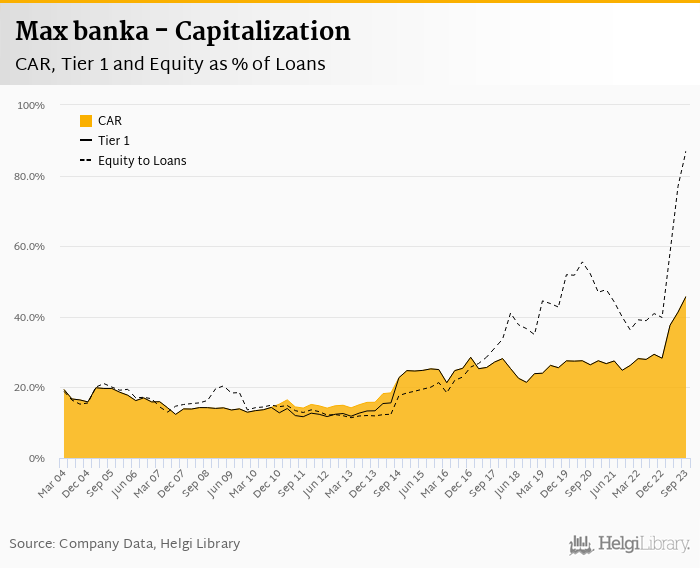

With loans falling by a third when compared to last year and re-started profitability within the last three quarters, Max banka's capital adequacy ratio should be high exceeding 40% on our estimates:

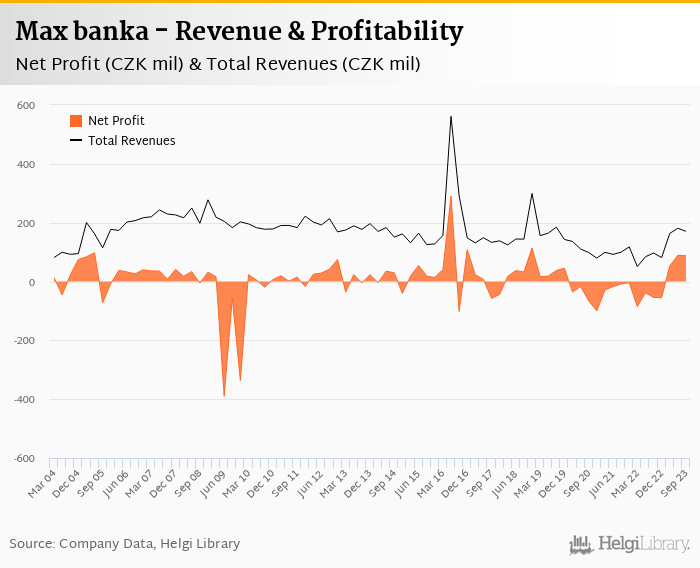

Overall, Max banka made a net profit of CZK 87.9 mil in the third quarter of 2023, up 262% yoy. This means an annualized return on equity of 12.5% in the last quarter or 7.0% when the last four quarters are taken into account:

The impressive profit turnaround of Max banka continues following by the takeover by Creditas Group. The profit growth is driven by a succesful deposit collection amid expanded interest spreads and is supported by cost cutting and provision write-backs.

With almost 100% of revenues coming from interest income and all the customer deposits placed with the Central Bank, Max banka remains heavily exposed to the interbank interest rate development. With limited product offer and scale, bigg challenges still lay ahead...